Jan

2021

Value vs Growth: Hope springs eternal

DIY Investor

9 January 2021

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

The US election has given long-suffering value investors new hope of a ‘great rotation’ in their favour, but that light at the end of the tunnel could in fact be a train…

The US election has given long-suffering value investors new hope of a ‘great rotation’ in their favour, but that light at the end of the tunnel could in fact be a train…

Joe Biden will become the President of the United States. As the votes came in the market started to rally, and most notably value stocks outperformed growth markedly.

This trend has been boosted by positive news about a potential vaccine from Pfizer.

Value investors have taken a lot of pain in recent years, with the trend for growth stocks, technology companies and e-commerce to outperform having accelerated during 2020. In this head-to-head debate, two of our analysts give their personal opinions on whether Biden’s apparent win has broken the ‘growth investing’ spell…

Why Biden’s win means a rotation to value over growth is on the cards | David Johnson

History has shown that the year following the election of a unified Democrat led government in the US is generally bullish. When the Democrats hold both chambers and the presidency the S&P 500 has delivered an average return of 9.8% in the subsequent 12 months.

If the Democrats fail to win the senate but hold the presidency and house the outlook is even better, returning 13.6% on average (based on data going back to 1944). With the forthcoming Biden presidency, I expect value and small-cap stocks will be the real winners, with there being potential for a reversion of growth’s outperformance over value if he is able to pass some big-ticket policies.

Fortunately, we don’t have to look too far back for evidence that this reversion occurring, with value stocks having out-performed their growth peers during September for the first time in 11 months.

The catalyst for this outperformance was the perception of an improving economic outlook from expectations of further stimulus as well as optimism on COVID-19 (although despite the potential for a vaccine, recent news on actual cases is less benign).

Economic recoveries typically favour value stocks, increasingly made up of sensitive, cyclical companies, as well as smaller companies, which are far more sensitive to the domestic economy and consumers than large caps.

With a Biden government one might expect a strong fiscal stimulus, which will be a direct boost for ‘value’. Biden’s other policies will be more ambitious, but also targeted, and will benefit select sectors (technology is not one of them).

He made his commitment to renewable energy and infrastructure clear during his campaign, proposing a $1.7trn policy aimed at making the US emissions neutral by 2050. Although he stopped short of a ‘New Green Deal’ that his Democrat rivals promised during their race for Democrat presidential nominee, he also promised a $1.3trn infrastructure improvement plan, which largely builds on the policies under the Obama administration.

This might mean construction and utilities to do well given their frontline role in the expansion of infrastructure, especially those with a renewable focus.

I think trusts like JPMorgan US Smaller Companies, which, as the name implies, has a small-cap bias, are likely to do well under Biden. Identifying clear winners of a value rotation is trickier, as there are few if any US value pure-plays left in the trust market, though the closest I might suggest would be BlackRock North American Income, with its overweight to financials.

US and global strategies with dedicated US value buckets, such as F&C Investment Trust and JPMorgan American, should benefit from this trend in a way those who have put all their eggs in the growth basket might not.

The outperformance of value and smaller companies relative to growth won’t just be due to the formers’ ability to capitalize on a Biden led economy, but also due to several headwinds facing the technology and broader growth sector.

Antitrust legislation for the big technology names (Facebook, Alphabet, Apple, and Amazon) is likely to be proposed, with Democrats looking to break up monopolies and limit their influence on society.

This could be a catalyst for the reversal in the outperformance of large-cap tech, given how focused the legislation will be.

The biggest obstacle for growth stocks, tech included, is the potential for fiscal-led inflation, where a surge in direct government spending (as opposed to Trump’s tax cuts) could see an upwards push in inflation.

This will be reflected in higher interest rate expectations, which could wreak havoc in the most expensive equity names, who have been able to justify their valuations partially through the opportunity cost of low yielding bonds.

Conversely, banks, a hallmark of the value sector, would welcome the prospect of higher interest rates, given that this is one of the major determinants of their profitability.

Expectations of higher interest rates could alone be the biggest catalyst for a reversal in the outperformance of growth stocks against their value peers.

Why Biden won’t derail big tech and growth stocks over the medium term | Thomas McMahon

I am feeling a sense of déjà vu after this US presidential election. The apparent victor is having his victory disputed; allegations are swirling about his connections to China (not Russia this time); the other side is claiming he won’t make it to the inauguration or much further, and stock markets have rallied on the expectation of fiscal stimulus (expenditure rather than tax cuts this time).

US and global markets could come down to earth shortly, just as they did after the 2016 result, and it is the long-term trends which will determine market leadership and economic progress.

