Feb

2022

Emerging Markets ETF: The Great Confluence

DIY Investor

8 February 2022

Where the growth is

Any investment professional that has spent even a small amount of time studying Emerging Markets will likely know that the key growth story in the developing world is the emergence of the middle class consumer. There are numerous studies published by investment banks, consulting firms and fund companies showing us how literally billions of people in developing countries are just now entering the middle class and increasing their discretionary consumption; seeking out more and better food, clothing, appliances, cars, educations etc. It’s a big story that is fundamentally changing economies across the globe and in rapid time. In a report titled “Going for Gold in Emerging Markets” [1] McKinsey & Co concludes:

“By 2025, annual consumption in emerging markets will reach $30 trillion—the biggest growth opportunity in the history of capitalism.”

That is a bold statement. Not a “large opportunity” or “good opportunity” but the biggest growth opportunity in the history of capitalism. And while it may sound hyperbolic, based on my personal research, analysis, travels, experience and logic I think it’s true. Besides, even if it turns out to be only the 2nd or 3rd best opportunity in the history of capitalism, it might be worth a closer look.

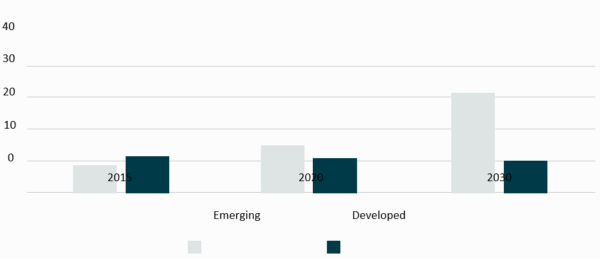

Middle Class Consumption of Largest 10 countries | PPP $Trillions [2]

The charts above and below illustrate the shift in middle class purchasing power from developed to emerging markets and the projected change in the source of consumption.

Global middle class consumption:

Global Middle Class Consumption: PPP $ Trillions and % Global Share: Top 10 Countries [3]

What did the Alibaba IPO mean?

The IPO of Chinese Ecommerce giant Alibaba is fading in the memory of the investment community. Though, with all the hype coverage, it is more like the haze of a mild concussion. I liked the assessment from popular financial pundit Josh Brown who wrote on “Alibaba day”:

“The truth is, today is a historic moment. It’s one of the largest IPOs in history – you’ve seen all the stats and superlatives I’m sure. But we won’t know just what it all means for weeks, months or years to come. The significance of this day will not be fully realized anytime soon – like most major market events. Sure, we can speculate.”

He was right. It was, after all, the largest IPO ever on the NYSE. It was a big deal. But what did it mean?

The Great Confluence

I suggest that what the Alibaba IPO “means” is that several powerful trends are coming together in a great confluence with staggering results. Just as the massive population wave in emerging markets is joining the consumer class, the tools, methods and models of consumption are undergoing a once in a lifetime transformation as three other major trends take hold.

Trend 1: smartphones are becoming affordable and ubiquitous

When did you first have a phone with a touch screen? For me the answer is 2009, just a few years ago. And yet, now, the idea of not having one, seems implausible. What would I do? Indeed, The Economist has recently labelled the smartphone “the defining technology of the age” adding a prediction that 80% of all adults “will have a supercomputer in their pocket” by 2020.

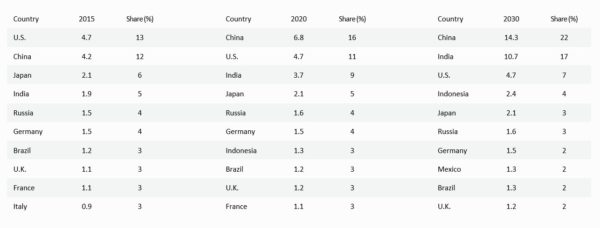

Smartphone Users Worldwide (2016-2025) [4]

*Projections

Fueling the spread of this technology are new competitors that are driving down prices for entry level smartphones making them affordable for more people. Chinese smartphone maker Xiaomi – started less than 10 years ago is currently the fourth largest smartphone player in the world, with sales growing over 52% in 2018, followed by 88% growth in the final quarter of 2019. It has recently expanded into music and video streaming to reach a user base estimated at 300 million people. [5]

In India, market leader MicroMax is selling smartphones for under 3,000 Rupees, or ~ $406. And, it may still be the first innings of this game. Consider for example that India has 1.37 billion people, and only 1/3 of the population are smartphone users. [6]

