Sep

2023

You should be dancing

DIY Investor

7 September 2023

North America should be a core part in any portfolio…by Alan Ray

There’s a phrase many people reach for when discussing the United States – American Exceptionalism – which in its simplest terms encapsulates the idea that the US is an exceptional society with a combination of attributes no other country possesses. This is, unsurprisingly, a controversial topic and even less surprisingly, one that’s been hijacked for political purposes in recent years.

To save time, and to avoid dancing around the topic, let’s put our cards on the table and say that we think there’s a strong case in favour of exceptionalism, but perhaps using the word ‘exceptional’ might not, on its own, be the best way to keep a cool head when it comes to investment.

We recently had cause to rewatch Martin Scorsese’s film The Last Waltz, which documents the final performance of the group of Canadian-American musicians known simply as The Band. One could be forgiven for drawing a blank on The Band, given its unexceptional name. The music, on the other hand, is truly exceptional and is a core part of the story of popular music that perhaps UK listeners have, with the passage of time, come to overlook.

The fact that the concert was filmed in San Francisco also makes for a potentially neat ending, as it’s fair to say that whenever the UK, or any other country for that matter, undertakes a soul-searching exercise about how it might capture some of that North American capitalist magic, San Francisco and the Bay Area always comes up.

It also helps from our perspective that The Band was North American, with diverse influence from across the continent, and while the US market naturally dominates, Canada has a lot to offer UK investors as we’ll come on to. The ending to the movie doesn’t tell the whole story, as The Band took a long and rambling journey to get to this supposed finale and rather messily continued to perform for several more years.

That’s a story for another time, but our conclusion for the purposes of this article is that, exceptional or not, one needs to look at North American equities with the same long-term perspective as anywhere else and accept that it might be a bit messy along the way. And that North America is highly influential on equity markets as a whole, even if UK investors sometimes forget about it.

Let’s try to put a little bit of data around the idea that some UK investors still see North America as a market to invest in from time to time. It has long struck us how lightly represented North American equities are in the investment trust sector, suggesting that many investors are underweight the world’s largest stock market.

There’s a whole debate about what ‘underweight’ even means to a private investor, and we of course know that the global funds often provide significant exposure to North America, but nevertheless total assets of c. £4bn out of an investment trust sector of approximately £260bn strongly suggests that many investors have paid too little attention to this important market.

The £4bn figure excludes Pershing Square Holdings (PSH), which is merely a way of highlighting that PSH adds another £10bn to the total and therefore has a big impact on any sector averages. Even £14bn seems like a low figure in the context of the investment trust market, considering how important the US is in the world of equities.

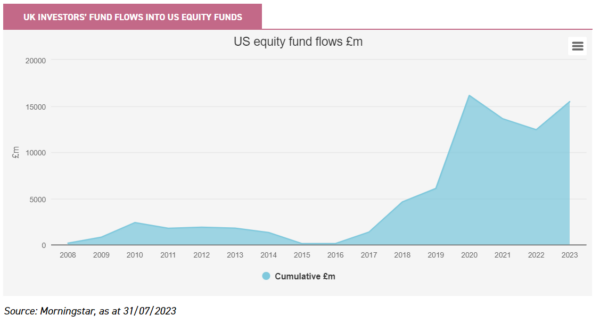

While it pains us to say it, it is quite possible that investment trust investors use other fund structures alongside their investment trust holdings, so we should explore some data from elsewhere. The data for fund flows involving open-ended funds is a more useful barometer of sentiment than the relatively small investment trust sector. The chart below shows UK investors’ cumulative buying or selling of US equity funds since the start of 2008, which is as far back as we have data.

This data includes ETFs, as well as traditional open-ended funds, so we aren’t ignoring passive strategies. The slightly depressing message this chart sends is that UK investors, as a whole, only recently became excited about US equities at the point they were starting to peak out. It’s likely, therefore, than many investors new to the US will be nursing losses.