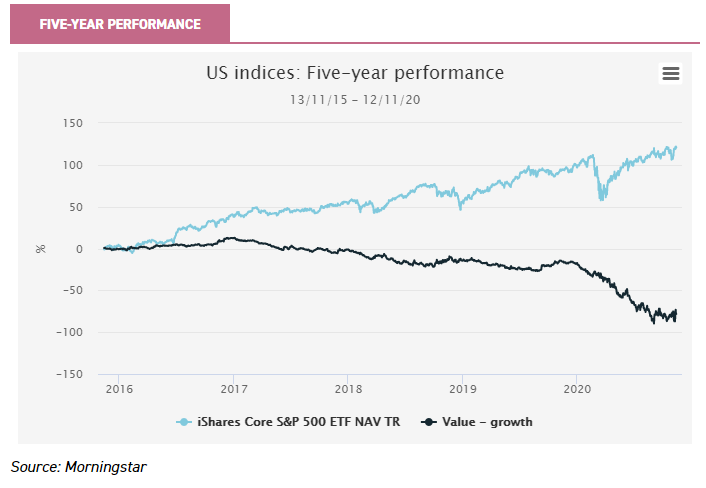

The chart below shows the relative performance of value versus growth and the S&P500 in absolute terms over the past five years.

The outperformance of value versus growth immediately after Trump’s late 2016 victory is clearly visible, but shortly after began a long and steady period of growth outperformance, which has only accelerated this year.

Long-term trends are causing this shift to long-duration assets, but let’s first remind ourselves of the short-term hurdles still to be faced. A second wave of coronavirus is sweeping the northern hemisphere as winter gets underway.

That will itself bring a continuation of behaviour change which favours e-commerce and disfavours broader economic activity. We do not yet know how severe this wave will be, and we can still hope it will be much milder than the first.

However, Biden plans to implement a four to six-week national lockdown in January. Should these plans survive and be implemented, the US economy will take a hit, and large-cap tech and e-commerce will outperform once again.

In the medium term, positive indications about vaccine efficacy remind us that this crisis will come to an end. Final approval and roll-out of the vaccines may take some time, however, and restrictions are unlikely to be lifted wholesale.

Nevertheless, the market can at that point look through the crisis to the inevitable recovery. It is true that e-commerce will likely lose some of its market share gains, but it will also retain some. And it will retain its ability to generate increasing returns to scale.

Furthermore, in the long run, the economic recovery is going to depend upon massive central bank support, including rates pinned to the floor for years to come.

The board of governors of the Federal Reserve sees rates close to zero until the end of 2022 at least. This should support long-duration assets such as growth stocks and creates a headwind for banks, a key value sector.

While materials and commodities are likely to see a sharp rebound thanks to base effects – a rapid rise in economic output as sectors come on line once more – trend growth and inflation are likely to remain low as the economic scarring works through.

In short, we will recover, but only to go back to the low growth and low inflation millpond we were becalmed in.

A major issue facing ‘big tech’ is clearly regulation, but this may not mean shareholders do badly. It might just be bad for the current leadership of these companies.

In an extreme scenario in which Amazon, say, was broken up, the e-commerce and data centre businesses would still both possess the highly attractive financial characteristic of rising returns to scale.

Furthermore, politicians’ bark is often much worse than their bite. The incentives for politicians to neuter monopolies aren’t there.

In fact, the ideal situation for Washington is to have Facebook, Apple, Google, and Amazon controlling huge parts of the economy and information streams but to be constantly worried about their position being challenged by reform.

That brings leverage. Consider how the Conservative Party continually threatens to end the BBC license fee but never does – this gives influence. It is possible to see the recent smackdown of Chinese internet names in the same light. The CCP is reminding Jack Ma and his like who is the real boss. I expect any Biden administration to copy the CCP.

Given the above, it might be a good strategy to add to growth and tech-focused trusts when or if discounts open up. Unfortunately, the market seems to agree, and so growth focussed trusts haven’t seen much discount widening.

Scottish Mortgage is on a slight discount while Allianz Technology Trust and Mid Wynd International are trading on slight premiums. All are close to their one-year averages. Should another wobble occur, I think it might pay to take the long view and take advantage of any discounts that do appear.

Click to visit:

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. In particular, this website is exclusively for non-US Persons. Persons who access this information are required to inform themselves and to comply with any such restrictions.

The information contained in this website is not intended to constitute, and should not be construed as, investment advice. No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not a recommendation, offer or solicitation to buy or sell or take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s Conflict of Interest policy is available on request.

Leave a Reply

You must be logged in to post a comment.