Jul

2021

Why companies with stronger ESG credentials should be expected to underperform…but won’t

DIY Investor

27 July 2021

Conceptually, ESG should underperform. Practically, that’s unlikely, but only active investors can reap the rewards – by Duncan Lamont

ESG investing is all the rage. However, aspects can polarise opinion. One of the most heated corners of the debate is the thorny and slippery subject of performance: does ESG investing result in better performance? A seemingly simple question but sadly there isn’t a simple answer.

The question matters because investors should have a view on the balance between drivers of their ESG strategy – is it to use their capital to achieve better outcomes, and how much is it to achieve a better risk/return trade-off for their beneficiaries?

A problem of definitions and comparability

First of all, what do you mean by ESG investing? Excluding “bad” companies? Favouring “good” companies? By whose definition of bad and good? Or simply by excluding certain industries that do not pass an appropriate test? Easier said than done.

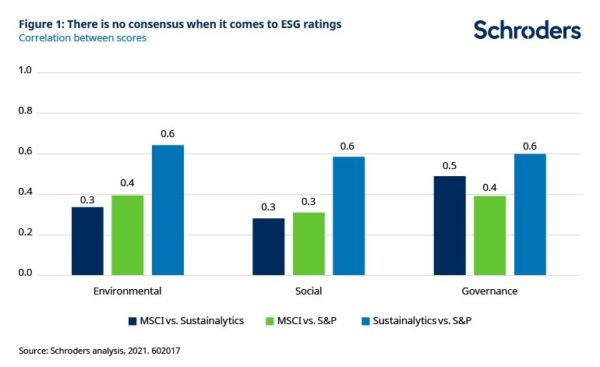

There is little commonality in ESG ratings from the major ratings providers. Frequently one will rate a company highly while another does so lowly (Figure 1). Tesla is a prime example. You can either love it or hate it from an ESG perspective, depending on which ratings provider you ask. There is no clear consensus.

Or do you mean that you integrate ESG risks into the investment decision making process? For example, you assess whether an investment is attractive by taking account of all of the risks it is exposed to, including ESG risks? This is another approach entirely.

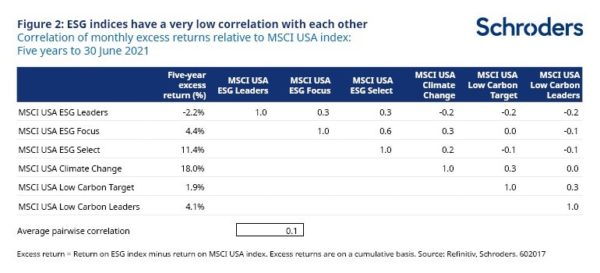

In addition to there being little commonality in ESG ratings between different third party ratings providers, even at a given provider there can be huge variation in how different ESG strategies perform relative to each other. For example, MSCI has six US equity ESG indices with at least five years of data. The average correlation (a measure of the strength of relationship between two variables, where 1 means a strong positive relationship, -1 means a strong negative relationship and 0 means no relationship) between their monthly excess returns over the five years to 30 June 2021 is only 0.1 (see Figure 2). Only two have a correlation of more than 0.5.

In other words, the relationships are relatively weak.

Furthermore, excess returns of the more climate-change/low carbon-oriented versions are negatively correlated with some of the others. This means that they typically performed poorly when the others did well.

This also comes through in the levels of returns that these different ESG strategies have generated. For example, over the same five-year period, the MSCI USA ESG Leaders index underperformed the MSCI USA, whereas the MSCI USA Climate Change index outperformed by 18%.

These differences should be expected – these indices are attempting to achieve different outcomes and putting different weights on different criteria to meet differing preferences from end investors. However, it does make it challenging to assess the performance of ESG strategies as a whole.

It should be obvious that any assessment of whether ESG strategies outperform depends to a very large extent on how you choose to measure ESG risks and where an investor chooses to place the ESG emphasis.

A further complication is that where do you even draw the line between traditional fundamental analysis and ESG-specific analysis? No equity analyst worth their salt would ignore the impact of a sugar tax on prospects for a sugary drinks company. You could argue the same for companies with high levels of leverage. It impacts the long run sustainability of a business model, regardless of whether you call this sustainability analysis or traditional fundamental analysis. Pragmatically, it doesn’t matter.

However, when it does matter is when you try to compare the performance of an ESG strategy with a non-ESG strategy. If the non-ESG strategy is also taking account of these factors (even if they don’t label it as such) then you can’t really say how much of a difference ESG analysis has made.

