Mar

2022

Financial Inclusion and Fintech in Emerging and Frontier Markets

DIY Investor

4 March 2022

Covid-19 has driven financial inclusion and the evolution of fintech. Ross Teverson explains why well-managed emerging and frontier market banks stand to benefit

‘Out of adversity comes opportunity’

Benjamin Franklin’s famous saying has been used on more than one occasion to describe the way in which the Covid-19 pandemic has accelerated change. Nowhere is this more evident, in our view, than in the emerging and frontier markets[1] financial sector. The resolve of governments to continue driving higher financial inclusion[2], and the willingness of companies to facilitate a shift to cashless transactions, are stronger than ever.

While the pandemic has created multiple challenges for emerging and frontier market banks, we believe that most have managed risk admirably, have continued to innovate, and have weathered the impact of Covid-19 much better than many had expected. The structural opportunity for these businesses remains intact and, in our view, is not currently reflected in valuations, which remain below pre-pandemic levels.

Financial inclusion and fintech as forces for structural change

Financial inclusion is a structural change that we believe creates opportunities for select emerging and frontier market banks. In recent years, developments in this area have been accelerated by supportive government policies, financial technology (‘fintech’) innovations and, latterly, by the need to minimise contact in a pandemic environment.

In much of the world, financial inclusion plays a key role in reducing poverty levels and boosting prosperity, which is why governments around the globe have been getting behind the effort. According to the World Bank, since 2010, more than 55 countries have made commitments to financial inclusion, and more than 30 have either launched or are developing a national strategy.

Understandably, fintech is seen by many as a disruptive threat to established banks in developed markets. However, it stands out as an opportunity, rather than a threat, to those incumbent banks in emerging and frontier economies that are driving innovation in their markets.

‘A backdrop that, for well-placed financial institutions, proves conducive to strong and sustained earnings growth for a long time to come’

As the shift to mobile banking and cashless transactions accelerates, we believe that our bank holdings offer an attractive proposition as they enjoy the competitive strength that comes from having low-cost traditional deposit franchises, while also benefitting from fintech-driven growth opportunities.

Even though many of the world’s unbanked individuals live in remote areas, where the nearest physical bank branch may be prohibitively far away from homes and places of work, rising mobile phone ownership and internet penetration is changing the way the world gains access to financial products. According to the World Bank’s Global Financial Inclusion Index (“Findex”), 78% of unbanked adults have access to a mobile phone.

In emerging and frontier markets, gradually increasing penetration of financial products, combined with supportive demographics, should create a backdrop that, for well-placed financial institutions, proves conducive to strong and sustained earnings growth for a long time to come.

Gaining exposure to the opportunity

Through our bottom-up, fundamental approach, we have identified several companies where we believe this change is underappreciated by the market. KCB in Kenya, United Bank in Pakistan, and Bank of Georgia are all held in the Jupiter Emerging and Frontier Income Trust. While all three are small-capitalisation companies, they are large players in their home markets and are all embracing fintech opportunities to create new avenues for growth.

Kenya Commercial Bank

The potential for fintech to drive positive change is most evident in Sub-Saharan Africa, particularly in Kenya. The Kenya Vision 2030 blueprint, launched by the Kenyan government in 2008, made financial inclusion a central goal and, since then, dramatic progress has been made. Financial inclusion in Kenya reached 82.9 per cent last year and, while this means that around 17 per cent of the population is still excluded from access to formal financial services, the numbers have improved dramatically since 2006, when only 33 per cent of men and 21 per cent of women had access to financial services (in that time, the gender gap has also narrowed – from 12 per cent in 2006 to 5 per cent in 2020).[1]

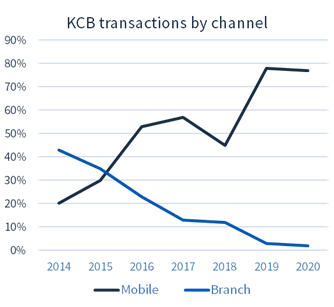

A large part of Kenya’s success has been down to the widespread usage of the mobile money platform, M-Pesa, which is now arguably the most successful mobile financial service in the developing world. M-Pesa was established by incumbent telecom operator, Safaricom, with KCB as its main banking partner. KCB leverages this burgeoning technology by offering loan and savings accounts with attractive fees and variable payment or savings periods.

‘The potential for fintech to drive positive change is most evident in Sub-Saharan Africa, particularly in Kenya’

Over the past year, KCB has enhanced its mobile wallet platform, Vooma, which allows customers to save, borrow, send and receive money, pay bills, and buy airtime. Lending is the largest product on the platform, followed by savings. The bank is now doubling down on its payment services by significantly expanding the number of merchants and billers on the platform.

KCB aims to have a million merchants on the platform over the medium term, up from just thirty thousand presently, with a view to having Vooma contribute twenty per cent to group revenues in two years’ time, up from five per cent today. KCB has established a dedicated division to oversee this transition and there are members of the management team, reporting to the board of directors, who have full ownership of these targets.

