Jul

2023

Investing Basics: What is portfolio rebalancing?

DIY Investor

24 July 2023

Portfolio rebalancing is a best practice recommended by many renowned investors and is strongly linked to the buy and hold approach.

The fundamental idea of buy and hold is to avoid excessive trading. Instead you define a strategic asset allocation and follow it over years. This sets it apart from stock-picking and market timing.

But keeping the same portfolio strategy over years is a challenge in its own right. Even without active changes to your portfolio, its structure will drift over time. This is due to market movements of the single portfolio positions. It can cause a major misalignment of your originally planned strategic asset allocation.

If this happens, it is time for a rebalancing. Positions with strong gains will proportionally be sold and positions which have lost in value will proportionally be bought. This will bring your portfolio back to your original asset allocation.

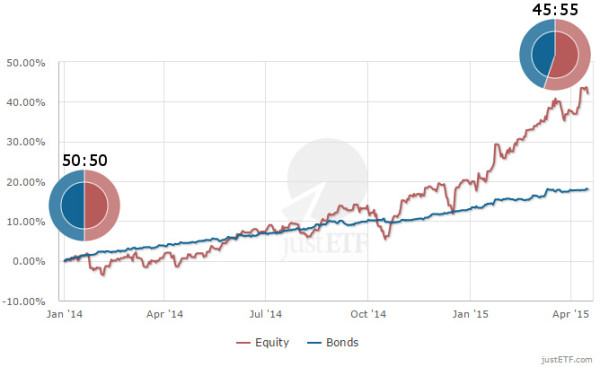

Change in asset allocation of a simple 50:50 equity bonds portfolio

Source: justETF.com

We have created a simple sample portfolio of 50 percent equity and 50 percent bonds to illustrate portfolio rebalancing.

The sample portfolio shows a strong increase of 42 percent for the equity share. The bonds share only grew by 18 percent in value. This caused a shift in the asset allocation from a 50:50 distribution to a 55:45 distribution. As you can see from the chart, the equity share shows a much higher fluctuation (volatility) compared to the bonds share. This equates to a now higher overall risk of your portfolio.

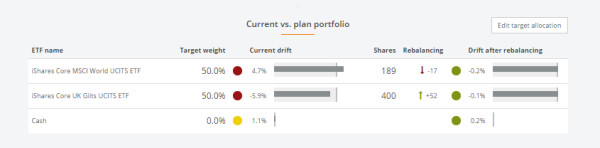

A rebalancing resets the portfolio to a 50:50 distribution. In case of the sample portfolio, this means that 17 shares of the equity ETF should be sold and 52 shares of the bond ETF should be bought.

Portfolio rebalancing in the case of a 50:50 equity bonds portfolio with justETF

Source: justETF.com, Screenshot justETF portfolio rebalancing for sample portfolio

Why does rebalancing make sense?

There are three good reasons why portfolio rebalancing will provide a benefit to you in the long run:

Risk control

Just like the economy, the stock markets go through boom and bust periods. By this, it’s natural that in some periods your portfolio will hold a higher risk than actually planned. Portfolio rebalancing helps you to steer your risk level in a simple manor; cost-efficient and time saving.

Anti-cyclical investment decisions

Portfolio rebalancing tends to provide anti-cyclical buy and sell signals. This means, you most likely will reduce positions in risky assets (like equity) in strong bull markets and increase them again in bear markets. This will result in a better long-term return.

Investment discipline

Portfolio changes based on a rebalancing strategy eliminate the need for market timing. Actually, the market tells you when to become active. Therefore, it is an ideal strategy for private investors to avoid the common pitfalls of private investing.

How much does rebalancing cost?

Portfolio rebalancing is not free of charge. In general, it involves trading fees and possibly taxes on capital gains. Therefore, it is vital to watch out for the cost – benefit ratio of any rebalancing. If the costs are too high, it might make sense to only rebalance some positions or even completely skip it.

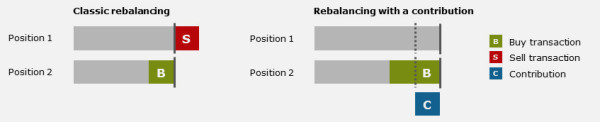

Cash flow rebalancing with a contribution

Besides a classic portfolio rebalancing with buy and sell transactions, it might be reasonable to do a cash flow rebalancing in some cases. You simply rebalance the portfolio with a contribution of new money. This only requires buy transactions and avoids tax-impacting sell transactions.

Classic portfolio rebalancing vs. cash flow rebalancing with a contribution

Source: justETF.com

justETF Portfolio Rebalancing function including

automatically generated order list

Commentary » Exchange traded products Commentary » Exchange traded products Latest » Latest » Take control of your finances commentary » Uncategorized

Leave a Reply

You must be logged in to post a comment.