That’s probably true for most markets, but it’s nonetheless a sad reminder that very often money flows to successful parts of the market too late to benefit from that success. This is one reason why we find fund flows such a useful collection of data, as they can give context to performance charts and how they compare to the average investor’s experience.

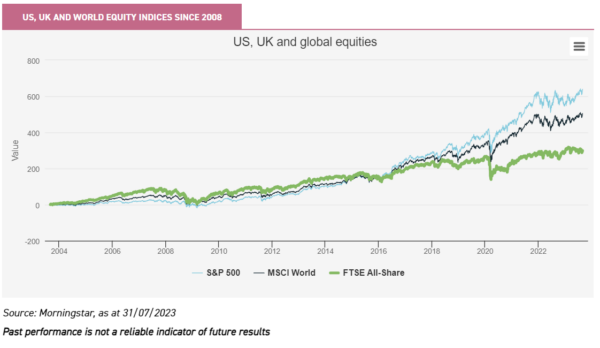

The next chart plots the S&P 500 Index against UK and global equity markets over the same period as the chart above, keeping in mind that the US is c. 70% of the MSCI World Index, so that index will naturally be somewhat correlated to US equities.

All of this leads us to our main conclusion. UK investors should stop considering the US as a cyclical part of their portfolio, to be bought and sold when things get hotter or colder. The US is at the heart of equity-investing culture and should really be a core part of portfolios. Let’s look at some options to achieve that.

JPMorgan American (JAM) perhaps shows that at least some UK investors think longer-term, as it has been around since 1881. Its investment strategy, and the importance the board places on costs and managing the discount, means that it has a very strong claim to be the first US trust that investors should consider, as it provides a low-cost, but truly active portfolio. Illustrating the breadth and depth of the market, it uses three different managers to construct its overall portfolio.

Predominantly an investor in large caps, JAM combines the skills of two fund managers, one with a value bias and one with a growth bias, to contribute stocks to the overall large-cap portfolio. On top of that, JAM’s managers use a dedicated small-cap growth manager to provide JAM’s exposure to small caps.

Those style biases are unified by a strong preference for quality, and it’s became a bit of a recurring theme here at Kepler to say that higher interest rates will, over time, favour companies with stronger balance sheets. JAM’s board also takes the trust’s status as a core holding very seriously, from the perspective of its discount, often buying shares at quite narrow discounts to keep JAM’s share price quite close to its net asset value.

At this point, we’re conscious that we’ve fallen into the usual trap of using ‘US’ and ‘North America’ interchangeably. There’s a rabbit hole one can spend a few minutes down learning about the differing definitions and the number of countries (more than you think) that may or may not be North American.

For our purposes, we are using the phrase in its most everyday sense, i.e. the United States and Canada. Since we kicked off this piece with a distinctly Canadian-American analogy, hopefully our Canadian friends can forgive us for this momentary lapse. Let’s see how we can get exposure to this fascinating market.

Middlefield Canadian Income (MCT) provides investors with a core exposure to Canada. In some ways, MCT and Canadian equities will feel more familiar to UK investors, as there is a stronger culture of equities paying dividends, and also financials and traditional energy sectors are big weightings in the main market indices.

Canada, however, is a major exporter of energy, through the network of pipelines that connect it to the United States, and also through the electricity grid, as Canada itself largely uses renewable energy to generate electricity, with hydropower dominating. In future, Canada is also set to be a significant exporter of LNG, with infrastructure under construction that will directly or indirectly help Europe achieve its pivot away from Russian gas, something it has yet to achieve.

MCT’s largest single exposure at the moment is to Canadian REITs, which share many of the same characteristics as UK REITs and have been following exactly the same path of falling share prices and widening discounts to NAV experienced in the UK. Dean Orrico, MCT’s manager, says that Canadian REITs are now trading, on average, on discounts in the mid-twenties, a level only seen twice before in the REIT sector’s twenty-year history.

Canada has a number of structural reasons why real estate is undersupplied, not least its points-based immigration system which means its relatively small population is growing faster than might be expected for a mature market. This puts MCT well-placed to benefit from a recovery in REIT prices.