Mobile transactions by KCB’s customers have rapidly overtaken in-branch transactions

In recent years, KCB, along with the rest of the Kenyan banking sector, has seen its share price get cheaper in relation to its earnings – initially due to concerns over a new law to cap interest rates (which ultimately had little impact on KCB’s profitability), and latterly due to the impact of Covid on the Kenyan economy. In our view, this created a compelling long-term investment opportunity considering its consistent track record of strong profitability and the potential to deliver strong growth

UBL (Pakistan)

Banking in Pakistan is unique because, unlike the corporate/consumer lending model of most banks worldwide, Pakistani banks have largely favoured government lending. There is very limited consumer or corporate debt: by way of comparison, in the UK, private sector debt stood at 190.3 per cent of GDP at the end of 2019[4]; by contrast, private sector debt-to-GDP for Pakistan stood at just 18.1 per cent at the end of 2019.[5]

However, consumer lending is now rising from a low base, which in our view is a tailwind that will likely support a positive loan growth outlook for many years to come. More striking to us is the opportunity in retail deposits. As the informal economy reduces, and savers become more educated about wealth management, this should be an area of substantial growth.

In markets like Indonesia, those banks that have been able to couple robust loan and deposit growth with a high level of profitability have delivered extremely strong returns for shareholders as the sector has developed. We believe the market has not yet recognised the potential for leading banks in Pakistan to do likewise.

What is more, UBL has a clear digital strategy, centred on offering innovative solutions to existing customers through its UBL Digital app, and on promoting financial inclusion through the provision of basic banking facilities to the mass population. In mid-2020, UBL appointed a new CEO, Mr Shazad Dada, who has stressed the importance of expanding the bank’s digital offerings.

In the first nine months of 2020, the bank added 200 thousand new users to its digital banking platform, taking the total to 1.2 million. There is a long runway for further growth, too, considering that the bank has over 10 million customers and a large part of the population remains unbanked. UBL is able to deliver a positive user experience and enjoys a high degree of trust with customers, as evidenced by its strong position in remittances, where it has approximately 24 per cent market share.[1]

Equally important is the resilience that UBL has exhibited over the past year, as Covid has weighed on the Pakistan economy. The bank has remained profitable and well-capitalised throughout and, other than a period of two quarters when Pakistan’s central bank asked banks to refrain from distributing dividends, UBL has maintained dividend payments.

Conclusion

Our change-based investment approach aims to generate long-term capital appreciation by investing in under-researched and underappreciated companies. We believe that many well-managed emerging and frontier market banks stand to benefit from rising financial inclusion and the evolution of fintech.

While Covid may have resulted in short-term challenges, we believe that our bank holdings are resilient, attractively valued, and are innovating to ensure that they are able to profit from structural change.

[1] Source: Kenya Economic Report 2020 Kenya-Economic-Report-2020.pdf (kippra.or.ke)

[2] A ‘frontier market’ is a stock market that is typically smaller and less-developed compared to an emerging market.

[3] ‘Financial inclusion’ is the process of individuals gaining access to basic financial products and services to meet their needs.

[4] Source: United Kingdom Private Debt to GDP | 1995-2019 Data | 2020-2021 Forecast | Historical (tradingeconomics.com)

[5] Source: Bloomberg

[6] Source: UBL Financial results for 9 months of 2020 – Daily Times

Risks

The Jupiter Emerging & Frontier Income Trust:

The Jupiter Emerging and Frontier Income Trust can utilise gearing for the purpose of financing the Company’s portfolio. The use of gearing means the Company may be subject to sudden and large falls in value and the investor may get back nothing at all if the fall in value is sufficiently large. The Company invests in emerging markets which carry increased volatility and liquidity risks. The Company invests in smaller companies, which can be less liquid than investments in larger companies and can have fewer resources than larger companies to cope with unexpected adverse events. As such price fluctuations may have a greater impact on the Company. This Company invests mainly in shares and it is likely to experience fluctuations in price which are larger than Companies that invest only in bonds and/or cash.

Investment trust companies are traded on the London stock exchange, therefore the ability to buy or sell shares will be dependent on their market price, which may be at a premium or discount to their net asset value.

Before making an investment decision, please read the PRIIPS Key Information Document which is available from Jupiter on request and at www.jupiteram.com

Important Information: This document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with a financial adviser, particularly if you are unsure whether an investment is suitable. Jupiter is unable to provide investment advice. Past performance is no guide to the future. Market and exchange rate movements can cause the value of an investment to fall as well as rise, and you may get back less than originally invested. The views expressed are those of the authors at the time of writing are not necessarily those of Jupiter as a whole and may be subject to change. This is particularly true during periods of rapidly changing market circumstances. For definitions please see the glossary at jupiteram.com. Every effort is made to ensure the accuracy of any information provided but no assurances or warranties are given. Company examples are for illustrative purposes only and not a recommendation to buy or sell. Jupiter Unit Trust Managers Limited (JUTM) and Jupiter Asset Management Limited (JAM), registered address: The Zig Zag Building, 70 Victoria Street, London, SW1E 6SQ are authorised and regulated by the Financial Conduct Authority. No part of this document may be reproduced in any manner without the prior permission of JUTM or JAM.

The Company currently conducts its affairs so that its shares can be recommended by financial advisers to ordinary retail investors in accordance with the Financial Conduct Authority’s (FCA) rules in relation to non-mainstream pooled investment products and intends to continue to do so for the foreseeable future. The Company’s shares are excluded from the FCA’s restrictions which apply to non-mainstream pooled investment products because they are shares in an investment trust.

Jupiter Unit Trust Managers Limited accepts no liability for any loss or damage of any kind arising from the use, in whole or in part, of this document.

Jupiter Unit Trust Managers Limited, registered address: The Zig Zag Building, 70 Victoria Street, London, SW1E 6SQ is authorised and regulated by the Financial Conduct Authority. 27912

Brokers Commentary » Brokers Latest » Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.