Jun

2022

Two funds on the rise that we’ve been buying more of

DIY Investor

6 June 2022

Saltydog names its latest portfolio changes, as well as running through the best-performing funds in May.

Last month, 65% of the funds that we analyse went down. The worst, T. Rowe Price Global Technology Equity, fell by 14.3%. Over the past year it has lost its investors over 40%.

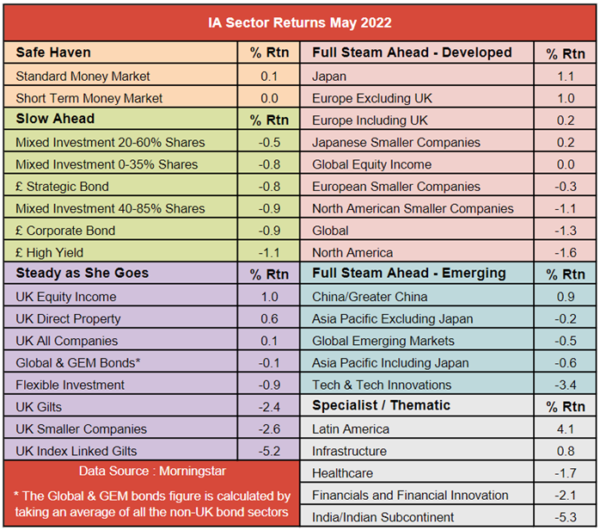

Many of the Investment Association sectors also went backwards in May.

The best-performing sector was Latin America, which went up by 4.1%. This sector has had a good year and has made over 20% so far in 2022. However, it has been a bit erratic. In March it went up by nearly 15%, but then lost 7% in April.

The UK Equity Income and Europe excluding UK sectors went up by 1.0%, and Japan went up by 1.1%.

As I have mentioned before, Morningstar, who calculate the performance figures, do not show averages for sectors “where performance comparisons may be inappropriate due to the diverse nature of the funds in the sector”. This includes the Specialist, Targeted Absolute Returns, and Commodities and Natural Resources sectors.

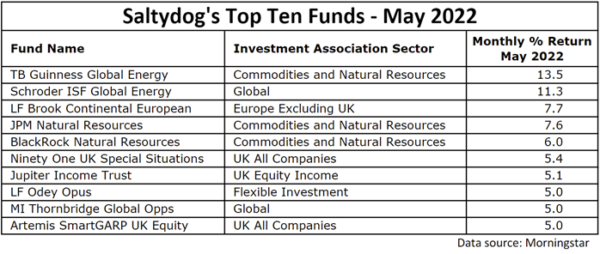

Some of the best-performing funds so far this year have been in the Commodities and Natural Resources sector, and this trend continued in May.

At the top of the table is the TB Guinness Global Energy fund. We have been talking about this fund for some time. One of our demonstration portfolios invested in it from December 2020 to April 2021, and again from October 2021 to November 2021. On both occasions it made money for us. We went back into it in January this year and since then it has gone up by more than 30%.

We also hold Schroder ISF Global Energy, which we only bought in March. Since then, it has gained nearly 25%.

Fourth in the list is the JPM Natural Resources fund, which is also from the Commodities and Natural Resources sector and currently features in both of our portfolios.

Last week I explained why we are not investing more in these funds. They are volatile and we have rules in place to limit the overall volatility of our demonstration portfolios.

I also pointed out that recently it has been difficult because the sectors in the less volatile, ‘Slow Ahead’ Group, have been trending down and so there has been little incentive to invest – they all went down in May. There was a bit of a pick-up a couple of weeks ago, but it feels too early to say that the tide has turned.

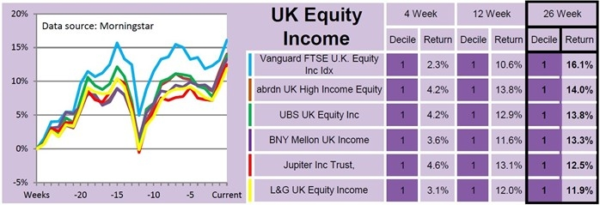

There are a few sectors in the more volatile ‘Steady as She Goes’ Group that went up in May, and at the top is UK Equity Income.

Our Ocean Liner portfolio has held one fund from this sector since February. It is the Vanguard FTSE UK Equity Income Index fund and it featured in last week’s reports. It was showing in the top 10% of funds in its sector over four, 12 and 26 weeks, and was at the top of the 26-week performance table. We are in the process of increasing our holding.

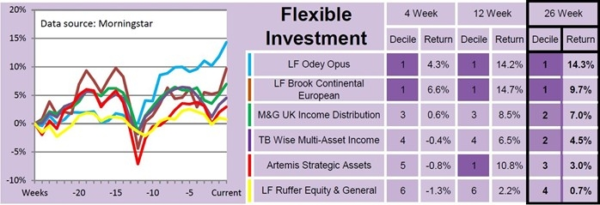

We are only invested in one other fund from the ‘Steady as She Goes’ Group, and that is the LF Odey Opus fund from the ‘Flexible Investment’ sector. It is one of our 10 best-performing funds in May, and also appeared in our latest weekly analysis. It is in the top 10% of funds in its sector one over four, 12 and 26-weeks, and is at the top of the 26-week performance table. We are also increasing the amount that we have invested in this fund.

Hopefully we will see some of the ‘Slow Ahead’ sectors start to make gains in the next few weeks. Until they do, we will still be holding a significant amount of cash. With the war in Ukraine, record inflation levels, rising interest rates, and most major stock markets trending down, that is probably not such a bad idea.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com

Leave a Reply

You must be logged in to post a comment.