Aug

2023

Investing Basics: Megatrends – How to align your investment portfolio with global developments

DIY Investor

20 August 2023

Megatrends are the major global  forces disrupting and reshaping our world. From technological innovation to demographic change to geopolitical shifts in power, you can surf these megatrends with an investment portfolio made up of ETFs.

forces disrupting and reshaping our world. From technological innovation to demographic change to geopolitical shifts in power, you can surf these megatrends with an investment portfolio made up of ETFs.

Nobody can hide from the megatrends. They are the irresistible waves of change that are transforming the economic, social and political fabric of the world. The megatrends can create and destroy entire industries and markets. They can push new actors onto the economic stage. They can force a rapid reorganisation of businesses and supply chains. And they can make 20th Century Sci-Fi prophecies come true as Artificial Intelligence replaces people in the workplace and self-driving cars become a reality.

Investors can benefit from the megatrends too via new ETF products designed to harness their power. ETF providers are increasingly responding to these developments with new products. Such theme ETFs do not simply track a market, such as an MSCI World ETF. While the MSCI World weighting and stock selection are determined solely by the stock market value (“market capitalisation”), the index provider for a theme index selects suitable companies for a trend such as Cyber Security. This requires many analyses to identify suitable companies. Moreover, theme ETFs should not be confused with the sector indices that have been available on the market for a long time.

The first theme ETFs in Europe came onto the market in 2007. But the development was accelerated when ETFs with the abbreviations ROBO (Robotics) or HACK (Cyber Security) were listed in the USA. And where the US leads, Europe is bound to follow; there’s now increasing momentum around megatrend ETFs here.

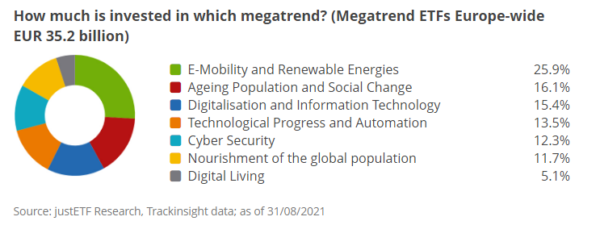

Investors have already invested over 32.2 billion euros in more than 85 theme ETFs that are tradable in Europe (as of 31/08/2021). The focus lies on ETFs for Clean Energy, automation, Robotics and Cyber Security. ETFs on indices on global water distribution, Healthcare Innovation or Artificial Intelligence are also popular. The largest providers of theme ETFs in Europe are iShares, Legal & General (LGIM) and Lyxor. In the meantime, however, many smaller providers such as HANetf or VanEck have also developed special themes in their product range.

So let’s take a look at the main dynamics and how you can gain exposure to them.

Climate change ETFs describe a megatrend in the same way but are constructed in such a way that the companies in the index act in a particularly climate-friendly way. Megatrend ETFs, on the other hand, aim to achieve the highest possible performance by participating in a megatrend. We have therefore not included climate change ETFs in our overview.

Megatrend: Ageing Population and Social Change

It’s well known that global populations are ageing due to declining birth rates and/or rising life expectancies. Naturally, this has major implications for business models, especially those linked to the Healthcare industry. Some companies are well aligned with this megatrend, especially those that are working on new medical treatments and pharmaceuticals targeted at age-associated diseases such as Alzheimer’s, cancer, arthritis, etc.

An important element of social change is, among other things, the trend towards equality of all genders. Especially in the last ten years, a greater awareness of the successful integration of minorities into our society has emerged. This can result in numerous opportunities for companies.

The largest ETFs on the megatrend “Ageing Population and Social Change” can be found here:

- iShares Healthcare Innovation UCITS ETF

- iShares Ageing Population UCITS ETF

- iShares Nasdaq US Biotechnology UCITS ETF

- UBS ETF (IE) Global Gender Equality UCITS ETF (USD) A-acc

- Rize Medical Cannabis and Life Sciences UCITS ETF

Check out our investment guides for all ETFs on Ageing Population, Healthcare innovation, Biotech, Gender Equality and Cannabis.

Megatrend: Technological Progress and Automation

Futurists like Ray Kurzweil believe that technological progress is accelerating exponentially. Moore’s Law is the most famous example of this thesis, as it posits that computer processing power doubles approximately every 2 years. Advances in computing power and associated technologies like AI are expanding the abilities of machines to compete with or complement humans, and companies are racing to be at the forefront of the “rise of the robots”.

The largest ETFs on the megatrend “Technological Progress and Automation” can be found here:

Find out about all ETFs on the topic of Robotics in our investment guide.

justETF tip:Megatrends and other investment themes can also be found with our theme filter in theETF search.

Megatrend: Digitalisation and Information Technology

The digital disruption of existing industries has already transformed music, media, communications, retail and financial services among others, and it shows no sign of slowing down. Countless start-ups are currently plotting the disintermediation of vulnerable legacy firms and hoping to join the likes of Facebook, Amazon, Alphabet, Netflix and Uber as the stars of the future.

