Jan

2022

Active is Anticipating what’s ahead – 2022 Outlook

DIY Investor

16 January 2022

Agility counts in a year of disruption and divergence

Agility counts in a year of disruption and divergence

Going into 2022, investors will want to prepare their portfolios for bouts of volatility and lingering inflation, likely by diversifying more broadly across asset classes, styles and regions. But they should also take this opportunity to factor in the disruptive structural trends that are driving – and even upending – our expectations of the future.

Economic growth seems likely to decelerate after the “base effect” rebound we saw in 2021. Covid-related uncertainty and supply bottlenecks will likely prove to be a drag on growth, as well as a continued source of price volatility. There should also be a divergence in growth figures and central bank support in various parts of the world, and the markets will likely react quickly to any positive or negative macroeconomic data. All the while, inflation seems likely to stay higher than many market-watchers expect.

So what does this mean for investors’ portfolios? We invite you to explore three structural themes that are likely to play a key role in the coming year.

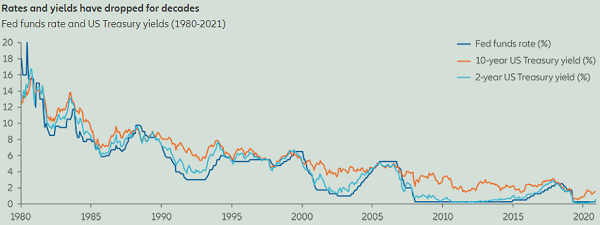

Navigating Rates

Investors need to watch the speed of interest rate adjustments, fluctuating exchange rates and shifting inflation expectations. We think central banks and many investors underestimate the probability that consumer price inflation may turn out higher than expected – and last longer than is currently priced into financial markets. While some central banks have already imposed rate hikes, and others are close behind, they are also likely to remain “behind the curve” in responding to inflationary pressures. So while inflation may creep up, we don’t expect to see an end to the decades-long era of overall low rates – which means investors must find new ways to protect purchasing power and search for yield.

Navigating rates: reinforce portfolios against monetary policy mistakes

Central banks are in uncharted territory in terms of the monetary stimulus they’ve been providing. This raises the risk of central banks making a policy mistake that would upend parts of the global economy, make inflation more volatile and affect financial markets. As a result, central banks are walking a fine line.

Consider that the US Federal Reserve (Fed) and European Central Bank (ECB) have announced plans to scale back their asset purchase programmes and hike rates. At the same time, these and other central banks won’t want to “tighten” too much. They have become more comfortable with higher inflation and are allowing it to outpace their rate increases. In monetary policy-speak, they are “behind the curve”. Given today’s high private and public sector debt levels, they are also aware that if they were to pull back on the monetary reins too hard, they could risk triggering defaults.

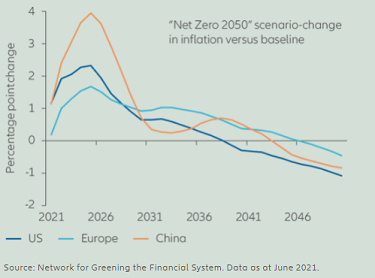

This continued monetary support is one reason we expect higher inflation to last longer than the markets currently expect. And there are other long-term developments in the real economy that are at least marginally inflationary: slowing international trade, higher labour compensation and the fight against climate change are just a few. Rising prices for CO2 certificates and the economic adjustments needed for a “green” economy will likely increase prices initially, even though they should benefit economic growth and the planet over the long term (see climate change chart).

But overall, the forces that have driven interest rates steadily towards zero over the past four decades are still at work, and we believe they will remain dominant for some time (see rates vs yields chart). Against this background, rates and yields seem likely to stay lower for longer overall.