I don’t think these issues can, or will, be easily resolved. Regulators are trying to provide clarity, such as with the Sustainable Finance Disclosure Regulation (SFDR) in Europe. But it’s so nuanced that there is no silver bullet.

However, I believe there is another way that we can approach the problem, through the prism of risk.

Think of ESG risk like credit risk

The first step is to think about ESG risk in similar terms to how we think about credit risk. It is a risk (or a set of risks) that could influence the long-term sustainability of a business – we might disagree on how important these risks are but it’s hard to argue against their existence.

In practice, there is no universally agreed upon way to assess a company’s ESG credentials. But let’s, for the sake of this argument, assume that there is. This is a big assumption but, reassuringly, if it fails, it actually strengthens some of the points I ultimately want to make.

Then, it should hopefully be easy to see that ESG risk is analogous to credit risk (different set of risks but the same idea).

Strong ESG companies will underperform IF markets are priced fairly

Sticking with credit risk, lower risk companies trade on tighter credit spreads (the extra yield borrowers have to pay over government bond yields) than higher risk.

AAA-rated companies trade on tighter credit spreads than BBB-rated companies, and much tighter credit spreads than the lowest rated, CCC-rated, companies.

Assuming that markets fairly price risk, this will translate into lower expected returns for bonds issued by low risk companies than those issued by high risk companies, even after allowing for expected default and downgrade losses.

We can also see how this plays out from a company’s perspective: companies with higher credit risk have to pay a higher cost of funding (via a higher credit spread). In this sense, they are “punished” by the market for being riskier. While not starving them of capital, it does make it harder for them to borrow large amounts of money than lower risk companies would find it.

We can translate these concepts exactly to the ESG-space. If assets are priced fairly with respect to ESG risks, you would expect:

- Companies with lower ESG risk to have lower expected returns than those with higher risk.

- Companies with lower ESG risk to benefit from a lower cost of capital than those with higher risk.

It is important to highlight that these are two sides of the same coin. It is impossible for companies with stronger ESG credentials to simultaneously have a higher expected return and a lower cost of capital.

But markets are not priced fairly

The points above hold if market prices reflect all available information, including all ESG risks. However, markets are notoriously bad at pricing risks that are not expected to materialise for several years, as is often the case with ESG. For example, the most significant risks from climate change and the responses to it are likely to play out over many years, not just, or maybe not even, in the short-term.

Indicative of this inefficiency is the popular discounted cash flow approach to company valuation, which normally assumes some level of growth in the near-term before reversion to a longer-term growth rate at some later point, often around three years out. This means that analysts often only make company-specific earnings forecasts for a few years, before the terminal rate kicks in.

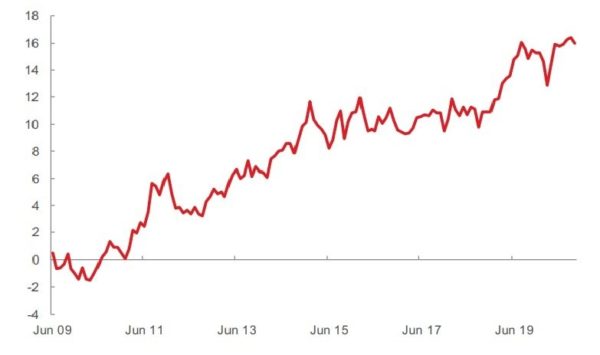

An easy way to see this effect is in the precipitous drop in number of earnings projections for companies as you look further into the future (Figure 3).

The inability of the market to focus on longer-term risks can result in significant mispricing. Therein lies an opportunity for the ESG-motivated investor: to identify, ahead of the market, companies and sectors that are most exposed to ESG risks, or that stand to benefit from developments in these areas. This is not exclusive to ESG. For example, the same is also true of thematic investing, or any other approach which is long-term in nature.

As we have written before, ESG ratings from the main providers will fail to achieve this. As with credit ratings agencies, they are backward looking and tend to lag developments. For example, many companies which have encountered governance scandals have been rated highly for governance beforehand, and only been downgraded after the event.

The point here is that if it is widely known (i.e. it is in a publicly released ESG rating) then it is likely to already be reflected in the price – even if this process is less efficient than would be the case for something like credit risk, given the lack of clear consensus on ESG risks.

In this case, you would be back to our original scenario, where companies with lower ESG risks underperform. The edge in ESG investing is to identify cases where risks are not yet correctly priced in.

And you can also win by backing improvers and avoiding deteriorators

The way I set things up earlier to argue that ESG investing should underperform is only true if we are in an equilibrium state, where everything is where it should be, and where it will stay.

