Aug

2021

Uncertainty turbocharges returns for this fund sector

DIY Investor

9 August 2021

Saltydog points out if the fear of inflation gets any stronger, then this sector could maintain its upward trajectory.

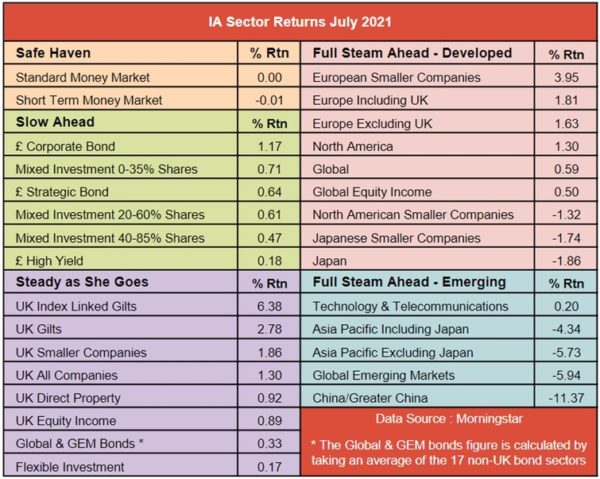

Each month, we look at the overall performance of the Investment Association (IA) sectors. Below is the table for July.

The best-performing sector, by quite some margin, was UK Index Linked Gilts, with a one-month return of 6.38%.

This is a relatively small sector with just a dozen UK domiciled funds. The IA’s sector definition is: “Funds which invest at least 95% of their assets in sterling denominated (or hedged back to sterling) government-backed index-linked securities, with a rating the same or higher than that of the UK, with at least 80% invested in UK Index Linked Gilts.”

We do not often see this sector at the top of our tables. The last time was February 2020, when investors realised that the coronavirus outbreak that began in China could not be contained and was spreading around the world. That month, nearly all the equity-based sectors were showing one-month losses. UK All Companies was down 9.4%, Europe excluding UK fell by 6.2%, Japan lost 8.2%, and North America went down by 6.8%. The worst-performing sector, Japanese Smaller Companies, dropped by more than 12%.

It is often the case that in times of trouble stock markets fall as investors look for safer places to put their money. In periods of uncertainty, it is difficult to predict the future earnings of companies and, in some cases, their survival may even be in doubt. This is when UK Gilts, which are backed by the UK government, often do well.

Last month was not great for equity markets, although not as bad as last February (at least in the developed economies). The major falls were in the emerging market sectors. The Chinese Communist Party is in the middle of one of its biggest economic policy shifts since the 1980s, and some of the recent reforms have not gone down well with investors. This has not only affected the China/Greater China sector, but also the Global Emerging Markets and Asia-Pacific sectors.

More generally, the spread of the Delta variant could slow down the recovery, and maybe stock market valuations have got ahead of themselves. There is also the growing concern that at some point central banks will have to stop pumping money in to support the global economy and raise interest rates to try to curb inflation.

The uncertainty has once again played into the hands of the UK Gilts and UK Index-Linked Gilts sectors.

In our weekly analysis, we combine these sectors. Here is our table showing the leading funds in the 26 weeks up until the end of July.

If the uncertainty continues, and the fear of inflation gets stronger, then this sector could maintain its upward trajectory.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.