Feb

2022

Climate Progress Dashboard: long-term temperature rise drops again to 3.3°C

DIY Investor

7 February 2022

Schroders’ latest update on climate change indicators shows slow progress in light of COP26, reduced oil and gas investment and surging carbon pricing – by Andrew Howard, Global Head of Sustainable Investment

Schroders’ latest update on climate change indicators shows slow progress in light of COP26, reduced oil and gas investment and surging carbon pricing – by Andrew Howard, Global Head of Sustainable Investment

The latest reading of the Climate Progress Dashboard points to a long-run temperature rise of 3.3 degrees over pre-industrial levels, down just slightly from 3.4 degrees in our previous update.

The dashboard consistently gives a more alarming result than other forecasters do. This is because of the misalignment between intent and action. Political targets and aspirations are relatively aggressive but policies to deliver those targets are less developed and less audacious. There’s even less actual action being undertaken to meet these targets and aspirations.

The positive momentum since our last update has been driven by the oil and gas sector’s continued curtailing of investment in new capacity, voluntarily or otherwise.

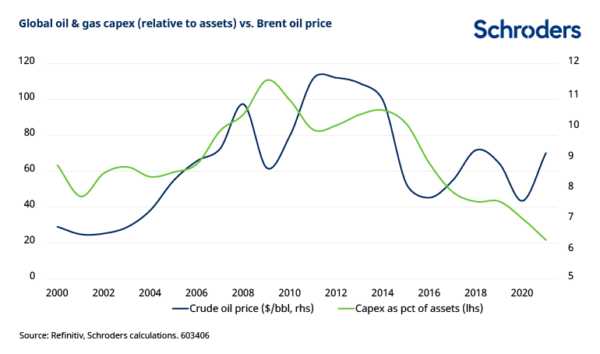

Oil and gas investment falling

This component of the dashboard assesses the global, listed sector’s investment in growth (capital expenditures, capex), relative to its asset base. That ratio yields an indication of the pace of capacity growth the industry is on track to deliver in the future.

Essentially we deduct our estimate of the expected decline in production of existing assets from that gross growth estimate to gauge the pace of new production growth implied by industry investment.

By comparing the rate of production growth to the rates implied under different climate scenarios plotted by the International Energy Agency, we can measure the long-run temperature rise implied by the industry’s production growth plans.

But will the oil and gas industry be tempted by rallying oil prices?

In previous updates, we have questioned whether the industry would be able to resist the temptation to raise investment as oil prices rally.

To date, the evidence looks encouraging. Industry-wide investment in new capacity has continued to slide. Fossil fuel producers are in the cross hairs of climate campaigners and policymakers, as are the financial services companies that provide capital to them. That constraint has been the major driver of the lower long-run temperature rise implied by climate action since our last update.

What’s changed for political action and carbon prices?

Political action and carbon prices have also moved in the right direction.

The increased level of political ambition reflects the ratcheting up of climate commitments in the run up to, and during, COP26, the UN’s annual climate conference. India established a net zero target, albeit its pace is contingent on developed economies providing capital to emerging counterparts to ease and facilitate that transition.

Carbon prices in Europe continue to reach new records, having proven resilient through the Covid crisis while also benefiting from a nascent re-opening.

Progress is slow

While COP26 provided neither the step forward we had hoped for, nor the setback we’d feared, progress toward the goals agreed in Paris in 2015 continues slowly.

There is much further to go to align the actions we see across all of the stakeholders, industries and social groups that will play key roles in driving decarbonisation.

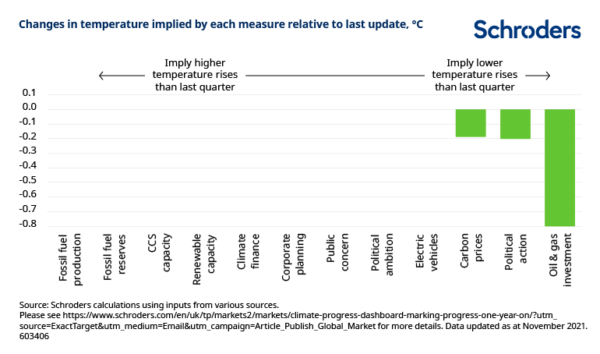

Summary of changes between Q2 and Q3

The chart below plots the changes in each indicator relative to the last update (July 2021).

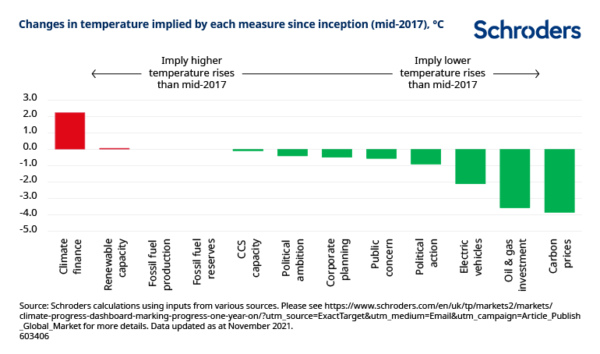

The chart below plots changes in each indicator since we launched the Climate Progress Dashboard in mid-2017.

Important information

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.