The fight against climate change may push up near-term inflation

US, EU, China: change in inflation vs baseline for “net zero 2050” scenario

What it means for investors: consider fundamental changes for this fast-changing environment

Given our view that interest rates are likely to stay lower for longer – while inflation remains higher than it was in the pre-Covid era – investors may want to rethink their asset allocations. Different approaches will likely be needed to navigate diverging levels of growth and yield potential. And it will be critical to be far more agile to navigate an era when market conditions can shift quickly – and the potential for policy mistakes remains elevated. Here are four ideas for the year ahead:

-

Use “barbells”

Higher central bank interest rates, reduced bond purchases and higher inflation will likely lead to weaker bond prices and rising yields. One way to approach this is to view portfolios as “barbells” that span two groups of assets: those suited to preserving capital (including government bonds, credit, cash-like investments and liquid alternatives) and those designed to generate capital growth and income (including emerging-market bonds, stocks and even private-markets assets). Investors can target a variety of outcomes via multi-asset solutions that combine elements from each group.

-

Think themes

Thematic investing offers the ability to diversify portfolios while aligning with powerful, long-term social and demographic shifts. Themes such as healthcare transformation and the embrace of digital technologies represent new sources of growth and yield potential – which traditional classifications by sector or region may miss. The UN Sustainable Development Goals provide a helpful “window into the future” to identify companies that are addressing these opportunities.

-

Tap private markets

Private markets may hold particular interest for institutional investors in this environment, where illiquidity premia are holding up well. They can offer various built-in hedges if the recent rise in inflation becomes a longer-term trend. Investors can also use private markets to seek financial alpha while also improving the world in which we live. This is particularly timely given the public and private sectors’ commitment to “build back better” in the wake of the Covid-19 pandemic – for example, by investing in education, healthcare or enhanced digital infrastructure.

-

Stay agile

Monetary and fiscal support is still high, though fading. Growth and inflation data will likely remain much more volatile than in past cycles, making predictions harder to make. And growth may be increasingly driven by “endogenous” (internal) factors such as consumption or high-tech advancement. In such an environment, scenarios can change quickly. That means the optimum mix of assets will naturally need to shift in response – all while keeping exposure to riskier assets without taking on undue levels of overall risk. This calls for a highly dynamic, active approach that can switch positions rapidly as economic conditions evolve.

Appreciating China

The world’s second-largest economy is in the midst of an unparalleled strategic transformation, and it’s important not to lose sight of that even as economic growth slows and regulatory clampdowns impact certain sectors. Volatility will continue to be a hallmark of investing in China, but we remain convinced of the long-term investment case. Those who understand China’s wider political context and strategy – and navigate its markets actively – may be best-placed to avoid bumps in the road along the way.

Appreciating China: don’t be deterred by volatility

A critical factor to watch in 2022 is how much China – the world’s second-largest economy – will continue to unnerve markets. Growth has undoubtedly slowed, and recent regulatory issues have triggered market selloffs. But in our view, these changes are part and parcel of investing in China, and investors should seek to weather them over the long term. More immediately, there is plenty of good news out of China. Its banking sector is robust, its government is committed to strengthening its “seat at the table” in the global economy and the country is financed to only a small extent from abroad. China’s equity market valuations are generally cheaper than their US counterparts. And with the nation preparing for the 20th Party Congress in October 2022, government officials will likely do what they can to boost optimism.

Make no mistake: investors will encounter rough spots. At the core of US-China tensions is an ongoing “digital Darwinism” – a multi-decade global power race fuelled by technology and artificial intelligence. In response, China is looking to boost self-sufficiency – promoting high-tech manufacturing and domestic consumer spending to help reduce dependence on foreign trade. “National champions” are set to emerge – companies that provide home-grown alternatives to previously imported goods and drive China’s global competitive advantage.

What it means for investors: understanding China’s history and strategy is critical

When it comes to China, we believe active management is essential – both to navigate this environment and to use the inevitable volatility to build positions. We see opportunities in sectors linked to China’s strategic need for self-sufficiency (semiconductors and robotics) and stocks linked to China’s carbon-emissions targets (renewable energy and the electric vehicle supply chain). Investors could consider adding thematic “satellite” investments to their core China A-share allocations, focused on big-potential areas such as healthcare or technology.

