Oct

2023

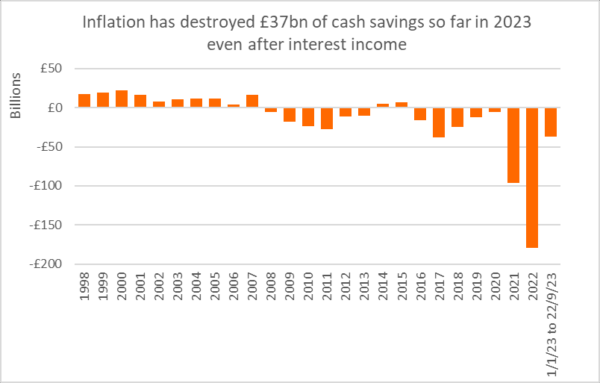

UK savers £37bn down as inflation hits cash pots, despite record interest income

DIY Investor

24 October 2023

- Savers have already lost over twice as much to inflation in 2023 as they have earned in interest

- Since January, UK savers have earned £32bn in interest

- Despite this, inflation eroded the value of savings by £69bn across the same period

- Investors in global equities have enjoyed returns 6x larger than cash and beaten inflation comfortably across the same period

- Nearly a quarter (22%) of people said they keep money in deposits or in physical cash to protect against inflation

The UK’s cash savings have fallen in 2023 and, crucially, savers are failing to make the most of their nest eggs, according to the latest annual Cost of Cash research from Janus Henderson Investment Trusts.

The UK’s cash savings fell to £1.95 trillion in July[1], down by £5bn since the turn of the year, reflecting pressured family budgets throughout the cost-of-living crisis. With interest rates at their highest level since 2007, those who have managed to save might consider themselves to be in a better position than in recent years. Between January and late September, they earned £32bn in interest across instant and fixed-term accounts, cash ISAs, NS&I and current accounts. Janus Henderson Investment Trusts also calculates they will earn a record £45bn in interest for the whole of 2023[2] – three times more than 2022, and more than they earned in the six years from 2017-2022 combined.

Despite high interest rates, however, savers are still losing out to inflation. Shockingly, soaring prices have seen the value of British nest eggs depreciate by £69bn between January and late September 2023, more than twice as much as the £32bn earned in interest in the same period.

Source: Janus Henderson Investment Trusts, Bank of England, ONS

Investors in global equities have enjoyed returns six times larger than cash in 2023 so far, beating inflation comfortably

Those who have been prepared to take some investment risk have seen greater returns than cash savers. Global equity markets have had a good 2023 so far, not only easily beating cash savings, but also inflation. The MSCI World, an index of global stocks, has returned a total 9.8% between January and late September[3] in a combination of income and capital gains. This is six times as much as the typical cash saver earned in the same period and almost three times (2.8) as much as inflation. Meanwhile the UK index returned 4.3%[4], 2.7 times as much as cash, which beats inflation by just under one percentage point.

Over long term, equities beat cash almost 4:1 and cash loses the race to inflation

Over the long term the picture is clearer still. £1,000 invested in global equities 25 years ago is worth £5,936 today[5], compared to £1,631 invested in cash – or 3.6 times better. Inflation comfortably beat compound cash interest over the same period too (CPI 83% v compound interest 63%).

Yet British people still believe cash deposit accounts provide the best defence against inflation

Surprisingly, almost one quarter (22%) of people surveyed by Opinium on behalf of Janus Henderson Investment Trusts, think that keeping cash in deposits or physically in notes and coins is the best way to protect their savings from the impact of inflation. Just one sixth (17%) selected shares in their various forms (e.g. as investment trusts, via funds or company stock).

When asked, one third of respondents (33%) said they did not know what investments were typically good long-term shields against inflation. This figure is up from just over a quarter (28%) a year ago. Further highlighting the need for greater awareness and education around financial decision-making.

Dan Howe, Head of Investment Trusts at Janus Henderson Investors, said:

“The current environment is undeniably difficult to navigate. We are presented with the reality of rising costs not only as we go about our daily lives, but as we read the headlines too. Interest rates, despite being at their highest level in 15 years, are still not enough to fight the corrosive effects of inflation. Taken together, it’s no wonder that many UK savers are struggling to decide how to best protect the value of their hard-earned savings.

“Environments like the one we currently find ourselves in can make us understandably wary about investing our savings, but the research shows that keeping them in cash has not protected them from inflation in the long-term. Since the beginning of 2021 savers have seen inflation consume one sixth of their cash savings, even after interest income has been added. In 25 of the last 34 years, equity investments have delivered superior returns compared to holding cash, and can provide investors with a much-needed boost to income in terms of capital gains and dividend payments, particularly when those dividends are reinvested.”

[1] Source: Bank of England, NS&I; latest data available

[2] Source: Janus Henderson calculated using Bank of England balances and rate data by account type

[4] Source: FTSE All-Share 31/12/2022 to 22/09/2023 – dividends reinvested

[5] Source: MSCI World, 31/12/1998 to 22/09/2023 – dividends reinvested

Leave a Reply

You must be logged in to post a comment.