Mar

2022

What is the outlook for UK dividends in a less certain world?

DIY Investor

13 March 2022

Russia’s invasion of Ukraine looks set to exacerbate economic trends which had already been influencing markets. Amid the uncertainty, experienced investors Sue Noffke and Graham Ashby give their views on the outlook for UK dividends – writes Simon Keane

Russia’s invasion of Ukraine looks set to exacerbate economic trends which had already been influencing markets. Amid the uncertainty, experienced investors Sue Noffke and Graham Ashby give their views on the outlook for UK dividends – writes Simon Keane

Investors had already been viewing markets in a more cautionary manner, even before Russian troops amassed on the border with Ukraine. The events which followed have shocked the world, and it’s not entirely clear yet what the longer-term economic and market implications will be.

Will investors continue to favour large companies capable of returning cash to them today as dividends (and perhaps through buying back their shares)? This trend had been in evidence before the invasion, when the prospect of rising interest rates in the major economies had been heavily influencing the investor mindset.

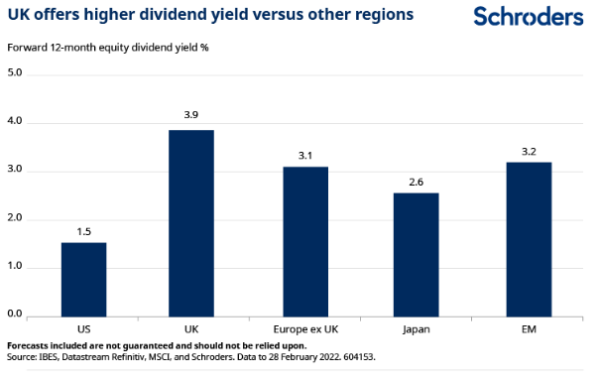

The UK stock market certainly has its fair share of large companies in the more mature and slower growing banking, telecoms, oil, mining and tobacco sectors. This fact is partly reflected in its above-average dividend yield versus other developed stock markets (see chart, below).

Whatever the economic implications, for, say, inflation, growth and so interest rates, investors shouldn’t forget the UK’s contingent of young companies. These companies have good potential to grow dividends as they realise global growth ambitions, even if they don’t all have the premium dividend yields much in demand for most of 2022 to date.

Sue Noffke, Head of UK Equities, says: “Companies such as business information group RELX, global recruitment company SThree, specialist financials 3i and Intermediate Capital Group (ICG), or global outsourcer Bunzl should self-fund growth if they execute on their strategies as anticipated.”

A company’s “fundamentals” describe the factors which may influence its ability to grow profitably, make superior returns on capital and create economic value in the process. They encompass quantitative measures, such as earnings-generating potential and balance sheet, or financial strength, as well as qualitative ones, such as competitive positioning.

Less well-known but world-leading high-returning UK companies

The fundamentals of some of the large companies in the UK can be less attractive. However, these are not set in stone. There is scope for a number of these companies to reinvent themselves as management teams navigate big changes in strategy.

Many of these companies are trading on particularly low valuations and many also benefit from very strong balance sheets.

The UK’s capabilities in the energy transition, where confidence in returns has improved greatly over the past five years, also show the potential of UK firms.

“Oil majors BP and Shell, energy supply or transmission companies SSE and National Grid and power generator Drax are all coming up with innovative solutions,” Noffke says. “They will have to be part of the solution as we shift to renewables.”

However the UK also has many less well-known but world leading companies, where confidence in their ability to generate superior returns on capital is high.

These could include those meeting growing demand for cyber security solutions, say, or others disrupting established business models in the case of the “fintechs”. Meanwhile, UK quoted data analytics specialists such as Ascential, Experian and RELX are also competing well on the global stage in an area where digitalisation trends are driving very strong demand.

The building materials and equipment sector may not be seen as cutting edge, but the UK boasts a number of leaders here, such as equipment rental group Ashtead and Ferguson, a specialist distributor of plumbing and heating products.

Ashtead is among a select group of UK “10 baggers” which have delivered 10-fold investment returns, or more, in the past decade and which have powered their way into the FTSE 100.

