Oct

2020

Unlocking the potential of graphene

DIY Investor

17 October 2020

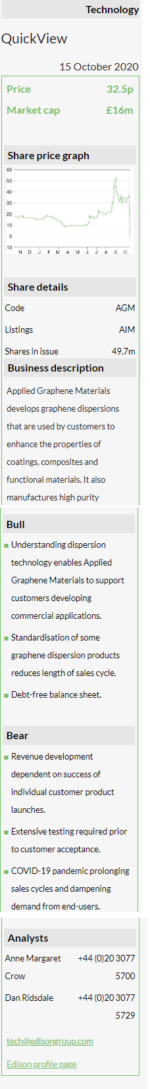

Applied Graphene Material’s (AGM’s) FY20 results show the beneficial impact of management’s decision in October 2019 to focus on dispersion and application technology to better support product development with those customers presenting the nearest-term revenue opportunities.

Applied Graphene Material’s (AGM’s) FY20 results show the beneficial impact of management’s decision in October 2019 to focus on dispersion and application technology to better support product development with those customers presenting the nearest-term revenue opportunities.

Revenues increased by 66% year-on-year in FY20 to £83k and adjusted EBITDA losses narrowed by £1.5m to £3.1m. With three new customer products launched in FY20 and three launched so far in FY21, progress looks set to continue.

Enabling customers to develop new products

Customer product launches during FY20 included a graphene-containing primer for Halford’s retail range and a Hycote-branded aerosol primer from James Briggs, which is sold to consumers via Amazon and to professional automotive paint shops.

Coatings innovator Blocksil introduced a high performance, anti-corrosion coating for industrial applications that was approved by Avanti for application on its large satellite communications dishes.

Since the year end, customers Infinity Wax and Halo Automotive have both launched products for the car-care market and Kent Europe has launched an aerosol anti-corrosion primer.

AGM has expanded its distribution network to include partners in Benelux, Greece, North America, Spain and Scandinavia, bringing the total number of salespeople to over 60.

During FY20 AGM launched the Genable 1400 series of dispersions of graphene nanoplatelets. Like the other Genable products, these dispersions are very well characterised and stable, making it easier for customers to deploy AGM’s graphene in their own formulations, but contain higher levels of graphene, giving greater flexibility.

Realignment reduced losses while growing sales

Revenues increased by 66% y-o-y during FY20 to £83k, driven by rising product sales. Adjusted EBITDA losses narrowed by £1.5m to £3.1m, reflecting the impact of the realignment programme on costs.

This progress on both revenue growth and EBITDA loss supports the FY21 consensus estimates. Net cash (there is no debt except for minimal IFRS 16 lease liabilities) reduced by £2.5m during FY20 to £3.7m at the year end.

Noting the working capital required to support the anticipated commercial expansion, management estimates the realignment has extended the company’s cash runway to October 2021 and states it will need to raise additional financing.

Valuation: Still too early to form a view

AGM has only recently started to commercialise its products and the sector generally is at an early stage of evolution, precluding a valuation.

|

Consensus estimates

Source: Company data, Refinitiv |

Applied Graphene Materials is a research client of Edison Investment Research Limited

Click to visit:

General disclaimer and copyright

This report has been commissioned by Applied Graphene Materials and prepared and issued by Edison, in consideration of a fee payable by Applied Graphene Materials. Edison Investment Research standard fees are £49,500 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison’s policies on personal dealing and conflicts of interest.

Copyright: Copyright 2020 Edison Investment Research Limited (Edison).

Leave a Reply

You must be logged in to post a comment.