Feb

2020

Free energy? You cannot get ought for nought: Thoughts of Saltydog Investor

DIY Investor

13 February 2020

In science it has always been assumed that there is no such thing as perpetual motion or free energy.

Certainly that was the philosophy in the past, and it is still true today. But what about the future?

Twenty years ago, my mobile phone was the weight and size of two house bricks; now it has a hundred times the performance and fits in my top pocket.

Technical progress today races across all scientific fields and is moving forward at an exponential rate.

‘We can ignore reality, but we cannot ignore the consequences of ignoring reality’

Whether it will be fast enough to prevent a climate catastrophe remains to be seen. Let us hope so, or it might be ‘Goodnight Vienna’ for us all.

Ayn Rand said, ‘We can ignore reality, but we cannot ignore the consequences of ignoring reality, and rest assured there will be consequences’.

Politicians can often act first and pause for contemplation later; this time around, when addressing the problem of climate warming, there has been a general world agreement to cease production of diesel and petrol driven vehicles by the middle of this century. Britain has chosen 2035 as an appropriate year.

Undoubtedly removing these pollutants will be a big step forward and the decision is to be applauded.

However, the chaos that this is going to cause to manufacturing and employment is difficult to comprehend, and what will be the replacement energy generation that will allow travel to become all electric while still being green?

Elon Musk of Tesla would like this to be in the form of lithium batteries, but this does not answer where the electricity comes from in the first place to charge all these batteries.

‘The only alternative at the moment would seem to be ‘Waterfuel’’

If dirty fossil fuel power stations are to be excluded, then surely that only leaves nuclear power generation, and politically will this be acceptable?

Solar and wind power are too unreliable to fill the gap, unless methods are found to store the unused energy generated during off-peak times.

Even supposing that the electricity generation is resolved, how on earth will cars get to the charging points; not everybody can park their cars off-street alongside their own charging plugs.

Even if you trebled the battery range and halved the charging time, I still struggle to see where and how the charging will take place.

The only alternative at the moment would seem to be ‘Waterfuel’.

This involves using electrolysis to split water into hydrogen and oxygen; the hydrogen can then be liquefied and stored for future use.

It can then be fed into existing gas installations and used to power hydrogen driven engines.

There still has to be a source of energy to complete the electrolysis process, but at least this could be a route into using surplus off-peak energy balanced along with say nuclear power.

‘I can imagine service stations dispensing hydrogen in a similar fashion as petrol and diesel’

This would require a huge infrastructure to effectively step into the place of today’s fuel industry; I can imagine service stations dispensing hydrogen in a similar fashion as petrol and diesel are done today.

Hydrogen conversion is a red hot development and investment area. I mentioned this a couple of weeks ago and a number of related stock market businesses have been bought to my attention by Saltydog members.

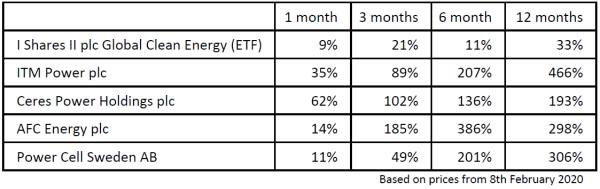

The table below shows their performance up until the end of last week.

At Saltydog we do not invest into individual stocks in our portfolios, but stick to funds where the risk is spread amongst many companies.

I am sure that the technology funds that we report on are up to speed with the future changes to the automotive industry, as we come towards the end of the era of oil and carbon-based fuels.

Also, we have not done any further checks on the companies listed above, and this should not be seen as a recommendation.

‘it’s easy to think that it can’t go on and that you’ve probably missed the boat’

When companies have done as well as these ones, in a relatively short amount of time, it’s easy to think that it can’t go on and that you’ve probably missed the boat.

However, I remember watching from the side-lines as ASOS shares went from a few pennies to a few pounds, and finally onto £22 before pulling back; they eventually peaked at just over £77!

Having said that they then dropped below £25 and are only worth around £35 now. I guess there are also countless examples of companies that have had a flying start, but never came to anything.

On a personal note, I have recently taken a position with the above companies, so I hope that their success continues into the future.

Best wishes and good investing,

Douglas

Visit:

Commentary » Exchange traded products Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.