The road won’t always be smooth, and investors would be well-served by accepting that volatility has historically accompanied China’s stockmarket growth. It also helps to understand China’s economic, social and cultural history and how its policy agenda is evolving. Complementing bottom-up analysis with an understanding of the broader context can help investors discover where the country’s strategic priorities translate into opportunities.

China equities have exhibited higher volatility – and attractive returns

MSCI China and MSCI ACWI performance since 2000 (in USD, indexed to 100)

Achieving Sustainability

With the global effort to reach “net-zero” emissions within a few decades, how can investors use their portfolios to have a positive impact? Investor demand, fast-evolving regulations and a deluge of data will raise the bar on what impact investors can achieve – and how they can achieve it. It’s a highly complex topic, involving disparate stakeholders at different stages of their net-zero journeys. We expect sustainability to be a disruptor for the older economy, as citizens around the world look to have a smaller ecological footprint while having a broader environmental and social “handprint”.

Achieving sustainability: invest in a global shift in mindset

In 2022, we expect to see sustainability increasingly factored into every investment decision – from mitigating future risks to finding today’s solutions. Here are five ways in which sustainable investing could help set the global economic agenda for the year ahead.

-

Defining net-zero pathways

In the wake of the latest UN Climate Change Conference (COP26), there will be increasing scrutiny on the “pathways” that individual stakeholders must follow to reach net-zero carbon emissions. Individual countries must articulate where they currently stand and how they plan to change, and all stakeholders will need to converge on a common goal. Their decisions will change how goods are manufactured and consumed, which will affect economic growth.

-

Processing data and navigating conflicts

We expect new regulations to have a significant effect on how businesses operate. Investors will need more resources to process enormous amounts of data, and they may see environmental, social and governance (ESG) factors compete with one another. For example, moving away from fossil fuels may benefit the environment, but eliminating certain jobs may limit access to food or healthcare – hence the need to facilitate a “just transition” to clean energy. Investors will need support to navigate a critical, complex and fast-evolving landscape.

-

Making sustainability structural

A new economy is taking shape, and sustainability affects every company, sector and region. For example, the “just in time” mindset that focused on the lowest cost and highest efficiency has been exposed by the Covid-19 pandemic. Supply chains have broken down and need to be rethought, and true costs that were once externalised and delayed may now be reflected upfront in the prices consumers pay.

-

Focusing on impact

Emphasising ESG factors can help improve the resilience of businesses and systems, but the pandemic and escalation of destructive weather events are shifting the agenda. Investors increasingly want their capital to effect real-world change. The growing field of impact investing offers an answer by providing a credible and scalable pathway to balancing a targeted, measurable environmental or social impact on the one hand, with a financial return on the other.

-

Moving beyond climate

Think of sustainability in three interlinked areas. The focus on climate change determines the temperature in which future generations will live. But we also must learn how to sustain life in that temperature, which means navigating planetary boundaries that respect biodiversity and provide a safe operating space for humanity. And all these changes must be made in a way that improves equality and social welfare, which is why inclusive capitalism will become increasingly critical.

What it means for investors: broaden your thinking and focus on impact

Don’t relegate sustainable investing to one portion of a portfolio. It is increasingly integral to a successful investment strategy. Consider, for example, how sustainability crosses over to our two other primary investment themes for 2022:

- China has a huge role to play as the world seeks to reach net zero and implement energy solutions, so it’s critical for the rest of the world to understand China’s journey – and engage with it.

- The “greening” of the economy will likely add to inflationary pressures in the medium term – even as inequality falls (see chart). Meanwhile, green investments may be able to provide the attractive yield potential that will be vital in today’s low-interest-rate environment.

As the world addresses these critical issues, we expect to see a broader notion of “impact” come to the fore – including how companies are managing their ecological footprint in addition to their broader social handprint. Investors should rightly push for this expanded view of business success. Moreover, meeting these critical sustainability goals will require large amounts of financing, which is why we expect all asset classes (including public and private) in all regions to be increasingly aligned with impact investing.

If future economic inequality falls, inflation could move higher

US wealth inequality vs consumer inflation

Leave a Reply

You must be logged in to post a comment.