In recent years, almost every part of the market has been eclipsed by the performance of a few leading growth stocks that have dominated the performance of the main market indices. Although the fund-flow figures above do suggest that many UK investors have missed out, this probably isn’t the case for everyone, as many of these stocks also feature heavily in the portfolios of some of the best-known global funds, as well as the technology-specialist trusts.

Nevertheless, as we enter potentially a very different era for markets, it’s worth remembering that over long periods of time, smaller companies can outperform larger companies and, while we’ve been through an era where it was possible to argue that certain large companies were able to perform like smaller companies because they were able to rapidly build a customer base of several billion people, we think that smaller companies will continue to provide a rich source of newer, more nimble companies.

The managers of JPMorgan US Smaller Companies (JUSC) have a phrase they use, namely ‘walking the floor’, to describe how they research their companies. US smaller companies are no different to smaller companies in the UK, in the sense that there are lots of them and they tend to be less well-researched than large caps.

Primary research, including visiting the companies, can really matter. The team, who focus on quality and growth, have assembled a portfolio of companies that have very high returns on equity, but which still trade at lower multiples than the overall benchmark. The team believe that small caps, overall, are very attractively valued and, as in the UK, small caps have historically done very well in periods following recession or slowdowns.

Chris Berrier and his team managing Brown Advisory US Smaller Companies (BASC) have a similar view, seeing valuations of smaller companies as a significant opportunity compared to history and compared to large caps. They also take a quality-growth approach, with strong earnings growth across the portfolio.

Every one of the trusts mentioned above has what’s called an integrated ESG policy, which means that ESG factors form part of the overall investment process. A recognition that a well-governed company might be less risky than a sketchily-governed company doesn’t, for example, seem like a controversial position for any fund manager to take.

The fact that ESG is integrated into every one of those processes tells us that ESG isn’t just a passing phase. BlackRock Sustainable American Income (BRSA) is a possible offering for investors who want an explicitly ESG-focussed trust, and BRSA voluntarily conforms to SFDR Article 8, the so-called ‘light green’ EU definition of an ESG fund. The team who manage BRSA are long-standing value investors, with or without an ESG-specific mandate, and 2022 provided a reminder that value-investing can provide very different outcomes to the overall market, with both BRSA and its corresponding index up over 3% against a falling market. BRSA also provides a dividend funded from a mixture of current revenue and reserves, and currently yields c. 4.4%.

It’s worth noting that BRSA does not exclude sectors such as energy, and that positive performance was, in part, driven by its holding in Shell. BRSA’s managers choose to engage with companies and to invest in ESG leaders or improvers in each sector, and of course being managed by BlackRock means that there is a very large weight of money behind any engagement with investee companies. This says to us that BRSA could find a place in any portfolio, even for those investors worried that ESG-investing means missing out on certain sectors.

Conclusions

There is of course an elephant in the room in discussing the idea that North America, and yes, the US in particular, should really be a core part of an investment portfolio. It’s impossible to read the UK financial press without coming across yet another article about UK companies listing in the US, or how the UK market is now structurally undervalued due to accounting and regulatory changes that, after many years, have seen capital from domestic pension funds dry up.

Those are real issues and, in our opinion, it’s totally OK for an investor to take the view that it’s important to them to put money to work in UK equities. One may indeed argue that we’ve reached the point of maximum pain in terms of how out of favour UK equities have become, and it’s important not to assume that nothing will change. Regulations and accounting rules can be changed again and, perhaps with that, the UK stock market could find a new lease of life.

We’ve deliberately chosen the phrase ‘UK stock market’ as it’s important to make the distinction between it and the ’UK economy’, which isn’t quite the same thing and is perhaps doing better than many assumed. The fact that there is a supply of UK companies listing in the US, or being bought by private equity, tells us that. None of that changes our point: North American equities are central to the story of equity markets, overall, and any properly diversified portfolio should be constructed with that in mind.

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Brokers Commentary » Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.