Jan

2022

How to protect your portfolio from inflation

DIY Investor

17 January 2022

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

We highlight trusts which could appeal in an environment where ‘transient’ inflation is here to stay…

We highlight trusts which could appeal in an environment where ‘transient’ inflation is here to stay…

Investment trusts investing in real assets have provided decent capital protection in recent decades. That said, it has to be recognised that share prices exhibit a relatively high correlation to equity markets over the short term. For example, during the initial coronavirus crash, share prices in the listed real assets sectors fell sharply in a general liquidation of the stock market, before staging a rapid recovery (an opportunity for the quick or the brave).

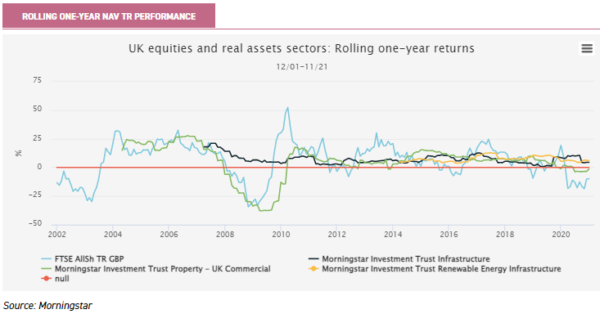

However, over the long run it should be the NAV and expectations for NAV total returns which drives the share price. The chart below shows the rolling nominal one-year NAV total return performance of three real assets sectors and UK equities. We have gone back as far as we have a usable track record. In periods where equities have fallen over a one-year period, infrastructure and renewables have consistently generated positive NAV total returns. Commercial property has a patchier track record, but has also done so excluding the two major global crises – the 2007/2008 crisis and the immediate impact of the COVID lockdowns.

Inflationary environments

A fundamental problem with looking at historical performance is regime shifts. If the future sees a fundamentally different economic environment, then relationships between asset classes in the past will not be a good guide to future behaviour. We would note that the period above has been generally one of declining interest rates which has benefitted the alternative assets shown, as well as equities and bonds. It has also been one of generally low inflation since the aftermath of the financial crisis.

Examining the environment we now potentially find ourselves in, we have seen a significant rise in inflation over the past 12 months which shows no sign of abating and could well herald the beginning of a period of sustained higher inflation. Reasons to believe this include the massive expansion of the monetary base during the pandemic, which dwarfed even that seen during the 2007/2008 financial crisis. They also include the persistent supply side issues arising from workers leaving the workforce for various reasons: return to country of origin, early retirement, unwillingness to be as socially active, or illness and death.

A related issue is social distancing and self-isolation guidelines along with repeated restrictions on operations that fall short of a lockdown. Given the globalised nature of the economy, issues in various countries can ripple across the world, and so the ongoing waves in different regions at different times are going to see these sorts of issues persist (particularly if the omicron variant leads countries to reimpose restrictions).

Another key factor is the net zero commitments of global governments which are going to require a shift to more expensive sources of energy, greater spending on infrastructure and equipment requiring scarce materials and further fiscal largesse. We are not economists, but let’s assume this is an accurate vision of the future: could real assets provide protection in such an environment?

Equities & Bonds: both doomed?

The data on the historic performance of investment trust sectors is not going to give us a good guide to the future, given no persistently high inflation in the past two decades. We need to look back further. In The Best Strategies for Inflationary Times , analysts at Man Group looked at the performance of various asset classes and equity factors in the periods of high US inflation over the past 100 years. They defined such a period as one with inflation over 5% and rising, conditions that the US is currently experiencing in the most recent statistical announcements.

Neither bonds nor equities provided protection in such periods according to the analysis. Companies benefit from inflation in ways which in theory might be expected to see their equity benefit. Inflation makes the real value of debt fall, while companies can raise prices for customers. However, these benefits have been outweighed in practice by the less stable economic climate and input costs rising faster than final product prices.

The analysis found that nominal returns were zero on average in US equities during inflationary regimes, with negative returns in 50% of the periods. The real return averaged -7% during inflationary times, with negative returns in 75% of periods. Nominal US Treasuries provided a real return of -5% and a 60/40 portfolio of -6%.

There was no decent equity sector to hide in either. The energy sector was the only one to generate a positive real return during these periods, of just 1%. Not only is this a meagre return, but a 100% allocation to energy stocks is likely to be too risky for any rational investor. Looking on a factor basis, slightly better returns were available from investing in ‘quality’. This generated a real 3% a year during the inflationary times.

