Sep

2020

‘An investor’s most powerful weapon is patience’*

DIY Investor

5 September 2020

Just a few months ago stock markets around the world were in free-fall; although there has been a recovery, where they go from now, nobody can be sure.

Of course there are some that say they do know, but now is the time to choose your ‘expert’ media input very carefully.

By and large the financial industry promotes a ‘buy and hold’ approach where you choose your investments wisely and then hold them through good times and bad.

‘the very pleasant feeling generated by being out of the market when it tumbles’

They maintain that successful investing is about ‘time in the market, not timing the market’; they will say that if you miss the few days during the recovery, when the markets soars, then you and your portfolio are ‘dead meat’.

However, they always fail to mention the very pleasant feeling generated by being out of the market when it tumbles, and in the last twenty-five years there have been some significant tumbles.

The largest being the dot.com crash, starting in 2000, then the Financial Crisis of 2008/9 and now the spread of coronavirus.

At Saltydog Investor we disagree with this strategy; we use an active momentum approach (sometimes referred to as trend investing) to choose the I.A. sectors and funds which make up our portfolios. It is important to say that we also treat cash as a sector in its own right.

The basic idea is that the greater the money being invested into a sector or fund, the quicker its value will rise; this in turn attracts more and more investors, and the greater the momentum upwards becomes.

‘the greater the money being invested into a sector or fund, the quicker its value will rise’

Obviously the opposite is also true, and the momentum can become downwards.

We buy into uptrends and sell out of downtrends. If it turns out that the correction is a small one, then unfortunately we can end up selling and then buying back at an increased price.

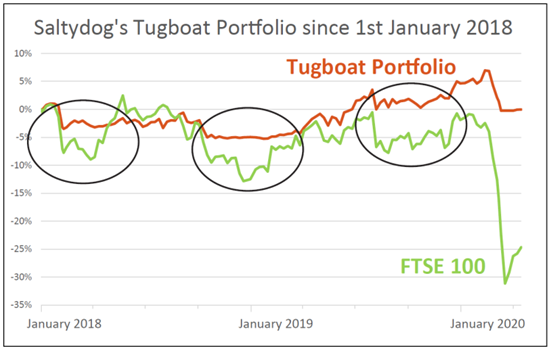

Not a clever result, but definitely better than experiencing the wealth destroying crashes that you can see in the FTSE100 graph.

In recent times we have consistently used this approach owing to the precariousness of existing world economies, and this time it paid off in spades.

Since the beginning of 2018, we have successfully navigated three relatively small market corrections, and are now well positioned to make the most of the next upturn, after this coronavirus generated crash reaches its conclusion.

The next question that needs to be asked is, where will the best market returns come from in twelve months time? The economies of the world will be hugely different from where they were at the beginning of 2020.

‘Sustainability and good ethical governance are now mainstream issues’

I do not have the knowledge to judge whether we will be living in a time of deflation, inflation or a 1930’s style depression, but large numbers of people are likely to have become unemployed thereby changing working practises forever.

I do think that it would be a mistake to ignore the ‘Greta’ effect, and the desire of many to improve the world’s environment.

Sustainability and good ethical governance are now mainstream issues, and there are a number of funds that provide a good return for people wishing to invest into these areas. At Saltydog, prior to the crash we had been using three such funds, and will undoubtedly visit them again.

- Royal London Sustainable World Trust (up 30% in 2019).

- Liontrust Sustainable Future Managed (up 25% in 2019).

- Janus Henderson Institutional Global Responsible Managed (up 25% in 2019).

I also see no reason why technology funds in all their shapes and forms will not continue to perform, with biotech and green energy funds leading the charge.

There is now a new kid on the block called ‘Waterfuel’; this involves using electrolysis to cheaply, efficiently and safely split water into hydrogen and oxygen. The hydrogen can then be stored for future use, when it can be fed into existing gas installations and also be used to power hydrogen driven car engines.

‘if they still look stormy and you feel insecure then take action and go into cash or the equivalent’

This process is perfect when there is an oversupply of wind or solar created electricity which normally has nowhere to go; now you can create hydrogen for future use.

This is really green and you are not going to run out of water or electricity to power the process. There is already an Island in the Orkneys that is entirely powered by this fuel, and one cannot imagine this process not spreading further.

As a fourteen year old I went away as an unpaid “decky learner”on the Kingston Garnet, a deep sea fishing boat from Hull.

The trips to Iceland were around five weeks and of course during that time the weather could on occasions be uncomfortable. This was the time of beam trawlers, the stern trawler had not yet been designed.

When hauling the nets the boat was beam onto the sea, and a big wave coming on board required agility, common sense and luck to avoid casualties.

I now get to my point.

The skipper addressed my concerns by saying that if you have taken all the action within your knowledge to make the boat and crew safe, then you can do no more – the rest is luck!

So is this so dissimilar from investing in today’s markets? Of course mistakes are unlikely to be life threatening but you still want your savings to be as safe as is sensibly possible.

The markets can, on occasions like now, be as unpredictable as the weather.

If it looks stormy and you feel insecure, then take action and go into cash or the equivalent.

We have the luxury of not having to carry on fishing to secure a livelihood; we can wait for better investment weather – take it from the Sage of Omaha, ‘an investor’s most powerful weapon is patience’.

Best wishes and good investing,

Douglas.

Founder & Chairman

* Warren Buffett

Commentary » Equities Commentary » Investment trusts Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.