Trend 2: Mobile and WIFI Broadband Internet Access are Surging

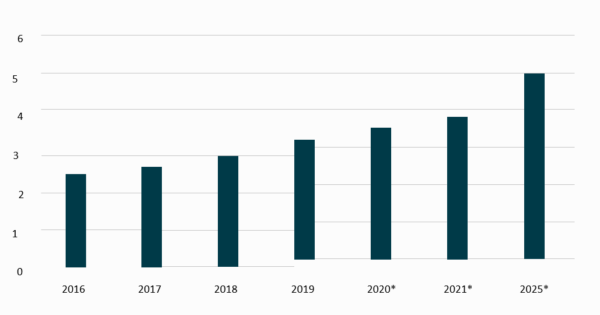

When was the first time you were able to reliably watch a video on your phone? The answer for me is only in the past couple of years. I live 50 miles from Apple headquarters and am generally slightly ahead of the U.S. curve in adopting consumer technology. It seems to me that if I am just getting these things, most of the people in the developing world must not have them quite yet. Indeed, the chart below indicates that this is true, and that the spread of mobile broadband is in the early stages but surging quickly.

Smartphone penetration (2019) [7]

Trend 3: The Globalisation of the Capital Formation Process

Across the developing world, local entrepreneurs are partnering with U.S. venture capital investors to pour their hearts, sweat and billions of dollars from institutional investors into ecommerce start-ups. Recent examples include Ant Financial raising $210 million for an Indian based online food delivery company Zamoto (October 2018). Additionally, in early 2019, Alibaba participated in raising $150 million for an Indian ecommerce company Big Basket and Tencent made an investment in an Argentinian mobile banking start up Uala. [9]

In many cases – like Alibaba – these enterprises are enjoying tremendous success and creating significant value. Alibaba and Tencent account for an estimated 40-50% of total venture capital flows in China [10], and while Chinese companies have received the majority of the funding and attention thus far, the trend is spreading.

India, with its massive population and low penetration rates is the current hot spot for venture investors. But it’s happening everywhere from Vietnam to Colombia to Turkey. It’s even happening in Africa, which has been an investment backwater for my entire lifetime.

Most emerging markets e-commerce companies are not in major ETFs

The Alibaba IPO in September 2014 raised awareness of a little-known fact about emerging markets ETFs – namely, that U.S. listed Emerging Market companies like Alibaba (NYSE: BABA) were not included in major indexes and ETFs. As even the USA Today reported:

“The fact that they’re saying it [Alibaba] won’t be in many indexes, or broadly followed indexes, it raises the question of what indices are supposed to do.” (USA Today)

The reason most of these companies IPO in the U.S. is because they are backed by U.S. institutional venture capital. The reason these companies are not included in the ETFs are technical. In short, it has to do with the legacy nature of the major index providers and the globalization of venture capital discussed above. Perhaps Tom Lydon of ETF Trends said it best:

“It’s the clash of the old world legacy index companies with the fast pace of IPOs and ETFs today” (Tom Lydon, Editor ETF Trends)

This issue has only recently been fixed. MSCI added Alibaba and similar companies to their indices over one year later in late 2015 and in two phases lasting into 2016. FTSE Russell only recently added these companies in late 2017. Investors in funds based on these indices missed out on the strong performance of Alibaba during these time periods. This highlights the potential issues that rules-based indices may encounter in reacting to the increasingly global and complex world of finance.

The Great Confluence is Just Getting Started

By now most of you have heard of Alibaba founder Jack Ma. But have you heard of Sachin and Binny Bansal? They are the founders of FlipKart – “the Alibaba of India”. They raised over $7 billion in funding rounds since the company’s founding in 2007. Wal-Mart recently announced that they will acquire a 75% stake in the company. We first highlighted this company in our initial paper in 2015 and told you that you would be hearing about it. How about Sim Shagaya and Konga.com? Ever heard of them? Don’t worry, you likely will.

Assessing the Great Confluence

The EMQQ Emerging Markets and Ecommerce UCITS ETF

The Emerging Markets ETF uses full physical replication to track an index of leading internet and Ecommerce providers serving the emerging markets, offering investors exposure to companies poised to benefit from the growth of online consumption in the developing world.

The index contains over 50 constituents, including Alibaba, Tencent and Baidu, weighted according to a modified market-capitalization methodology with individual constituents capped at 8%. To be included, companies must derive more than half their profits from Ecommerce or internet activities, including search engines, online retailers, social networks, online video, online gaming, e-payment systems and online travel.