In our view quality equities could be a good place to be in the aftermath of the pandemic based on their good performance after the global financial crisis. The evidence that they have done well in inflationary environments only support this argument. However, it is fair to say that conventional bonds and equities look like they are both likely to suffer during a period of major inflation.

Furthermore, the low T-Stats on the results for energy and quality warn that the results in these bright spots are not robust and relying on similar performance in the future would be highly risky. With equities looking likely to do poorly in a sustained inflationary period, and bonds unlikely to protect, can real assets take up the role?

Commercial property – valuation opportunity?

In theory, commercial real estate should provide a perfect hedge to inflation. Inflation feeds through into rents paid and into the discount rate (or cap rate) used to value properties. However, this neat theory stumbles upon some practical issues. First is the fact that annual uplifts for inflation are only sometimes written into rental contracts. It is common for contracts to have step-up periods of a few years which means that any indexation is imperfect and lagged.

Furthermore, in extremis these contracts are likely to be a matter of negotiation between landlord and tenant, as we saw through the COVID pandemic. In fact, the retail sector is seeing some movement towards turnover-based rents which would reduce the visibility of rental income even further (although this does result in an indirect link to inflation).

More fundamental is the link between commercial real estate returns and GDP. This has historically been stronger than the link with inflation, according to analysis by CBRE. It notes there is no clear relationship between inflation and returns. If inflation is driven by strong growth, it benefits the asset class as tenants prosper, rents are raised and vacancies are lower. Growth expectations for rents rise. However, in any stagflationary environment – a real danger at the moment – vacancies may rise and tenants’ businesses may not do so well.

Most important is the link between inflation and interest rates. Rising interest rates see cap rates rise and valuations fall. If this is occurring during a period of high GDP growth, then this latter factor may outweigh the negatives.

But if not, then inflation could be a net negative for commercial real estate. In fact, CBRE finds that historically a one percentage point increase in CPI would have led to a 1.1% decline in the value of an all-property portfolio. A one percentage point rise in GDP would have increased returns by 0.9% on average. These averages hide wide variability due to the specific circumstances of each inflationary spell.

More promisingly, CBRE’s scenario analysis suggests that in an inflationary environment over the coming years, if it is accompanied by good GDP growth, property would see stronger returns. You can see the details of their analysis at the following link.

Other supportive analysis for commercial property comes in Inflation and Real Estate Investments by Brad Case, Senior Vice President, NAREIT, and Susan M. Wachter, Richard B. Worley Professor of Financial Management, at The Wharton School of the University of Pennsylvania . They look back to 1978 and periods of inflation above the median of 3.2% (a more modest hurdle). They find REITs generate a positive real return in 65.8% of periods, more than any other asset class except commodities. We suggest this reflects the above analysis – in more modest inflationary regimes, accompanied by a strong economy, commercial real estate can be a good hedge.

We think there are three reasons commercial property trusts could be an interesting play in the current inflationary environment. The first is the interest rates background. In our view rates are likely to be pinned low to support the economy. Central banks have been fairly consistent in their messaging that they view the current high inflation as indicative of special circumstances and, looking through to the underlying economy, lower rates are still appropriate.

This reflects the impact of the pandemic on inflation and the possibility of ongoing disruption from it. We also suggest it reflects a recognition that a good period of inflation would be very helpful for highly indebted nations. Rising inflation should therefore push up rents, while if rates are kept low cap rates will be too. This is dependent on the UK economy – and our global peers – not tipping back into recession and the current recovery continuing, so there are risks to this scenario.

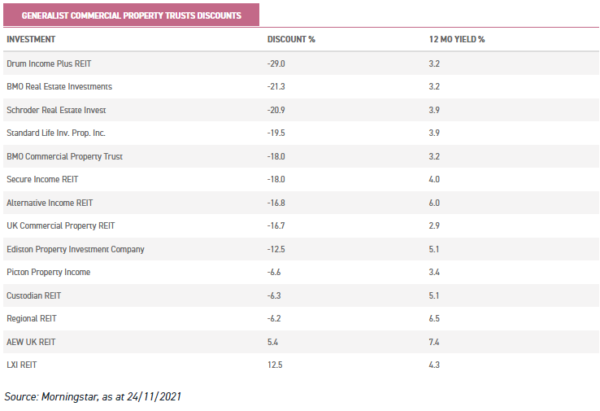

The second reason we believe commercial property trusts are attractive is their currently wide discounts, which potentially provides some protection against a coming recession, and boosts potential share price returns. The table below shows the discounts of the generalist UK commercial property trusts.

