May

2022

Investing Basics: Why ETFs and SIPPs make a great combination

DIY Investor

23 May 2022

Once you’ve decided to take control of your pension with a SIPP, you’ll find cost-effective and flexible ETFs are a great way to put your plans into action – writes Dominique Riedl

Self Invested Personal Pensions (SIPPs) offer the ultimate in flexibility for those who want to take charge of retirement plans.

Despite ongoing tax-shelter innovation in the UK – such as the Lifetime ISA – pensions are still likely to be the best investment vehicle to secure your retirement because they enjoy superior tax breaks in comparison to ISAs for the majority of people.

And SIPPs are the cheapest, most diversified pension product you can buy when you combine them with low-cost Exchange Traded Funds (ETFs).

The SIPP plus ETFs combination has hit a sweet spot in recent years as the government has made personal pensions more flexible, while competition in the financial industry has driven down the cost of ETFs and SIPPs to unprecedented levels. Add to that the incredible range of markets that can be accessed using ETFs, and it’s hard to beat the level of control you can achieve with a DIY portfolio held inside a SIPP.

Of course, your first priority should always be to take up your employer’s contribution in whatever workplace pension they offer. But beyond that, you’re likely to enjoy a better retirement in the future by taking advantage of the compound gains you make when your contributions go into low-cost ETFs inside SIPPs.

Here’s why teaming up ETFs and SIPPs is such a potent combination.

1. Costs make a huge difference over the long term

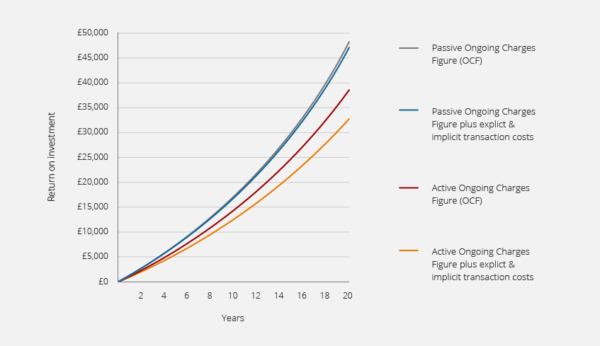

The UK’s financial regulator, the Financial Conduct Authority (FCA), produced this chart to graphically show how low costs can improve your wealth over time.

Returns on a £20,000 equity fund over 20 years assuming average FTSE all share growth

The FCA’s scenario shows that a passive investor (grey and blue lines) can achieve an up to 42% better return than an active investor (red and orange line) because the passive investor benefits from a low-cost investment strategy over two decades.

When you’re saving and investing over the decades before retirement, compound interest makes a huge difference to how much you end up with.

The returns you compound over the years will be determined by three things – the returns from the assets you hold, the costs of investing in those assets, and any taxes along the way.

You can’t control the markets, but by controlling your costs, you can improve your returns. ETFs tracking major indices in the US, UK, Japan and Germany can cost as little as 0.05% a year to own. There’s also no stamp duty tax paid on ETF purchases.

Also, with ETFs, it’s up to you when you trade, so if you’re starting out with small sums you can allow your pension contributions to roll up for a few months and then invest quarterly instead of monthly to further cut costs.

Simply put, the more of your money that goes towards securing your retirement, rather than paying the salaries of expensive fund managers who studies have proven probably won’t beat the market anyway, the better.

Of course, there are no income taxes on dividends, interest or capital gains payable inside a SIPP. If your employer’s pension contribution is funnelled into your SIPP then that’s another boost.

Combine those features with upfront pension tax breaks, the ability to control your future income so it’s taxed at a lower rate than you qualify for now, and the potential of 25% tax-free cash, and you optimise every available advantage to transform your financial future.

2. A passive portfolio of ETFs makes for a simple yet powerful pension

A passive ETF portfolio that’s diversified across the main asset classes enables you to enjoy all the long-term wealth creation potential of global equities, balanced by safer holdings in bonds and cash.

Your portfolio can be as sophisticated as you like. You can add commodities, property, and gold ETFs, or you can keep things simple. SIPPs are allowed to hold a far wider range of investments than ISAs (although exactly what you can hold does vary by SIPP provider) so you won’t lack choice.

justETF’s Strategy Builder enables you to identify the best ETFs to deliver your diversified portfolio with just a few clicks.

Managing your portfolio needn’t be a chore, either. Rebalancing annually or when things move too far out of line will only take a few minutes, and you can easily do it yourself.

Again, justETF can tell you what you need to buy and sell to stay on target.

3. You can easily adjust your ETF portfolio as you age

The ideal portfolio for a 30-year old is not the same as for a 60-year old.

As we age we typically want to take less risk on equities and hold more safe assets like bonds. We’re closer to spending our savings, and we have less time and earning years ahead of us to recover from a stock market crash.

Because ETFs are cheap and easy to trade, adjusting your asset allocation as you age is straightforward. You can reduce your exposure to equities and add to your bond ETFs in a matter of minutes.

4. You can make tactical allocation decisions

Even if you take a more active investment approach to the markets you’ll also find an ETF portfolio is to your advantage.

Think the US market looks expensive? Reduce your US holdings and add to ETFs tracking the indices of countries you believe are cheaper.

There’s no risk of a remote fund manager taking chances with your pension when you’re in charge!

5. ETFs can deliver a retirement income, too

We now have more options than any previous generation when it comes to deciding how we manage our pension pot to deliver a fulfilling retirement.

Ironically the ability to mix and match so many options can lead to analysis paralysis, especially when coupled with so much uncertainty about the years ahead.

Many sensible investors remedy this by using their assets to generate an income to live on.

ETFs can again provide a solution, as many pay an income.

As you approach retirement you can switch to more income-oriented ETFs – or simply swap your accumulating ETFs for distributing versions instead of buying an annuity or some other costly financial product.

And if you do want to draw on your capital, you can sell down your ETF holdings as required.

Naturally, you will need to make sure you’re balancing income and security. The screening tools can help with your research.

Click to visit our friends at:

Commentary » Exchange traded products Commentary » Exchange traded products Latest » Financial Education » In Retirement » Pensions commentary » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.