Jul

2022

Why Japan is more ESG leader than laggard

DIY Investor

3 July 2022

Emma Stevenson explains where Japan’s sustainability strengths lie, and where there is room for improvement.

It’s a common preconception when it comes to sustainability that European companies are leading the way and leaving other regions in their wake. As ever, the true picture is more nuanced.

Japan in particular is a country where many companies have strong ESG (environmental, social, governance) credentials that have perhaps been overlooked.

Liam Nunn, Global Value portfolio manager, said “It’s a bit of a myth that Japan is miles behind on all sustainability issues. In fact, we think many Japanese companies have led the way in their approach to stakeholder management.”

Creating benefits to society

When it comes to assessing a company’s ESG strengths and weaknesses, many investors look at the treatment of different stakeholders. This means not only the environment but also employees, suppliers, customers, the wider community, as well as shareholders.

“Japan’s strengths on the social aspects of ESG investing long pre-date the current shifts towards sustainable investing”, according to Japanese equities portfolio manager Masaki Taketsume.

He added, “A strong community focus is an area where we’d argue Japanese companies have a sustainability edge. Even large corporates tend to have a “home base” and strong ties to the suppliers and wider community around them. While this is definitely a positive, there is still an important role for us to play, as shareholders, by encouraging companies to take a wider, more global, view of sustainability, rather than simply a local focus.”

Examples of this can be seen in terms of the products made by certain companies. Take HU Group, a provider of diagnostic testing services. Roberta Barr, Sustainable Investment Lead – Equity Value, said “HU Group’s very fast production of a Covid-19 test was critical to Japan’s pandemic response”.

Information sharing is another way in which some companies are demonstrating they understand their responsibilities to wider society.

In September 2020, Japanese telecoms company NTT agreed a social contribution coordination agreement with fellow operator KDDI.

Liam Nunn said “This agreement allows for the ‘mutual utilisation’ of their assets in the event of large scale natural disasters. Clearly, providing uninterrupted communications services in a region of the world that is plagued by natural disasters has substantial social value.”

ESG considerations not just for emergencies

It’s not only in times of emergency that Japanese companies consider how they can help wider society. Several companies are tackling areas where they can deliver positive social benefits for their customers or the environment, while also – hopefully – deriving benefits in terms of their business operations.

Roberta Barr said, “NTT is a good example again here. The company has better initiatives in place compared to peers when it comes to helping increase access to telecommunications for underserved populations. For example, they have long-established accessibility programmes to support internet usage among the growing elderly population in Japan.”

Another example with a more environmental focus would be Panasonic. Liam Nunn said, “Panasonic is a key player and investor in a number of areas that are likely to be crucial for the world to improve industrial energy efficiency and reduce carbon emissions.

“Probably the most eye-catching example is their investment into improved electric vehicle solutions – including working to develop a cobalt-free battery to reduce reliance on the controversial metal.”

Cobalt is a rare metal used in electric vehicle batteries as well as smartphones and laptops. It is a by-product of mining copper and nickel.

Relations with employees are a strength

Japan is well-known for a culture of loyalty between employers and employees. This is demonstrated in the idea of a “job for life” which is less prevalent than it was but still holds truer in Japan than in other regions.

Masaki Taketsume said “In larger companies, such as Toyota, it’s still fairly common to offer dormitory accommodation for young employees. From the company’s perspective, clearly this is designed to foster a sense of corporate culture and build loyalty to the firm.

“There are also many benefits for the employee as they can be partially sheltered from the high costs of relocating to a new position, as well as gaining opportunities to meet different colleagues.

“There are nuances to the situation though. One is that the improved job security and the loyalty between employer and employee may effectively limit demands from workers for salary increases.”

Environmental credentials are mixed

When it comes to the environment and cutting harmful emissions, the picture is perhaps more mixed. Masaki Taketsume said “Energy security remains a concern a decade on from the major earthquake and associated nuclear disaster at Fukushima, which led to the shutdown of all Japan’s nuclear power reactors. Japan’s dependence on imported fossil fuels remains very high as a result.”

However, there are signs that some businesses are taking very seriously the need to reduce emissions and hit climate targets.

Simon Adler, Global Value portfolio manager, said, “We recently engaged with one Japanese industrial business that was targeting emissions reductions aligned to a 2 degrees of global warming pathway. We felt that wasn’t ambitious enough. Happily, the firm is now targeting 1.5 degrees.”

Improvements to shareholder focus

In terms of the focus on other stakeholders, greater consideration of the needs of shareholders is one area of clear improvement over recent years.

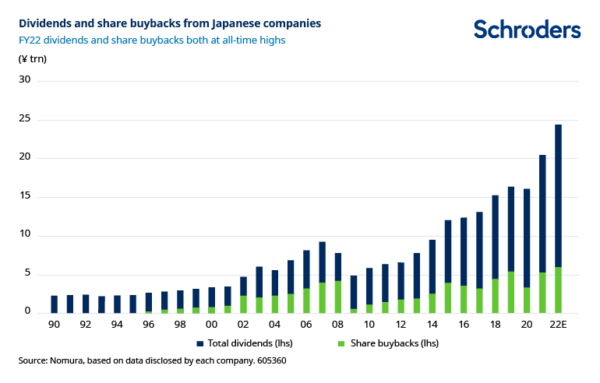

“Changing corporate governance trends are seeing company management pay greater focus to shareholder returns, in the form of dividends or share buybacks” said Masaki Taketsume. “The fact that Japanese companies are generally in good financial health compared to their counterparts in the US and Europe should help this trend to continue.”

The chart below indicates how dividends and share buybacks from Japanese companies look set to reach an all-time high for full-year 2022.

“A specific example where we’ve seen a company improve shareholder returns is Dentsu”, said Simon Adler. “The company sold its head office and is now returning some of the proceeds to shareholders.”

“Another example we could point to in terms of better capital allocation decisions is gaming and e-commerce firm DeNA”, said Roberta Barr. “It recently sold part of its shareholding in Nintendo, which has brought in cash that could be returned to shareholders.

“Many Japanese companies have value locked up in cross-shareholdings with other firms. Selling such holdings can simplify corporate structures and unlock value. We think this is a case where engagement can really help drive financial improvements.”

Board diversity remains ripe for improvement

Finally, mention must be made of the lack of diversity on Japanese company boards. Different perspectives and opinions are essential for good decision-making in any group.

Roberta Barr said “Japanese boards tend to be dominated by older Japanese men, and have little international representation. What we’re asking companies is what kind of pipeline and support they’re putting in to make sure women gain the experience they need to move to board level.”

Masaki Taketsume said, “One positive sign is that corporate governance, including the push for greater diversity on boards, is now less a political issue than a regulatory one.

“The introduction of Japan’s Corporate Governance Code, and the related Stewardship Code, were initially driven by former prime minister Shinzo Abe. However, subsequent revisions of the code is now being pushed through by regulators, rather than politicians, with a focus on strengthening the structure and functioning of boards, making core management more diverse and improving disclosure.

The views and opinions contained herein are those of Schroders’ investment teams and/or Economics Group, and do not necessarily represent Schroder Investment Management North America Inc.’s house views. These views are subject to change. This information is intended to be for information purposes only and it is not intended as promotional material in any respect.

Leave a Reply

You must be logged in to post a comment.