In excess of $360 million of ETF tracks the EMQQ Index as of 29th October, 2019. EMQQ Emerging Market and E-Commerce UCITSETF is issued by HANetf and listed on London Stock Exchange, Borsa Italiana and Deutsche Boerse XETRA with a TER of 86bps.

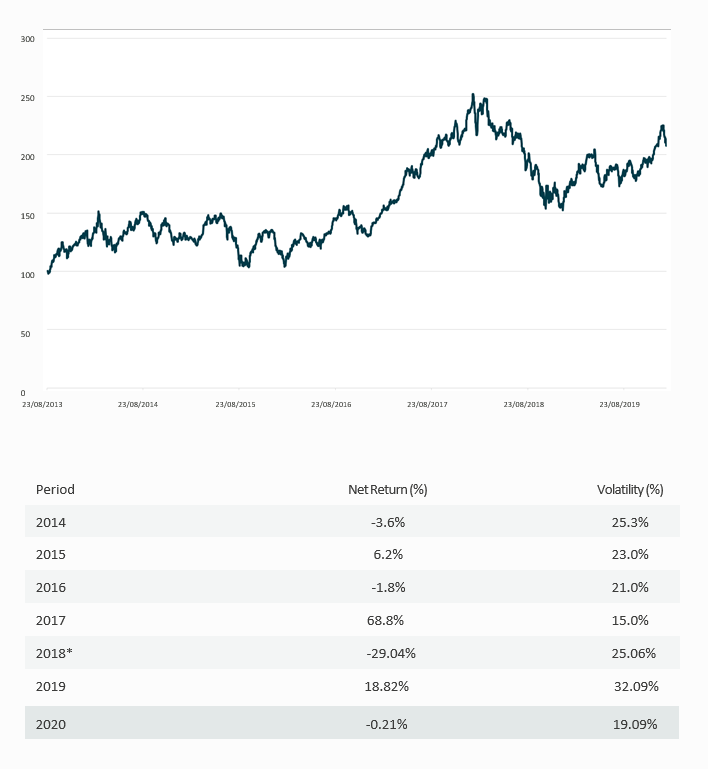

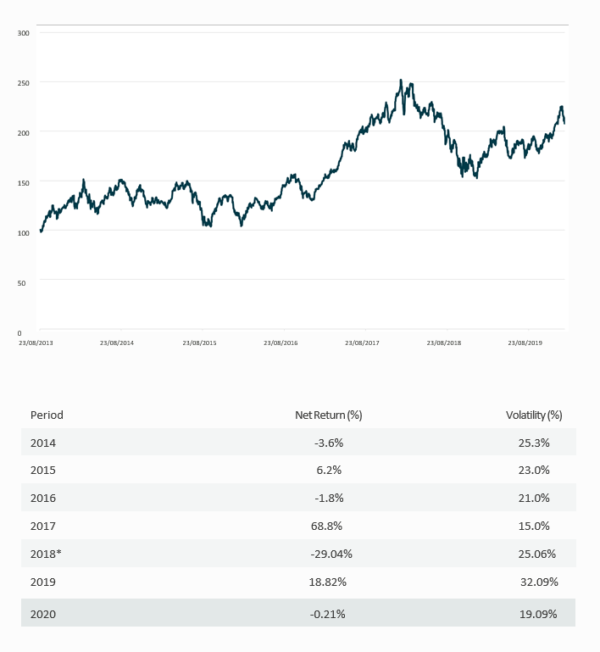

EMQQ-Index performance (usd) to 23rd August 2019

*Index data up to the 01/10/2018. Fund data from 02/10/2018. Performance before inception is based on back tested data. Back testing is the process of evaluating an investment strategy by applying it to historical data to simulate what the performance of that strategy would have been. Back tested data does not represent actual performance and should not be interpreted as an indication of actual or future performance. Past performance for the index is in USD and shown net of fees. Past performance and back tested index performance is not an indicator for future results and should not be the sole factor of consideration when selecting a product. It is provided for illustrative purposes only. Indices cannot be invested in directly. Investors should read the prospectus of the Issuer (“Prospectus”) before investing and should refer to the section of the Prospectus entitled ‘Risk Factors’ for further details of risks associated with an investment in this product.

Source: Bloomberg, HANetf

Learn more about our Emerging Markets ETF

Alternative investments Commentary » Equities Commentary » Exchange traded products Commentary » Exchange traded products Latest » Latest

Leave a Reply

You must be logged in to post a comment.