This group also includes 3i and ICG whose alternative financial instruments have proven very successful. Their products have matched the needs of companies seeking new forms of finance and investors requiring a wider variety of assets beyond quoted shares (public equity), bonds and cash.

Stronger outlook for sustainability and growth of UK dividends

If safety is the current watch-word then “dividend cover” gives an indication of the margin of safety for dividends.

As the ratio of a company’s earnings over dividends, a low number might indicate self-funding cash returns could become more problematic longer term. Earnings are only an accounting concept though and investors place most emphasis on modelling a company’s cash flows.

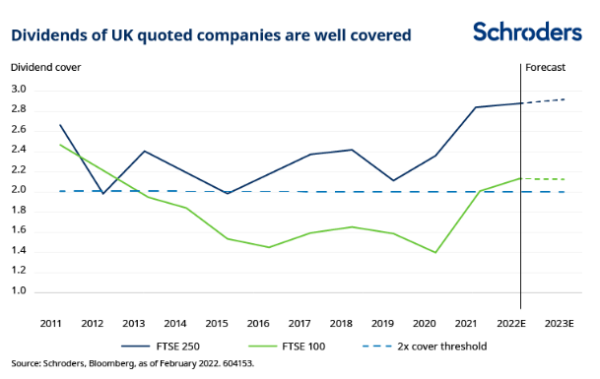

Dividend cover in the UK has improved since the nadir of the pandemic.

Dividend cuts by a small number of very large payers (oil companies and banks) weighed disproportionally on the market’s aggregate dividend pay-out in 2020. While the ban on banking dividends has since been lifted and payments are rebuilding, the effect of the oil companies rebasing payments to significantly lower levels is perhaps more profound.

Allied to this, the earnings of the banking, oil and mining companies have bounced back particularly strongly.

Graham Ashby, UK fund manager, says: “What happened with Covid is some of the issues around the sustainability of dividends came to the fore and overall dividends ended 2021 around 20% lower compared with prior to the pandemic.

“As a consequence, dividend cover is back closer to two times compared to 1.5x for a number of years prior to the crisis. We are in a stronger position than we have been for a while for dividend growth and the sustainability of yields.”

Noffke points out that a number of the large companies are using dividend cuts to invest in the growth aspects of their businesses.

“Examples could include BT digitalising its network to support the products that customers want, SSE investing in renewables, or GlaxoSmithKline rebasing this year to funnel more cash into its pipeline of future medicines,” she says.

Dividends of smaller companies are, in general, more volatile (dividend cuts were deeper during the pandemic and bounced back more sharply) but they enjoy higher cover. The chart above compares dividend cover of the FTSE 100 to the FTSE 250, the next most established UK stock market index.

Smaller high growth UK quoted companies can be poorly understood

And opportunities for growth can be less well appreciated among the smaller companies. “One of the reasons to invest further down the capitalisation spectrum is to find more interesting companies where dividends are more sustainable,” says Ashby.

The “sell-side” analysis for many of the smaller companies can be sparse. This analysis is the research published by investment banks tasked with marketing/selling companies to potential buyers.

The lack of interest explains part of the attraction of games and crafting company Games Workshop, according to Ashby. “It’s not particularly well-followed, but cash flow is coming through year in year out and, to the company’s credit, when it builds up too much they return it to investors,” he says.

The company’s fantasy worlds have potential to become global franchises. It is licencing intellectual property (IP) to specialist video games producers and major entertainment groups, including the Walt Disney Company.

“We have been encouraging them to reinvest as they have a huge opportunity for growth – I’d take better dividend growth over 10 years’ time at the expense of some growth in the short term,” Ashby says.

Games Workshop is covered by just four sell-side analysts which is low for a company with a market capitalisation just outside of the FTSE 100.

It is another UK company to have achieved 10 bagger status in the past decade, generating investors a 21-fold return based on share price appreciation alone, but 40-fold with dividends reinvested on a total return basis (all returns in the 10 years to 31/12/2021, source Refinitiv Datastream).

Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Important information

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Brokers Commentary » Brokers Latest » Commentary » Equities » Equities Commentary » Equities Latest » Investment trusts Commentary » Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.