Dec

2021

UK M&A surge highlights undervalued domestic opportunities

DIY Investor

9 December 2021

Jonathan Winton, co-portfolio manager of Fidelity Special Values PLC

While the UK market has looked cheap for some time, the key difference in 2021 is that fundamentals are now improving. Jonathan Winton, co-portfolio manager of Fidelity Special Values PLC, discusses how this backdrop is driving a spate of M&A bids which could act as effective catalysts to close long-standing valuation discounts.

Key points

- We believe the raft of M&A bids in the UK highlights how attractive domestic valuations are both in an absolute sense and relative to other geographies.

- Our focus on undervalued companies with improving fundamentals means that it is not unusual for our portfolio holdings to be the subject of bids.

- If the offer is fair, it gives us a welcome opportunity to recycle the proceeds into new investment opportunities with greater upside potential.

The near-term economic outlook for the UK is encouraging with Brexit now behind us, most remaining restrictions related to Covid-19 now lifted and real time data suggesting a continued rebound in economic activity. Consequently, the UK is predicted to grow at the fastest pace of the major developed economies, providing a good backdrop for UK corporates.

Valuation anomalies spur bids

This bright outlook is reflected in the number of M&A bids we are currently seeing by private equity groups and other corporates in the broader UK equity market. Our focus on undervalued companies with sound or improving fundamentals means that it is not unusual for our portfolio holdings to be the subject of bids. In fact, over the past year, 10 of our holdings in Fidelity Special Values PLC were the subject of bids.

These bids highlight how attractive UK companies’ valuations are both in an absolute sense and relative to other geographies. While the UK market has looked cheap over the past five years, the major difference in 2021 is that fundamentals on-the-ground look very good.

From a portfolio perspective, this backdrop has helped us find attractively valued companies of better quality than would normally be the case, reflected, for example, in the continued elevated gearing level of Fidelity Special Values PLC.

The attractive valuations might reflect the fact that a particular company or business has experienced internal issues or been impacted by headwinds in its sector or the wider economy. The key is that we feel these issues are temporary and our due diligence gives us the conviction that the business will positively change over the medium-term. This uncertainty and the resulting impact on valuation creates an opportunity for acquirers who typically take a longer-term view.

Many UK listed companies are market leaders in their industries with attractive growth potential, and with Brexit in the rear-view mirror, companies and acquirers are more willing to commit to making new investments in the country. These dynamics, along with the current availability of capital, means we are likely to see more bids if the valuation discrepancy remains in place.

True value

We welcome bids by private equity groups and other corporate acquirers if they recognise the true value of individual businesses and are willing to pay a fair price. These acquirers typically tend to take a longer-term view than market participants who can at times be overly pre-occupied by near-term uncertainty.

We are equally happy to take a public stance and vote against a bid if we think the offer undervalues the business, as we recently did with Spire Healthcare. We don’t see M&A as a threat – the UK is a large market so we are never short of new investment ideas and have had no issues putting to work the cash released from recent bids.

Positive outlook

Overall, we believe the portfolio is well positioned to benefit from an improving economic backdrop and we remain excited about the opportunity set on offer. Our holdings continue to trade at a meaningful discount to the broader UK market, despite resilient earnings, superior returns on capital and relatively low levels of debt. This quality profile combined with the more positive outlook give us confidence that we can continue to deliver attractive returns to investors from here.

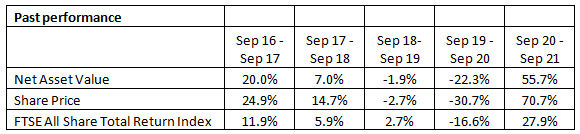

Past performance is not a reliable indicator of future returns.

Source: Morningstar as at 30.09.2021, bid-bid, net income reinvested. ©2021 Morningstar Inc. All rights reserved. The FTSE All Share Total Return Index is a comparative index of the investment trust.

Find out more about Fidelity Special Values PLC

Important information

Past performance is not a reliable indicator of future returns. The value of investments and the income from them can go down as well as up, so you may get back less than you invest. This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to an authorised financial adviser. Overseas investments are subject to currency fluctuations. The shares in the investment trust are listed on the London Stock Exchange and their price is affected by supply and demand. The investment trust can gain additional exposure to the market, known as gearing, potentially increasing volatility. The trust invests more heavily than others in smaller companies, which can carry a higher risk because their share prices may be more volatile than those of larger companies and the securities are often less liquid. This trust uses financial derivative instruments for investment purposes, which may expose it to a higher degree of risk and can cause investments to experience larger than average price fluctuations. Investors should note that the views expressed may no longer be current and may have already been acted upon.

Commentary » Equities Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.