Dec

2022

Cost of Cash: 4 in 5 parents losing out on children’s savings

DIY Investor

14 December 2022

Following today’s inflation figures, new research from Janus Henderson Investment Trusts reveals how much parents could be missing out on when saving for their children.

Despite four in five parents (79%) regularly saving for their children’s future, almost half (48%) still opt for cash savings – which have significantly underperformed on returns compared to stocks and shares investments.

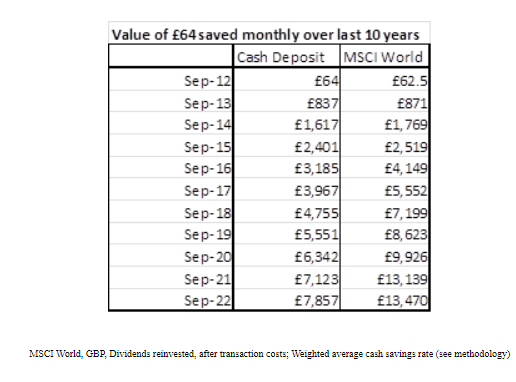

With an average £64 per month invested, this equates to a potential £5,790 worth of returns in stocks and shares, versus £177 of interest in cash savings over the last 10-year period.

The research shows that parents are thinking long-term. Saving for the deposit on a home purchase is the primary reason people save for their children’s future (26%), closely followed by further education costs (25%) and a lump sum (25%).

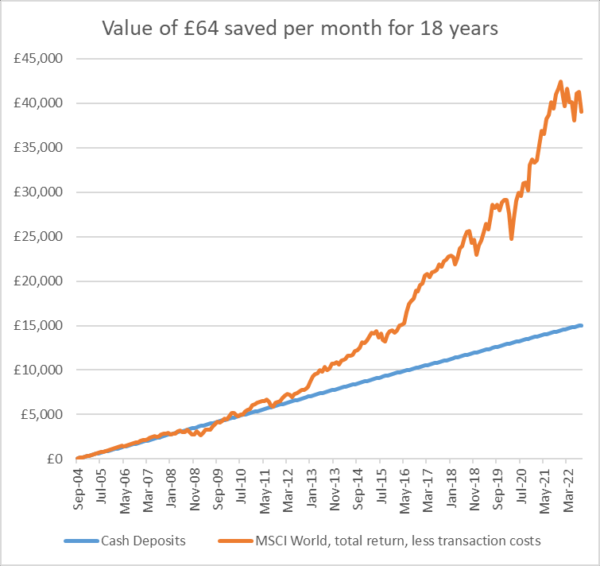

Those who have saved £64 per month for 18 years, perhaps for university, would have earned just £1,182 in interest since September 2004, but the return (or profit) on a similar investment in stocks and shares would be £25,221. After inflation, cash savings would have lost significant purchasing power over this period, more than offsetting the interest earned.

Dan Howe, Head of Investment Trusts at Janus Henderson Investors, said: “Cash is essential for immediate needs, but it’s an expensive trap in the long term.

“The great effort many parents have made to save for their children’s futures has delivered disappointing returns if they opted for cash accounts. Right now, interest rates are on the up and volatile stock markets understandably provoke anxiety. This may tempt parents to continue to save for their children in cash. Yet history shows that it only loses purchasing power over time, and returns fall behind stocks and shares over the long term too. Actually, the extended time -horizon parents have when saving for their children is well suited to assets like investment trusts.

“Regular investment is an important way to meet the challenge of volatile markets. A savings strategy that invests steadily in investment trusts, regardless of market conditions, allows savers to benefit from pound-cost averaging. This means their money buys more when prices are low and less when prices are high – and it builds steadily over time. Perfect for long-term savings goals.”

Appendix:

|

How are people saving for their children? |

|

|

I put money in a current account for them |

37% |

|

I keep physical cash for them |

39% |

|

I put money in a savings account for them |

48% |

|

I invest in premium bonds for them |

22% |

|

I invest in a Junior ISA for them |

30% |

|

I invest in a Cash ISA for them |

26% |

|

I invest in a Stocks & Shares ISA for them |

22% |

|

I invest in a pension for them |

18% |

|

I invest in investment trusts for them |

21% |

|

I invest in the stock market for them |

18% |

Methodology:

Janus Henderson Investment Trusts commissioned Opinium Research to conduct a nationally representative survey of 1,219 UK Parents. The survey was conducted between the between the 26th and 29th August, 2022

Janus Henderson Investment Trusts sourced aggregate cash savings balances and savings interest rates from the BSA which sources them from the Bank of England. Median balances per household are sourced from ONS Wealth & Assets.

MSCI World is an index which tracks the return from global stock markets. Janus Henderson Investment Trusts used the total return index of the MSCI, converted to GBP to calculate returns from investing in global equities and deducted transaction fees of £1.50 per transaction to mimic a regular savings plan. Investors opting for regional or country focused investment trusts rather than those with a global mandate will experience different returns.

CPI is sourced from ONS.

Brokers Commentary » Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » News » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.