The third reason is the secular tailwinds behind the industrials sector. This area of the commercial property market seems likely to be less cyclically-exposed than it was in the past due to the ongoing shift from high street retailing to online or mixed models.

Trends to onshoring caused by the pandemic, aversion to reliance on China and Brexit are also increasing demand for industrial space. High quality industrials would seem to be in a good position to grow income in an inflationary environment and should be less affected by rising cap rates given the strong fundamentals.

There are trade-offs to be made with property. Trusts with more in industrials currently have higher ratings, so investors need to find a mix of discount potential and greater security of income to fit their outlook and risk appetite. At the more stable end of the spectrum, we like Picton Property Income (PCTN). It has one of the narrowest discounts in the sector of just 5.5%, with 56% invested in industrials. The drawback at the moment is the modest 3.4% yield.

However, its recent half-year results reported dividend cover of 120% and we understand that the board is keeping the payout under review. Its sector positioning would seem to put it in a good position to deliver dividend growth in an inflationary environment. UK Commercial Property REIT (UKCM) is another trust with a high-quality industrials-focussed portfolio (over 50%). The discount has widened out to 18% in recent weeks. In our view this is likely due to investors who were hoping for a dividend increase in the half year report (published in September) being left disappointed.

UKCM’s dividend yield is 3.2% on the current share price. With high levels of cash on hand, the trust is certainly in a position to generate higher income in the coming months and years if it can profitably invest this cash, which means we think the board will potentially be able to increase the dividend sooner or later. In the meantime, with cash on the balance sheet, performance should be more stable in an inflationary environment.

Possibly at the riskier end of the spectrum, both BMO Commercial Property (BCPT) and BMO Real Estate Investments (BREI) trade on discounts of close to 20%. They have lower weightings to industrials and consequently more diversified portfolios. We think the wide discounts could lead to attractive shareholder returns in a positive inflationary environment in which the UK recovery continues to be strong.

Core infrastructure – solid bedrock?

Infrastructure has some of the best inflation protection potential, but there are important nuances that need to be considered on a trust-by-trust basis. Infrastructure should provide stable income from their long-term contracts, paid by governments or institutions with high credit ratings. Like property though, the inflation linkage of the income and the impact of rising discount rates need to be considered.

As for the first consideration, in the PFI sector inflation linkage is typically explicit and annual. This is not the case elsewhere, making it very valuable. However, contracts do vary, and some of the core infrastructure trusts invest in demand-based assets from which a proportion of the income depends on the usage of the asset (like a turnover-based rent). Examples include High Speed 1 – the Eurostar train line – owned by HICL Infrastructure (HICL).

These trusts all publish sensitivity analyses which outline how we should expect to see the values of their portfolios change if certain long term assumptions change. This captures the impact on contracted cash flows and the discount rate used to value the assets. Having a positive linkage to inflation is all well and good but, as we discuss above, if the inflation leads to rising interest rates this will have a counteracting effect.

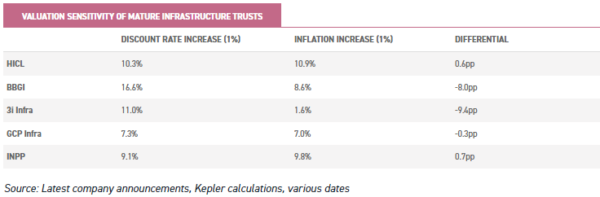

In the table below we show the most recent sensitivities reported by the mature infrastructure trusts to a 1% increase in inflation and a 1% increase in the base rate . We have assumed a linear relationship between the factors and the valuations to standardise them, so the exact numbers should be taken with a pinch of salt. Furthermore, the trusts’ analyses assume a flat increase across the board, which is unlikely.

HICL stands out as having the highest positive sensitivity to inflation while also being one of only two trusts to have a greater sensitivity to inflation than to an increase in the base rate. INPP has a similar profile. BBGI and 3i Infrastructure look more exposed to rising interest rates in an inflationary environment, while GCP Infrastructure has a more modest and consistent exposure to the two factors.

