Sep

2020

Emerging Markets: ‘a rising tide will not lift all boats’

DIY Investor

18 September 2020

Key takeaways

- A number of emerging market countries have experienced pandemics in recent years so were better placed to react to the coronavirus outbreak compared to the developed world.

- Looking ahead, countries expecting to export their way to economic development may find it difficult if protectionism is on the rise.

- Large domestic markets, such as China, may be best placed to provide longer-term investment opportunities given export markets may not be available as before.

While the coronavirus originated in Wuhan, China, there have been significant differences in infection and mortality rates across emerging markets as well as in the ongoing economic impact. As a result, we believe that some countries, and the businesses that operate from them, will be better placed to recover and eventually grow over time compared to others.

Several emerging countries have experienced pandemics, like SARS, MERS and Asian swine flu, so were better placed to react to the coronavirus outbreak. Countries such as China and Vietnam, with competent, unified and proactive governments, managed the situation efficiently. They benefitted from testing capacity, the ability to impose a lockdown and a willingness to utilise technology despite privacy concerns.

When the virus is under control

A longer-term economic impact from the coronavirus pandemic is likely to be felt by certain emerging market governments that were forced to spend more than they could afford and implement unconventional monetary experiments.

For example, the Reserve Bank of India (RBI) has started its own version of operation twist, buying long-dated government bonds while simultaneously selling short-dated bonds, in a bid to reduce longer-term interest rates and stimulate the Indian economy.

We are concerned about the debt levels within countries such as Argentina, Nigeria and South Africa, as well as larger emerging market economies, like Brazil, India and Indonesia.

We believe these countries will need to start bringing their budget deficits under control once the virus has run its course, a process which in the past has often led to sustained periods of sub-par growth*.

Among some of the hardest-hit equity markets during the COVID-19 pandemic have been those with high foreign ownership of domestic government bonds, such as Mexico, South Africa and Indonesia.

The selling of these bonds by retreating foreign investors typically puts pressure on the domestic currency. Those countries with aggressive monetary policies before the virus hit, like Turkey and Brazil, also experienced difficult equity market conditions.

Country analysis matters

Our view is that the next 20 years are not going to be as favourable for emerging markets as the prior 20 years. First, the golden age of globalisation has passed. Countries expecting to export their way to economic development will find it difficult if protectionism is on the rise.

Second, artificial intelligence (AI) and automation are reducing the comparative advantage of cheap labour and thus making economic development based on industrialisation more difficult.

Lastly, the nature of China’s growth story is changing from being commodity – and imported capital goods – intensive to one that is consumption-led, which provides less support for other emerging markets.

Therefore, we argue that there is going to be a large disparity between the success stories of certain emerging market countries and the failures of others, making country selection important.

Governance factors remain crucial

Not all controlling shareholders in the Emerging Markets asset class oversee their company for the benefit of all – including minority shareholders like ourselves. Not all political regimes provide predictable rule of law and regulatory standards.

Consequently, we remain cautious towards investing in state-owned enterprises, which can be forced to participate in ‘national service’ – a directive by the domestic government to act on its behalf.

Our preference remains to invest alongside entrepreneurs who tend to run smaller and medium-sized companies, and care about the interests of all shareholders. We believe these companies represent the future of emerging markets.

A focus on large domestic markets

We think that countries with large domestic markets, such as China, may be best placed to provide longer-term investment opportunities given that the export markets may not be available as before.

That said, we remain positive on Vietnam, which has been receiving a disproportionate share of foreign direct investment flows compared to other emerging countries.

It is a logical place to diversify supply chains away from China given it has improving infrastructure along with a young and educated demographic. The only impediment is that the stock-picking pool of liquid (easily tradeable) stocks is limited.

At a company level we are also looking for businesses that are creating intellectual property, not just technology patents but also brands.

Mirroring the developed world, themes such as the growth of ecommerce and the digitalisation of payments will continue to grow in stronger emerging economies. We think that successful countries and companies will need a reformist government that helps set favourable policies to pull these factors together.

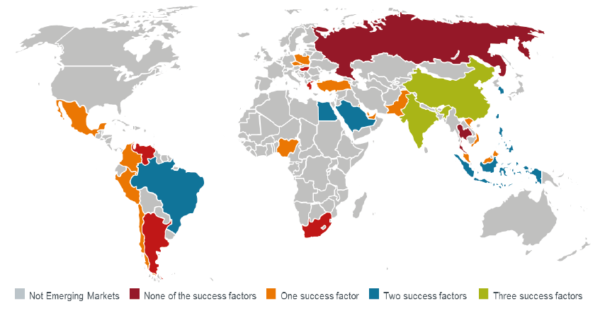

There are certain key factors that we believe emerging markets need for future success:

- Large domestic market given deglobalisation

- Creation of intellectual property (technology patents and brands)

- Reformist or innovative government

OUR VIEW IS THAT NOT ALL EMERGING MARKETS ARE WELL-POSITIONED

Source: Janus Henderson Investors as at 31 May 2020

Based on these factors and the dynamics likely to be at play in a post COVID-19 world, we believe ‘a rising tide will not lift all boats.’ For us, the most compelling opportunities on a longer term view are likely to come from emerging Asia where innovation is happening, and where the middle class high-spending consumer demographic is growing. What is clear, however, is that care is required when analysing the relative merits of constituents of the asset class with disparity growing between those who succeed or fail.

* Sub-par growth: Growth that is at levels below average or below what is expected

Click to visit:

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

For promotional purposes.

Commentary » Investment trusts Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Uncategorized

Leave a Reply

You must be logged in to post a comment.