Jul

2022

Why we are happy to own just one fund

DIY Investor

11 July 2022

Saltydog runs through fund performance in the first half of the year and reveals the one fund it owns in its ‘Tugboat’ portfolio.

Each quarter we rank all the funds that we monitor based on their returns over the previous three months.

In the first quarter of the year, the best-performing fund was Schroder ISF Global Energy with a three-month return of 33.7%. In the top ten there were four funds from the Latin America sector, three from the Natural Resources sector, two from the Specialist sector, and one from the Global sector.

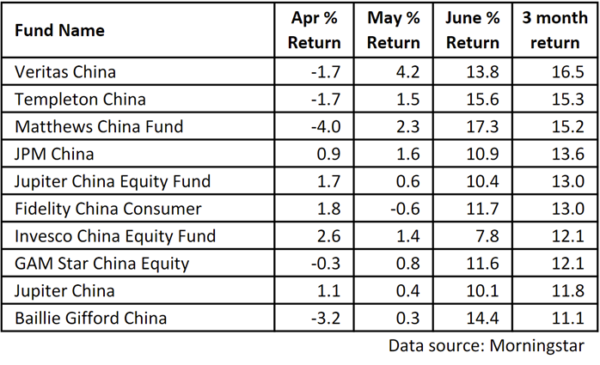

We have now done our analysis for the second quarter and things look quite different. Over the three months, less than 10% of the funds that we look at each week have gone up. The top twenty funds are all from the China/Greater China sector. Here are the top ten.

We are now in the position where our most cautious demonstration portfolio, the Tugboat, is only invested in one fund, and that is from the China / Greater China sector. Let me explain why.

On the whole, the financial industry encourages private investors to adopt a buy and hold strategy. They suggest that you control the overall risk of your portfolio by fixing the amount that you allocate to cash, fixed income and equities. You then invest in a range of sectors and rebalance once or twice a year. You are not trying to second guess which sectors are going to do well, you diversify and just hope that when some go down, others go up and on balance you come out on top.

At Saltydog Investor we promote a different philosophy. Each week we provide our members with performance data on the Investment Association sectors and the most readily available funds. We combine the sectors into our Saltydog Groups, based on their historic volatility. The sectors in our “Safe Haven” group, have been the least volatile, then it is “Slow Ahead”, “Steady as She Goes”, and finally the “Full Steam Ahead” groups and Specialist sectors.

By limiting the amount invested in the more volatile sectors we believe that it is possible to control the overall volatility of the portfolio. This is similar to the standard process of balancing cash, bonds and equities, but there is one significant difference. We limit the maximum amount that can be invested in the groups, but would only expect these to be reached when conditions are favourable. If the sectors are going down, then we are quite happy holding cash.

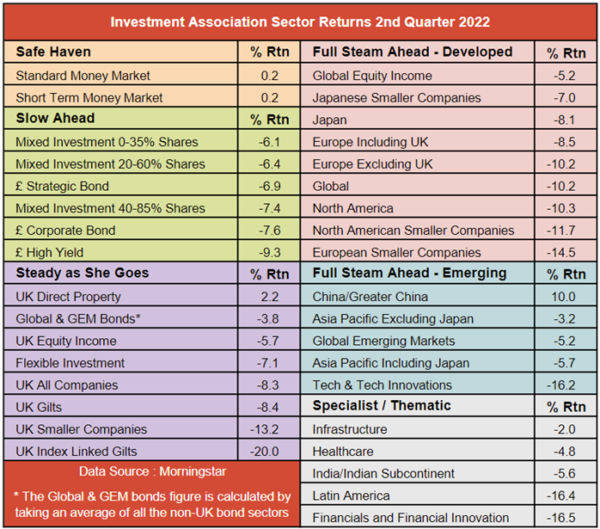

Here is a table showing how the sectors in each of our Groups performed during the second quarter of this year.

The Money Market sectors in the “Safe Haven” group are basically cash or cash equivalents and went up slightly during April, May and June.

The sectors in the “Slow Ahead” Group invest in bonds or a mixture of bonds and equities. These sectors tend not to be very volatile and can often give reasonable returns. In our most cautious demonstration portfolio, the Tugboat, we are allowed to invest up to 70% of the total value in funds from these sectors. However, why would we when they are all going down? Surely, we would be better holding cash until we can see some of the sectors in this group starting to make gains and then we could invest in the best performing funds. We are not currently holding any funds from the “Slow Ahead” group.

It is a similar story in the “Steady as She Goes” group. The only sector that has gone up is UK Direct Property, so we see little point in investing in any of the others at the moment. The UK Direct Property sector has other issues around liquidity which I will not go into today. We are not currently holding any funds from the “Steady as She Goes” group

Nearly all of the remaining sectors in the most volatile “Full Steam Ahead” Groups are also showing losses over the last three months, along with the Specialist / Thematic sectors.

The only exception is China / Greater China, which has gone up by 10%. Our Tugboat portfolio is currently 94% cash, with the balance in the Baillie Gifford China fund.

Our Ocean Liner is 80% cash. We are still holding some funds investing in natural resources and energy, although we have reduced our holdings. They are the best performing funds so far this year, but have had a difficult month. We also hold the Templeton China fund.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com

Brokers Commentary » Brokers Latest » Commentary » Latest » Mutual funds Commentary » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.