Oct

2023

Two bond funds rising steadily that we have bought

DIY Investor

4 October 2023

Saltydog Investor has spotted two funds which score well for keeping a lid on risk and have been steadily rising over the past six months.

Most stock markets around the world went down in September. In the US, the largest global economy, the Dow Jones Industrial Average fell by 3.5%, the S&P 500 went down by 4.9%, and the Nasdaq lost 5.8%. The next biggest economy is China, where the Shanghai Composite dropped by 0.3%, followed by Japan, where the Nikkei 225 ended the month down 2.3%.

In the UK, the FTSE 100 bucked the trend, gaining 2.3%, but the FTSE 250, which is probably more representative of our domestic economy, went down by 1.8%.

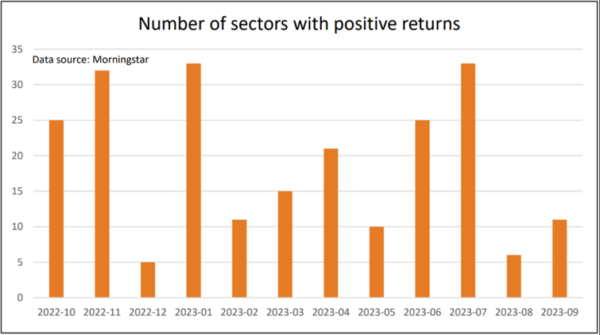

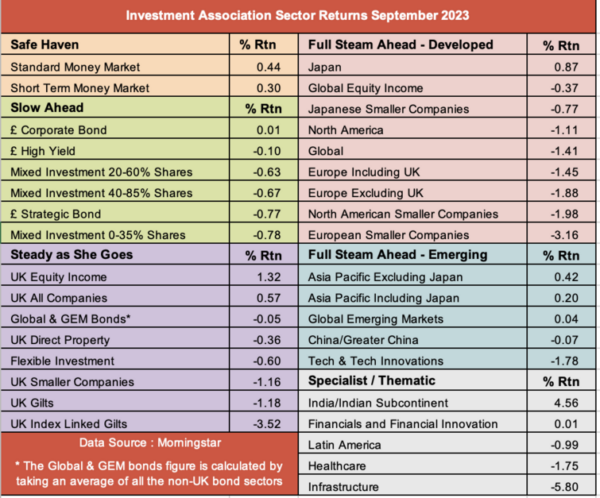

Our latest sector analysis shows that most funds also went down in September. The data has only just come through, and we may see some revisions over the next few days, but early indications suggest that 11 out of the 35 sectors that we monitor went up last month. That is an improvement since August, but still much worse than June and July.

Some sectors only just made it over the line. The £ Corporate Bonds and Financial & Financial Innovation sectors both went up by 0.01%, and Global Emerging Markets only made 0.04%. It would only take a minor correction in the fund data to drop them into a loss-making position.

There are only three sectors that went up in August and September. The two money market sectors and India/Indian Subcontinent.

In our demonstration portfolios, we currently hold three money market funds – Royal London Short Term Money Market, L&G Cash Trust and abrdn Sterling Money Market. They continue to make steady progress.

We also hold the Jupiter India fund, which is currently our best-performing fund.

Because markets have been so volatile this year, we have been looking for funds that have done consistently well rather than ones that do fantastically well one month, but then lose it all the next.

Each week, we rank all the funds that we monitor, based on their standard deviation (a measure of risk) over the last 12 weeks, and allocate them a Vindex (Volatility Index) number ranging from one to 10. Funds with a Vindex of one have been the least volatile, while funds with a Vindex of 10 have been the most volatile. As you would expect, the three money market funds that we hold all have a Vindex of one.

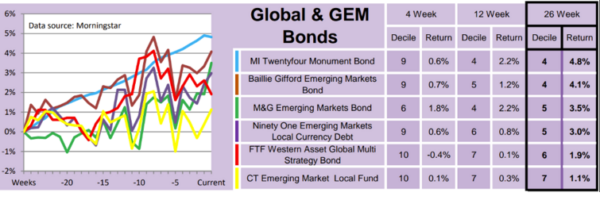

In June, we added the MI TwentyFour AM Monument Bond fund to our Ocean Liner portfolio and a month later put it into the Tugboat portfolio as well. It is in our Global & Global Emerging Market Bond sector, where we combine all the non-UK bond sectors. The funds in this sector can be quite volatile, as you can see from the graph below, but MI TwentyFour AM Monument Bond stands out because of its relative consistency. It also has a Vindex of one.

The graph is from last week’s analysis and shows the Monument Bond fund dropping slightly the previous week, but it has subsequently gone up.

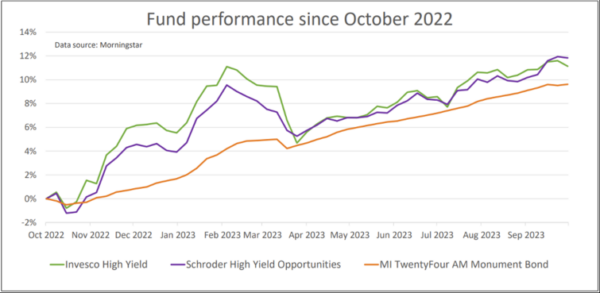

Last week, we had another deep dive into the Vindex one funds and found a couple more that look promising. They are the Schroder High Yield Opportunities and Invesco High Yield funds. Both are from the Investment Association’s £ High Yield sector.

The £ High Yield sector is made up of funds investing in fixed-income securities issued by companies with credit ratings below investment grade (rated BBB, or lower, by major credit rating agencies such as Moody’s, S&P, or Fitch). They are considered to have a higher credit risk than government or investment-grade corporate bonds, but in return typically offer higher yields.

This is how they have performed over the last year.

You can see that they have been more volatile than the Monument Bond fund, but have been going up fairly steadily for the last six months.

Our Tugboat portfolio has bought the Schroder High Yield Opportunities fund, and the Ocean Liner has chosen the Invesco High Yield fund.

We have started with a relatively modest investment, but might increase it if they continue their upward trajectory.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Commentary » Investment trusts Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.