Apr

2021

UK equity funds have a strong first quarter

DIY Investor

8 April 2021

The ‘unloved’ UK has been the place to be in the first quarter of 2021, points out Saltydog Investor

It has been a reasonable start to the year, especially for developed markets. After a good March, the FTSE 100 ended the first quarter of 2021 up by 3.9%. The FTSE 250 has done even better, gaining just over 5%.

Over the Channel, in France, the Paris CAC 40 has gone up by 9.3% so far this year, and the German DAX is marginally ahead, up 9.4%.

The US indices are also showing gains. The S&P 500 has made 5.8%, while the Dow Jones Industrial Average is up 7.8%. The Nasdaq, which was the star performer last year, has had a slower start to 2021, up 2.8%.

Some of the emerging markets have not fared as well. The Shanghai Composite Index has lost 0.9% in the first three months of the year, while the Brazilian Ibovespa is down 2%, even after a strong recovery in March.

The performance of overseas markets gives an interesting insight into the global economy, but replicating the returns as a UK investor is not always that straightforward. If you invest in a fund that buys overseas listed stocks, then you also have to take into account any currency movements.

If sterling weakens, then your gains will be boosted, however if the pound gets stronger your overseas gains will be negatively impacted when converted back into sterling.

In the first three months of the year, sterling has been strengthening. It is up by only 0.8% against the US dollar, but it has gained 4.9% against the euro.

The Investment Association (IA) sector performance data for the first quarter, highlights a couple of clear trends.

The fixed interest sectors have had a difficult couple of months. The worst-performing sector has been Global Emerging Bonds – Local Currency, which is down 8.05%, followed by UK Gilts, which has lost 7.39%.

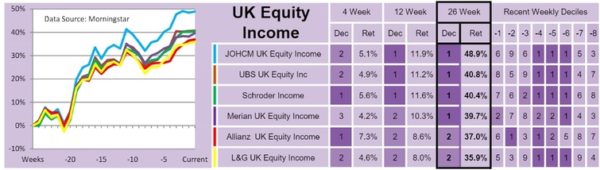

The equity markets have done much better, with the UK sectors topping the table. The best-performing sector after the first three months of the year is UK Smaller Companies, up 9.05%, followed by UK Equity Income, up 6.79%. The UK All Companies sector is not far behind, up 5.8%.

Our demonstration portfolios have been holding funds from the UK Smaller Companies and UK All Companies sectors since last November.

Last week, we added the Schroder Income fund from the UK Equity Income sector.

At the time, the UK Equity Income sector was the leading sector, based on its performance over the previous four weeks, and the Schroder fund was in decile one over four, 12 and 26 weeks. It should help strengthen our exposure to funds investing in the UK.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

Commentary » Equities » Equities Commentary » Latest » Mutual funds Commentary » Mutual funds Latest

Leave a Reply

You must be logged in to post a comment.