Jan

2022

Unloved funds seeing performance pick up

DIY Investor

11 January 2022

Having spent a few months in the doldrums, funds investing in this region capitalised most from December’s ‘Santa rally’.

After a difficult November, mainly due to concerns over the spread of the new Omicron variant of Covid-19, most stock markets rose in December.

In the UK, the FTSE 100 went up by 4.6%, its best month of the year, and ended up making 14.3% in 2021. It was a similar story for the FTSE 250, up 4.3% in December and 14.6% for the year.

Despite all the problems caused by the pandemic, most of the well-known stock indices ended up recording double-digit gains in 2021. The notable exceptions were the Brazilian Ibovespa and the Hong Kong Hang Seng.

Stock Market Indices 2021

| Index | 1 Jan to 31 March | 1 April to 30 June | 1 July to 30 Sept | Oct 2021 | Nov 2021 | Dec 2021 | 2021 full year |

| FTSE 100 | 3.9% | 4.8% | 0.7% | 2.1% | -2.5% | 4.6% | 14.3% |

| FTSE 250 | 5.0% | 4.0% | 2.9% | 0.3% | -2.5% | 4.3% | 14.6% |

| Dow Jones Ind Ave | 7.8% | 4.6% | -1.9% | 5.8% | -3.7% | 5.4% | 18.7% |

| S&P 500 | 5.8% | 8.2% | 0.2% | 6.9% | -0.8% | 4.4% | 26.9% |

| NASDAQ | 2.8% | 9.5% | -0.4% | 7.3% | 0.3% | 0.7% | 21.4% |

| DAX | 9.4% | 3.5% | -1.7% | 2.8% | -3.8% | 5.2% | 15.8% |

| CAC40 | 9.3% | 7.3% | 0.2% | 4.8% | -1.6% | 6.4% | 28.9% |

| Nikkei 225 | 6.3% | -1.3% | 2.3% | -1.9% | -3.7% | 3.5% | 4.9% |

| Hang Seng | 4.2% | 1.6% | -14.8% | 3.3% | -7.5% | -0.3% | -14.1% |

| Shanghai Composite | -0.9% | 4.3% | -0.6% | -0.6% | 0.5% | 2.1% | 4.8% |

| Sensex | 3.7% | 6.0% | 12.7% | 0.3% | -3.8% | 2.1% | 22.0% |

| Ibovespa | -2.0% | 8.7% | -12.5% | -6.7% | -1.5% | 2.9% | -11.9% |

| RTSI | 6.5% | 12.0% | 7.5% | 3.7% | -10.7% | -3.0% | 15.0% |

Data Source: Morningstar

This general upturn in the equity markets was reflected in the Investment Association (IA) sector performance in December.

Nearly all the sectors went up, but there were some exceptions, mainly the sectors investing in bonds. However, the Technology and Technology Innovations sector was also in negative territory, along with the two Japanese sectors and China/Greater China.

Having spent a few months in the doldrums, the three UK Equity sectors (UK Equity Income, UK Smaller Companies and UK All Companies) made the most of the Santa rally and ended up being the best-performing sectors in December – all going up by more than 4%.

UK funds have been out of favour with investors for some time. The latest IA fund sales statistics show that £755 million was withdrawn from UK equity funds in November.

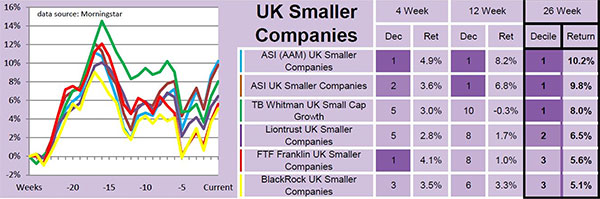

In our latest four-week analysis, the UK Smaller Companies sector has just inched ahead of UK Equity Income and UK All Companies is still a close third.

Our demonstration portfolios have recently invested in two funds that featured in last week’s 26-week data table, ASI (AAM) UK Smaller Companies and FTF Franklin UK Smaller Companies.

We have held the FTF Franklin UK Smaller Companies fund before and it did well for us. Both portfolios bought this fund in November 2020 and then sold it last October – in that time it had gone up by 35%. It then fell, along with most UK Smaller Companies funds, but has rebounded in the last few weeks. Now that we are holding it again, we hope that it goes on to do as well as it did in the first three quarters of last year.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Brokers Commentary » Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.