May

2022

Simple DIY Investing with Vanguard LifeStrategy Funds

DIY Investor

19 May 2022

DIY Investor exists to ensure that its users have the information, financial literacy and indeed willingness, to get to grips with investment products and take control of their personal finances – by Jemima Reeves

However, the sense of ‘relief’ that is often expressed by those embarking upon an investment regime suggests that there are complex emotional factors at work – possibly fear – that has prevented them from doing so in the past.

RDR may have left a large number of people in limbo – denied access or unwilling to pay for financial advice, but not sufficiently confident to make their own financial decisions.

Recently appearing on the syllabus for the first time, levels of financial education in the UK are not high with a recent survey suggesting that lack of financial knowledge was stopping consumers from making informed decisions about mortgages (44%), pensions (43%), and even the simplest products such as ISAs (32%); 60% of the 25-34 age group admitted that their personal finances caused them stress, anxiety and sleepless nights.

‘levels of financial education in the UK are not high’

These people may be facing a stark choice between paying high upfront costs to an adviser or doing it themselves; education has to be the key, if they decide to engage.

In their infancy, the new crop of digital investment managers, or ‘robo-advisers’ are designed to bridge the gap between full-blown advice and DIY investing with automated advice based upon complex algorithms.

For most, a very simple investment strategy that provides a good chance of a decent outcome is sufficient, and that is precisely what is on offer from US investment behemoth Vanguard with its LifeStrategy funds.

The experienced DIY investor would not be daunted by the prospect of constructing a well balanced portfolio based around shares, funds, ETFs and investment trusts, but for those less experienced LifeStrategy funds deliver a ready-made solution that goes a long way toward making investing accessible to everyone.

Launched in June 2011 Vanguard’s funds are a range of low cost all-in-one funds which are made up of a basket of Vanguard’s globally diverse, standalone index funds – simple DIY investing.

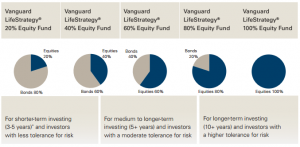

There are five options to choose from, with the number in the name representing the proportion of equities held by each fund:

- LifeStrategy 20% Equity Fund

- LifeStrategy 40% Equity Fund

- LifeStrategy 60% Equity Fund

- LifeStrategy 80% Equity Fund

- LifeStrategy 100% Equity Fund

Each fund comprises over 1,000 individual investments and, for example, LS60 comprises 60% of Vanguard’s equity funds (Developed World (ex UK) 19.2%, FTSE UK All Share 14.9%, US Equity 13.8%, Emerging Markets 4.3%, Europe (ex UK) 4.2%, Japan 2.2% and Pacific (ex Japan) 1.2%) and the remainder being a range of standalone bond funds (Global 19.3%, UK Gilts 5.9%, UK Corp. Bonds 3.7%, UK Inflation-linked Gilts 3.2%, Others 7.9%).

The proportion of equity exposure indicates the risk associated with each fund – the higher the exposure the greater the risk; those with a longer time horizon and willing to embrace more risk or volatility in exchange for a potentially higher return would select a fund with a higher equity holding.

Those with a lower tolerance to risk or a shorter time span should opt for a LifeStrategy fund containing more bonds in the mix and overall exposure could be achieved by holding more than one fund.

Vanguard has monitored the average total annual return based upon the mix of investments in each fund in order to make selection transparent; the higher volatility associated with higher equity funds increases the range of potential returns including the potential for losses in certain years.

‘Vanguard’s funds may just be the simplest answer to DIY investing’

LifeStrategy funds are automatically rebalanced on a regular basis to ensure that you are not exposed to more risk than you accepted when you chose a fund at the outset.

Vaunguard’s products differ from other multi-index or multi-asset funds where an investor is offered a range of potential exposure to equities – 20 – 60% for example – which can be an infinitely moving feast according to decisions made by the fund manager.

LifeStrategy funds deliver a simple, low cost and diversified strategy that a novice investor can understand and implement by simply:

- deciding their attitude to risk/volatility

- selecting a corresponding LifeStrategy fund

- choosing a low-cost broker, and setting up a regular investment

In terms of a DIY investment strategy there can be few simpler, and Vanguard LifeStrategy funds may be the ideal first step towards taking control of your investment strategy.

The funds tick a number of boxes on the basis that they are globally diversified and have low charges – Vanguard has reduced its annual charge to just 0.22% from 0.24% (plus a one-off 0.10% dilution levy), and automatically rebalance.

LifeStrategy funds can be used variously according to the stage in their journey an investor is at.

Those in the early stage of building their wealth, perhaps within an ISA or SIPP may decide they can tolerate the additional risk and ride out the volatility of LS100 or LS80, whereas those seeking certainty either approaching, or in, retirement may plump for LS40.

Vanguard’s funds may just be answer to simple DIY investing – start off on the journey in your twenties, and then set a diary entry to remind you to switch funds on your fortieth, fiftieth and sixtieth birthdays.

At retirement, and no longer contributing to the fund, LifeStrategy can be used to deliver a regular income by withdrawing 3.5% or 4.0% annual income by selling units; since June 2011 the average total return on the LS60 has been just over 9% per year.

Each of the five LifeStrategy funds comes in both accumulation and income versions but the 1.4% average distribution yield for the funds is unlikely to be sufficient for most without selling units.

Vanguard reduced its annual charge as investment in the funds passed £5 million and further economies of scale are expected as the funds continue to grow.

Globally, Vanguard was the most popular fund manager in the world in 2016, attracting nearly $200bn in new money – more than its nearest 10 rivals – including giants Fidelity and BlackRock; it now manages over $3 trillion in assets.

Low cost passive investing has seen a surge in recent years, as the fees charged by active fund managers have come under heavy scrutiny.

The Financial Conduct Authority released a damning report last year, warning that on average ‘actively managed investments do not outperform their benchmarks after costs’.

It also said that active managers tend to cluster around the same around the same price points, which is harming competition, and called for greater clarity on fees.

Vanguard’s LifeStrategy funds neatly embody Humbug’s mantra – keep it simple son, or KISS; they are simple, low cost, diversified and available to suit your tolerance to market risk/volatility.

Commentary » Exchange traded products Commentary » Exchange traded products Latest » Financial Education » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

One response to “Simple DIY Investing with Vanguard LifeStrategy Funds”

Leave a Reply

You must be logged in to post a comment.

[…] Investor recently wrote about its range of Life Strategy funds (Simple DIY Investing with Vanguard Life Strategy Funds) and the company also offers a range of what it calls ‘all-in-one’ funds – target retirement […]