However, I’ve just shown that ESG investing can outperform by unearthing which companies are not priced where they should be with respect to ESG risks, at any point in time.

The second way that ESG investing can outperform is by understanding that no company’s ESG characteristics are set in stone. They evolve over time, as is the case for credit risk.

For example, if a BBB-rated company’s credit risk falls, its credit spread will reduce and its credit rating may be upgraded. Equivalently, it could move in the opposite direction. In both cases, the price of its bonds will change based on its changing risk profile (price gains for the improver, price declines for the deteriorator).

In the same way, a company with weak ESG credentials (high ESG risk) that moves in the right direction will become lower risk, and hence should experience a price gain (and a corresponding fall in its financing costs). This is also where asset owners and asset managers are playing an increasingly prominent role, in encouraging and driving positive change.

The data backs up this hypothesis. Studies have shown that companies with improving ESG characteristics (positive ESG momentum) also outperform (Figure 4).

Figure 4: Companies with positive ESG momentum outperform those with worsening credentials

Performance of top versus bottom ESG momentum quintile portfolios for developed markets

Past performance is not a guide to the future and may not be repeated

Cumulative performance differential of the top and bottom ESG momentum quintiles for developed market companies. ESG momentum is defined as the prior 12 month change in ESG score. Performance is constructed from a hypothetical long-short indexed portfolio, going long for the equal-weighted upper ESG momentum quintile of MSCI World Index, while the bottom equal-weighted quintile goes short. The portfolio was rebased monthly. Data is from June 2009 to October 2020. Source: MSCI, Aon

It may not always be obvious from headline figures that a company is on an improving trajectory with respect to ESG. Indications of a cultural shift may come through in conversations with management well before you see it in the numbers and even longer before there is any improvement in a third party rating. As previously, this is where the committed ESG investor can have an edge. Active ownership – using our voice and influence to gain insight and effect change – is a key element of ESG investing.

Summary

In a state of the world where all assets are priced fairly and nothing changes, investors should expect companies with strong ESG credentials (low ESG risks) to underperform companies with weak ESG credentials (high ESG risks). This is analogous to how investors are used to thinking about credit risk.

But we all know this isn’t a true reflection of the investing environment. ESG investing can outperform by virtue of either, or both, of the following:

- Identifying companies where ESG risks are not yet properly reflected in prices

- Identifying companies which are transitioning with respect to ESG (overweight the improvers, underweight the deteriorators)

Because my equilibrium assumption about markets pricing ESG risks efficiently does not hold (such as because investors have differing views on how to measure and price these risks), then this will amplify the investment opportunities. Outside of some stocks and sectors where it may be easier to reach a consensus that they are “bad” or “good” with respect to ESG, it is quite possible that we never reach (or even get close to) the equilibrium state where all ESG risks are priced efficiently.

Third party ratings are widely available so therefore it would be unrealistic to expect them to contain material information that is not already reflected in prices. Furthermore, because they are backward looking, they can only tell you whether a company has experienced an improvement in its ESG credentials (which is, of course, useful information), not whether it is likely to experience one in future. They are not useless, but they only go so far.

In summary, ESG investing CAN outperform more traditional approaches. However, this is only a realistic expectation outcome for actively managed strategies.

That is not to say that passive ESG strategies do not have the potential to have a positive impact. By allocating capital towards companies with positive ESG credentials and away from companies with weaker credentials, they can influence their costs of capital. “Bad” companies will find it harder/more expensive to raise money whereas “good” companies will find it easier/cheaper. At a societal level, there is scope for this to be a force for good. However, when it comes to their investment portfolios, they may have to accept that the cost will be felt in lower returns.

PS. Don’t forget that ESG investing is susceptible to the same human factors which we see elsewhere, namely fear and greed. It is entirely plausible (likely) that some sectors or stocks which are popular with ESG investors (or thematic funds which focus on e.g. climate change) will end up overvalued if they are hyped up too much. If this were to happen then this “mis-pricing” could set the scene for them to underperform. However, this would not be an invalidation of ESG investing, merely evidence of human nature in action.

It is also a reason why investors would be wise to avoid unduly constraining their investment universe, for example by focusing on too narrow a sector of the market. Doing so could leave them with little choice but to buy certain stocks, even if they are overvalued.

Furthermore, in the same way that sometimes “quality” stocks outperform and sometimes there is a “dash for trash”, markets are sure to go through periods when companies that are lowly rated with respect to ESG have their day in the sun. As it always has been, as it always will be.

Click to visit:

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.

Commentary » Equities Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » Mutual funds Latest

Leave a Reply

You must be logged in to post a comment.