May

2022

What lies ahead for stock markets after recent falls?

DIY Investor

22 May 2022

Frank Thormann discusses which types of companies could offer some brightness after a gloomy period for stock markets.

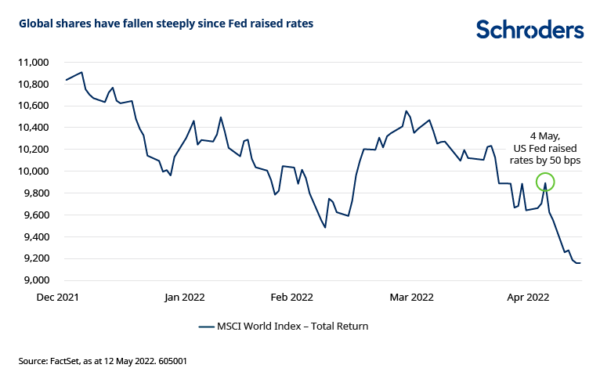

Global shares have had a difficult few weeks and have fallen particular steeply since the US Federal Reserve (Fed) raised interest rates by 50 basis points (0.50%) on 4 May.

For once, the US is performing worse than average, with its high weighting in technology and growth stocks counting against it.

As equity investors, one of our main sources of information about what’s going on comes in the form of quarterly reporting seasons. These see publicly-listed companies provide detailed explanations about what they’re seeing day-to-day; what is changing and what is not changing.

Latest earnings season positive, but clouds for some sectors

The reporting season for the first quarter has recently concluded. In fact, for the vast majority of companies, the business climate is still quite positive, showing strong revenue and earnings growth. It’s by no means been as robust as 2021, but for companies listed in the US S&P 500 stock market index, revenue and earnings have grown by a low teens percentage.

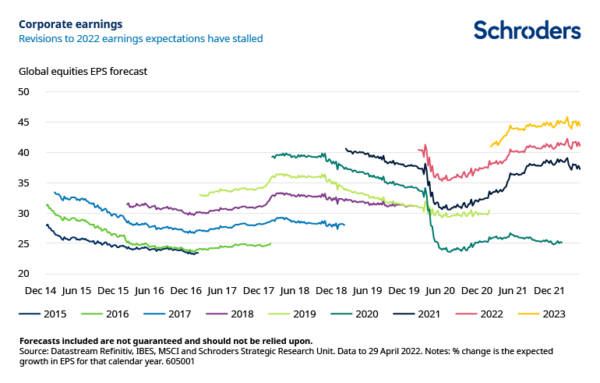

Looking ahead to the rest of the year, earnings estimates are not being revised higher but they’re also not falling dramatically. I’d say that’s a fairly strong achievement.

However, there are some sectors that are more challenged and where clouds are gathering on the horizon.

One sector that saw earnings declines in Q1 was financials, particularly banks. This was largely because of a jump in provisions. Provisions are funds that are set aside in anticipation of future losses. We should remember that bank losses for bad loans have been low for a very extended period, so provisions have risen from what was probably an unsustainably low level.

It’s possible that a lot of these provisions will be relatively short lived. The big question will be whether the US Fed can engineer a soft economic landing, or whether the economy will end up in recession. Clearly, if we end up in recession then banks could face a rise in bad debts.

Another sector that’s having a difficult time is manufacturing. Anything involving making physical goods and shipping them around the world is facing a very complex situation right now. There’s a lot of cost pressure in supply chains.

Providers of “mission critical” goods or services will fare best

That cost pressure, and the ability of companies to pass on cost increases to customers, is the key element that we as stockpickers are focused on right now. In a nutshell, the source of “pricing power” – or the ability to raise prices without destroying demand – comes from having a product or service that is indispensable or mission critical.

That can be real, or it can be a matter of perception. Take Coca-Cola, for example. If you go to the supermarket, you’ll find it next to own brand equivalents which cost a fraction of the price and taste more or less the same. But customers perceive that Coca-Cola is unique, and that’s enabled the company to push through a c.7% year-on-year price increase.

An example in technology in Microsoft. The Microsoft suite of tools is probably mission critical for most office workers. It’s hard to see any such businesses cancelling their Microsoft contract just because Microsoft is raising prices a little bit.

Those sorts of companies are able to weather the inflationary environment really well.

Energy sector could surprise on spending restraint

A sector under great scrutiny right now is energy, given the rise in the oil price this year. We think oil prices are likely to remain relatively robust.

Another positive surprise could come in the form of capital discipline, i.e. reining in spending. That’s a concept that been pretty foreign to the energy sector in the past. However, we’re now seeing companies refrain from increasing drilling activity at any price. Instead, they’re focusing on free cash flow generation, and on returning that cash to shareholders.

That combination means energy remains a sector of interest for us.

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Leave a Reply

You must be logged in to post a comment.