Companies are already using the growing field of Artificial Intelligence today. The entertainment industry is turning into a digital entertainer with computer games and streaming. With crypto tokens, Web 3.0 is ready to shake up the structures of the rapidly growing platform economy of Web 2.0. In the future, this trend will presumably be unstoppable.

The largest ETFs on the megatrend “Digitalisation and Information Technology” can be found here:

Find out more about all ETFs on the topics ofDigitalisation, Artificial Intelligence, Cloud Computing and Blockchainin our investment guides.

Megatrend: Cyber Security

Of course, society’s increasing reliance on the internet simultaneously increases the threat of potentially devastating cyber-attacks by hackers. IT security has become big business as attacks have become more widespread, sophisticated and damaging. Increasing awareness of these risks and the real harm they can do means we can safely assume that Cyber Security companies will be in demand for the foreseeable future.

The largest ETFs on the megatrend “Cyber Security” can be found here:

Find out more about all Cyber Security ETFs in our investment guide.

Megatrend: E-Mobility and Renewable Energies

A growing world population creates an enormous need for energy and mobility. More efficient mobility concepts such as self-propelled electric vehicles, energy generation from renewable sources and the coming hydrogen economy are inevitable megatrends in order not to burden the environment and the climate even more.

The largest ETFs on the megatrend “E-Mobility and Renewable Energies” can be found here:

Find out more about all ETFs on Renewable Energies, Battery Technology, Electric Mobility and Hydrogen in our investment guides.

Megatrend: Nourishment of the global population

Rising populations, income levels and industrialisation naturally increase the demand for staple foods and clean water. When adding unequal distribution of water resources and growing pressure on our existing reserves from climate change, contamination and overuse, this results in the megatrend nourishment of the global population.

The largest ETFs on the megatrend “Nourishment of the global population” can be found here:

iShares Global Water UCITS ETF

Rize Sustainable Future of Food UCITS ETF

iShares Global Timber & Forestry UCITS ETF

Find out about all ETFs on the topics of water and wood in our investment guides. Find ETFs on the future of food with the justETF search.

Megatrend: Digital Living

In the isolation during the Corona pandemic, the importance of some digitalisation trends that are directly aimed at end consumers became particularly obvious. These include the rapidly growing trend of computer games (E-Sports), as well as digital learning. The greater importance of digital retail (E-Commerce) was also very clear and continues to grow. Last but not least, digital offerings from financial service providers became increasingly popular (Fintech).

The largest ETFs on the megatrend “Digital Living” can be found here:

- VanEck Vectors Video Gaming and eSports UCITS ETF

- L&G Ecommerce Logistics UCITS ETF

- Invesco KBW Nasdaq Fintech UCITS ETF Acc

- Rize Education Tech and Digital Learning UCITS ETF

Find out about all ETFs on E-Commerce, E-Sports and Fintech in our investment guides.

Find ETFs on Digital Education with the justETF search.

Megatrends may not give you the edge

While megatrends are having a huge impact on the world and ETFs are ideal for investing broadly and cost-effectively in global financial markets, some financial theorists are critical of the idea that you can successfully use such megatrend phenomena to boost your returns. Be aware that if you tilt your portfolio towards particular sectors then you may not be rewarded for the risk in the long run and there’s no guarantee you will outperform a more diversified, passive investment strategy. You should, therefore, think through the following points of criticism before deciding to invest in megatrend ETFs:

- Some scientific studies show that potentially above-average industries cannot be reliably identified in advance. Although they may succeed in outperforming the market, this is unlikely in the long term.

- For the investment in the still young industries to be worthwhile, the stocks on the stock market would still have to be cheaply valued. However, it is often the megatrend companies that are already in the focus of investors and are, therefore, expensive. In order to make the investment particularly worthwhile, the stocks in the megatrend ETFs would still have to be significantly undervalued today. Since the terms ‘megatrend‘ and ‘hype‘ often fall in the same breath, the probability of this happening is low.

- The indices on which the ETFs are based require comparatively much effort. After all, a large number of companies must first be examined and, if necessary, identified as being in line with megatrends. Megatrend ETFs are therefore somewhat more expensive. A cheaper alternative could be sector ETFs into which megatrend companies grow over time through their success and the resulting increase in market capitalisation.

- A narrow selection of individual titles is detrimental to diversification. This increases the risk of equity investments. The megatrends ETFs currently available on the market generally contain a relatively narrow range of 25 to 150 shares.

- Many megatrend ETFs are still small and have a volume of fewer than 100 million euros. The past has shown that such ETFs are disproportionately often threatened by a later fund closure.

Alternative investments Commentary » Alternative investments Latest » Commentary » Exchange traded products Commentary » Exchange traded products Latest » Financial Education » Latest

Leave a Reply

You must be logged in to post a comment.