Sep

2020

Top 10 Most Shorted UK Stocks; Most Active Short Fund Managers

DIY Investor

9 September 2020

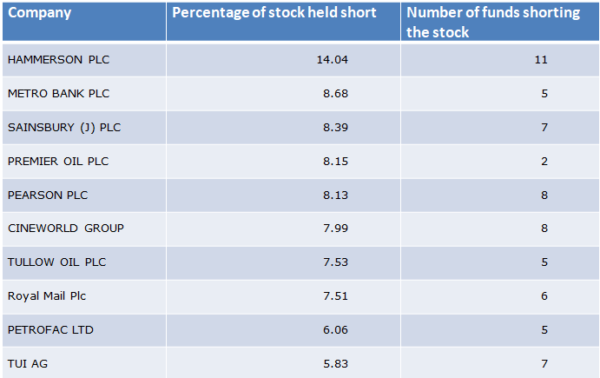

New analysis(1) from ETF provider GraniteShares, which offers a range of 3x short and 3x leveraged ETPs on popular UK and US stocks, reveals that as of 7th September 2020, Hammerson PLC, the property and investment company, was the most shorted UK listed company.

14% of its stock was held short by 11 investment firms, with Caxton Europe having the largest short position with 4.33% of the company’s shares.

The next most shorted UK listed companies were Metro Bank PLC, Sainsbury (J) PLC, and Premier Oil PLC, where the respective reported short positions were 8.68%, 8.39% and 8.15%.

In terms of reported short interest in companies tracked by GraniteShares ETPs, three companies featured: Vodafone Group Plc (4.02% short interest), Rolls-Royce Holding Plc (1.66%), Lloyds Banking Group Plc (0.51%)

Source: FCA, current disclosures as reported on 7 September 2020

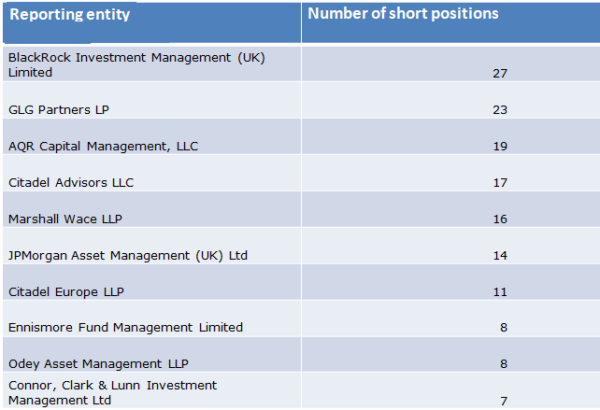

In terms of which fund managers had the most short positions on UK listed companies, the analysis reveals BlackRock Investment Management (UK) Limited had the highest number with 27.

This was followed by GLG Partners LP, AQR Capital Management LLC, Citadel Advisors LLC and Marshall Wace LLP with 23, 19 and 17 and 16 short positions respectively.

Source: FCA, current disclosures as reported on 7 September 2020

Will Rhind, Founder and CEO of GraniteShares, said: “Markets around the world rose in August, which resulted in losses for many short sellers. Indeed, it is estimated that short sellers lost around £420 million on FTSE 100 companies last month. (2)

“However, markets are very volatile at the moment and we have recently seen executives of large listed companies selling off some of their stock, which has resulted in share prices falling.

“Through our single stock leveraged and short ETPs, we offer sophisticated investors the opportunity to go 3 times long or short of a range of FTSE 100 and US tech stocks, a way of obtaining exposure to both the old and new economies. This is reflected in investor interest: the 3x Long Rolls-Royce ETP (3LRR) and both the long and short exposures to Tesla have been among the most popular ETPs over the last few weeks. The 3x Long Tesla ETP (3LTS), which was listed on 2 July at $5, has been as high as $49, before its recent pull back. The ETPs can help sophisticated investors navigate volatile markets and, as with the example of the long Tesla exposure, are a powerful tool to capture price momentum.”

Commentary » Equities » Equities Commentary » Equities Latest » Exchange traded products Commentary » Exchange traded products Latest » Latest

Leave a Reply

You must be logged in to post a comment.