HICL’s focus on core infrastructure is designed to make its income resilient and dependable, and it looks like an interesting option for inflation protection. We note the managers’ report in the recent half-year results that they have not yet adjusted their long term assumptions on inflation, with the next opportunity likely to be the at final results, due to be released in May 2022. Despite trading on a premium of 9.3%, HICL yields 4.9%.

Renewable Energy Infrastructure – coming into its own?

We could construct a similar table as that above for renewable energy infrastructure trusts. However, the complication is the effect of changes to the discount rate or the expected inflation rate on valuations is sometimes dwarfed by the impact of changes in power price expectations. These trusts do have an explicit and implicit linkage to inflation. Many of the subsidies that these trusts benefit from are directly linked to inflation.

The indirect link is that short-term power prices are a key input to inflation rates, but over the longer-term are perhaps less linked. Given the trusts hedge their power price exposure to varying degrees (with the notable exception of Greencoat UK Wind), unpicking the exact degree of inflation linkage is complicated. In the solar sector, we note that NESF and FSFL have a greater sensitivity to a rise in inflation than a rise in the discount rate.

The opposite is true of USF and BSIF though, due to their fixed price contracts and hedging activities. However, long-term power price expectations are likely to be a more important driver of NAVs than short-term power prices. We saw this during 2021, when the sector’s share prices re-rated downwards on lower long term power price expectations despite rising short term inflation.

The same basic counter-balance remains – rising interest rates will impact the valuation of the assets negatively. In terms of the discount rate, renewables funds generally are newer and the asset class is less established than traditional core infrastructure.

This means discount rates tend to be higher, offering an element of a buffer to rising rates. It is also the case that the newer trusts in the newer sectors tend to have higher discount rates. Managers of all of these trusts often have levers to pull in terms of extending the life of the assets and other asset management activities which could offset any increase in the discount rate via base rates.

All told, we do think the renewable energy infrastructure trusts generally stand to benefit from inflation. However, the long-term outlook for power prices is likely to be a bigger driver of share price returns, which could prove to be bigger influence on long term returns.

One trust in the sector we think stands out as an inflation hedge is Greencoat UK Wind (UKW). UKW is the only renewable energy infrastructure fund to explicitly state that its aim is to grow dividends in line with inflation. This has been achieved each year since launch, with the target for the following year based on the December calculation of annual RPI.

Of the underlying portfolio, 61% by value has revenues directly linked to inflation with the remainder linked to power prices. Dividend cover has fallen over the past year, and UKW’s cashflows were hit by low winds over the summer which reduced revenues earned. However, not having hedged any power price exposure, the board is potentially in a strong position to generate strong cashflows in the current high power price market, and thereby potentially continuing to hit its dividend growth target.

Conclusions

Any persistent period of high inflation is bad news for both equities and bonds, using history as a guide. While some areas of the equity market might do better than others, the likelihood of real returns from any diversified equity portfolio look modest in an environment where we see high inflation. Tilting a portfolio towards energy and commodity producers as well as high quality companies would seem to have been the best strategy on average, but it still seems likely to lead to real losses overall.

Alternative investment trusts investing in real assets look like they could offer decent protection in a persistent inflationary environment. However, there are some complications. Chiefly investors need to consider the amount of inflation pass-through in the income generated, and understand the sensitivity to the discount rate. The latter is going to become more important in a stagflationary environment, which remains a real possibility – especially if there is a resurgence of the virus in key countries in the global economy.

HICL Infrastructure stands out for us in the core infrastructure space as offering good sensitivity to inflation. In renewables, Greencoat UK Wind has strong inflation linkage. We also think JPMorgan Global Core Real Assets (JARA) could offer useful diversification. The managers’ analysis backtesting their asset mix over the past 15 years suggests it would have generated a real return of at least 3% per annum each year. Of course, there have been no major periods of inflation during this period, so the results need to be considered in that light.

Finally, we think commercial property has been forgotten in the surge in interest for alternative-income trusts and this may have created a value opportunity for contrarians. Commercial property revenues are likely to have a reasonable linkage to inflation, while discounts offer some comfort on the downside.

All these assets are likely to do better if growth is high and discount rates remain low. However, if inflation is accompanied by recession and/or rapid interest rate rises, the inflation-linkage could be overwhelmed by negative valuation effects. Commercial property looks most exposed to this, but high-quality portfolios investing in industrials like UKCM and Picton look likely to be more resilient if this environment develops

Commentary » Equities » Equities Commentary » Investment trusts Commentary » Investment trusts Latest » Mutual funds Commentary » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.