Aug

2022

Why invest in Physical Carbon EUAs?

DIY Investor

15 August 2022

Creates environmental impact via an attractive returns profile

Physical carbon EUAs offer an attractive returns profile (supported by tightening emissions regulation) with low correlations to other asset classes. The price of EUAs has increased 270% in the last three years.

While investors hold the physical allowances, polluters cannot use them, which in turn prevents emissions from occurring (in contrast to most offsets).

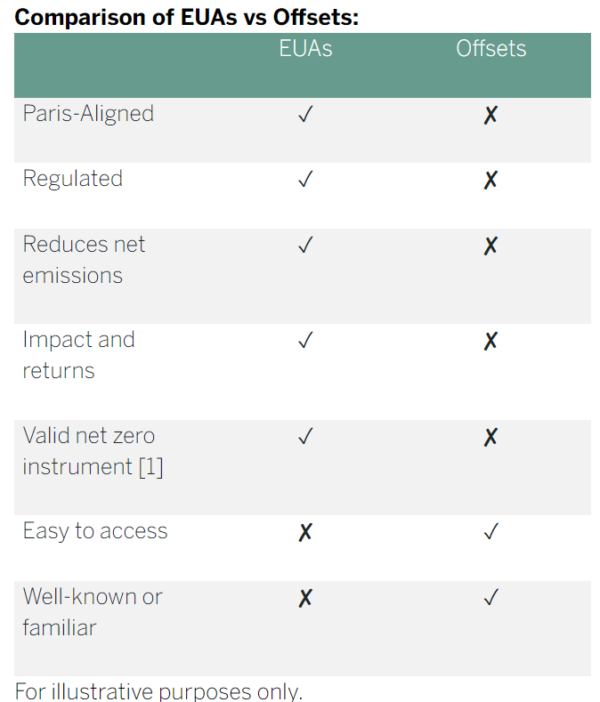

EUAs are an asset that create a positive environmental impact and can be re-sold. Investing in physical EUAs can therefore enable investors to achieve both positive environmental impact and financial returns – together at the same time. In contrast, offsets have no resale value once used and (mostly) do not reduce emissions.

Recognised as valid by the Paris Aligned Investment Initiative

EUAs are also recognized as a “valid” way to achieve global net zero emissions targets by the Paris Aligned Investment Initiative, comprising:

- IIGCC (Europe)

- Ceres (North America)

- Asia Investment Group on Climate Change (Asia)

- Investor Group on Climate Change (Australasia)

IIGCC’s Net Zero Investment Framework – launched in March 2021 – provides a blueprint to help investors contribute to tackling climate change and achieving net zero emissions globally by 2050. IIGCC has more than 300 members with over €37 trillion in assets under management.

Prevents pollution in 3 ways

Buying a physical allowance means investors prevent pollution in 3 ways:

1. While investors hold physical allowances, polluters cannot use them;

2. Under EU law, withholding EUAs triggers additional allowances being cancelled in future years, amplifying the effect and locking up more allowances, further reducing supply. When an investor sells their EUAs this effect stops, but is not reversed, and the investor’s temporary ownership of EUAs creates permanent emissions reductions;

3. As polluters and investors compete for a reduced supply of EUAs, prices rise until dirty fossil fuels are too expensive for industrial firms to continue using. This forces polluters to find cheaper, greener alternatives like carbon sequestration or new ways of producing clean energy.

Environmental impact is permanent and quantifiable

Independent studies conclude that withholding 1 EUA for 10 years permanently prevents 0.82 – 1.48 tonnes of emissions. [2]

Positive returns outlook

Tightening emissions regulation may provide a positive catalyst for the performance of the EUA market with analysts forecasting EUR86 by 2030and the EU Commission forecasts EUR85 by 2030. [3]

Investor use cases

Physical carbon allowances enable investors to achieve both positive environmental impact and financial returns, at the same time.

Improve Impact

Create genuine environmental impact by withholding allowances from polluters. EUAs are an asset that create a positive environmental impact and can be re-sold; Unlike offsets, which have no resale value once used and (mostly) do not reduce emissions.

Possible price appreciation

Since the supply of carbon allowances is diminishing, their scarcity value is increasing, creating potential for an attractive returns profile.

Qualify for ESG standards

Combine with equity/fixed income structures to create net zero portfolios or qualify for ESG standards such as CTB/PAB benchmarks.

Hedge price risk

Given most portfolios are short the carbon price already, investors can neutralise their exposure to a rising carbon price.

Why invest in SparkChange CO2?

SparkChange CO2 is the world’s first physically-backed EUA investment product that’s tradable on stock exchanges. This makes physical EUAs easily investable.

For every SparkChange CO2 ETC unit, a carbon allowance is purchased and made unavailable, creating scarcity. This forces emitters to compete for fewer allowances at a higher price, incentivising the switch to carbon abatement technology.

The purchasing, holding and divestment of SparkChange CO2 creates a positive environmental impact.

According to independent studies, holding 1 European carbon allowance for 10 years would create 0.82-1.48 tonnes of permanent emissions reductions. As the structure underlying CO2.L holds physical Carbon Emission Allowances, it has the same positive environmental impact as an investor would have if they held physical EUAs themselves directly.

Other allowance-based products use derivatives (futures) which are higher risk, more expensive for investors and do not offer the genuine environmental impact that EUAs provide.

Summary

- SparkChange was founded in 2018 to solve the problem of poor access to physical carbon allowances

- The company has created the world’s first physically-backed EUA investment product that’s tradable on stock exchanges. This makes it easy to invest in physical EUAs

- Physical EUAs offer both quantifiable environmental impact and price return

- EUAs have risen more than 270% in the last 3 years on the back of market reforms, a more ambitious 2030 emissions reduction target and increasing investor interest in this asset class [4]

- EUAs recognized as a ‘valid’ way to achieve global net zero emissions targets by the Paris Aligned Investment Initiative

- The purchase, holding and divestment of SparkChange CO2 produces a positive environmental impact

- SparkChange CO2 can be used to qualify for ESG benchmarks

- SparkChange CO2 can be used to hedge carbon price risk

Download the complete whitepaper.

The price of any Shares or the value of an investment in ETPs may go up or down and an investor may not get back the amount invested. Past performance is not a reliable indicator of future performance. This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any financial instrument or product or to adopt any investment strategy. Any decision to invest should be based on the information contained in the appropriate prospectus and after seeking independent investment, tax and legal advice.

These products may not be available in your market or suitable for you. The content of this document does not constitute investment advice nor an offer for sale nor a solicitation of an offer to buy any product or make any investment.

Alternative investments Commentary » Alternative investments Latest » Commentary » Exchange traded products Commentary » Exchange traded products Latest » Latest

Leave a Reply

You must be logged in to post a comment.