Aug

2023

Time to take the plunge?

DIY Investor

21 August 2023

UK smaller companies have historically outperformed after every fall. Is this the right time to brave the uncertainty?…by Ryan Lightfoot-Aminoff.

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

The UK has been struggling with a number of headwinds over the past year. A confluence of global factors has contributed to a higher inflationary environment, which has had a tough impact on both UK business and consumers.

This has led to an increase in negative sentiment, which has had an effect on the stock market, particularly on companies at the lower end of the spectrum.

Smaller companies tend to perform worse in challenging market conditions for a number of reasons. They are often focussed on a single sector or niche, which means they cannot rely on diversified product lines to help them out in challenging periods. Similarly, their customer bases are often smaller, meaning the loss of one customer could have a bigger impact on them than that of a larger company.

Furthermore, they will likely find it more difficult to raise capital in challenging economic conditions, as banks often tighten credit standards and equity holders become more risk averse in difficult periods. This uncertainty feeds into share prices as investors move towards lower-risk areas, such as large-cap equities, government bonds, or even savings accounts, which leads to more sellers than buyers of these riskier assets and so small-cap share prices often struggle in weaker economic periods.

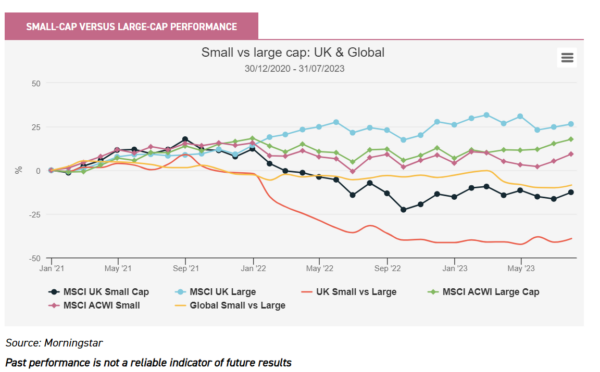

As the chart below shows, UK small caps have had a period of difficult performance recently, in both absolute and relative returns. Since the beginning of 2022, when economic conditions started notably deteriorating, UK small companies have delivered negative returns and underperformed UK large caps.

This has been an issue globally, as the yellow line in the chart below shows. This demonstrates cumulative relative performance of global smaller companies versus their large-cap peers and shows a period of underperformance.

However, this has been particularly prominent in the UK, as shown by the red line which demonstrates how the cumulative underperformance of UK small versus large caps started at the turn of 2022 and continued to October, before levelling out. It is true that some of this UK underperformance is due to the particularly strong performance of UK large caps last year, but as the chart shows, UK small caps also did particularly poorly in absolute terms.

After such a period of underperformance, the mind naturally turns to the potential for recovery. While there remains plenty of uncertainty surrounding the immediate market outlook, waiting for a recovery to be confirmed can lead to missing out on the best returns, while the beauty of investment trusts is there is often a share price discount offering an additional premium for taking a risk early.

Furthermore, as we discussed in a previous note, investment trust discounts have historically lagged underlying market rebounds and offered an extra source of returns when the recovery is eventually recognised by the market. UK small caps have historically done particularly well after a period of difficult performance, which we think makes them look attractive at this juncture.

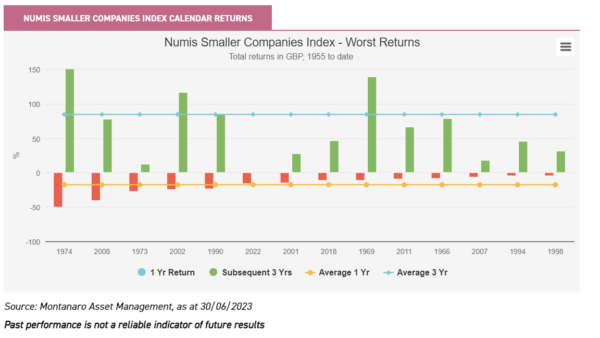

Data has shown that since 1955, every time the Numis Smaller Companies Index has had a negative calendar year, it has been followed by positive returns over the subsequent three years, with an average return of 84.4%. In 2022, the index fell 16%.

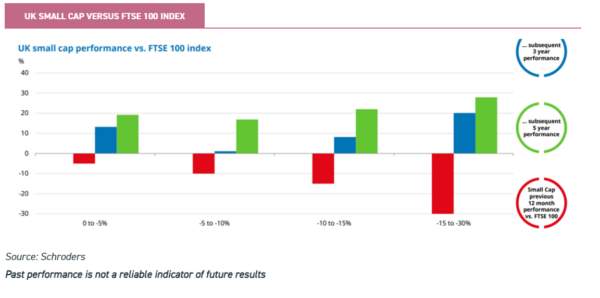

Further evidence shows that a similar effect is visible after periods of relative underperformance of smaller companies versus large caps. Every time the Numis Small Cap plus AIM ex IT Index has underperformed the FTSE 100 Index over a 12-month period, it has been followed by positive returns over the following three and five years, with the worst relative performance leading to the strongest periods of subsequent returns. Whilst past performance is no guarantee of future returns, the index returned -4.8% in the year to 09/08/2023, underperforming the FTSE 100 Index by 10.1%.

Beyond these periods of relative performance, the current valuations of smaller companies offer further validity to their investment case. When the FTSE SmallCap Index has traded below a P/E of 10x, the average return over the following 12 months has been 36%, and over the next 24 months, this figure jumps to 60%. According to Invesco, the current figure is below 9x. As such, the managers believe there is plenty of value in the UK stocks at the moment, especially when looked at with a long-term mindset. The managers of Invesco Perpetual UK Smaller Companies (IPU), Jonathan Brown and Robin West, highlighted this in a recent note. They believe this could be a catalyst for a recovery as valuations of small caps effectively go through a period of mean reversion. We believe the discount on IPU also provides a margin of safety for investors, as valuations in the portfolio are depressed and the shares are trading at a discount of c. 11%, meaning investors can access the portfolio companies at an even lower price. This discount is wider than the trust’s five-year average and the average of the peer group, despite the managers’ track record of outperformance. If smaller companies do rebound as they have done historically, this could prove an attractive entry point for long-term investors, as not only could they capture the recovery of smaller companies, but also the narrowing of the discount of IPU.

The four-strong management team behind Schroder British Opportunities (SBO) also believe that the historical ability for smaller companies to bounce back could be an additional tailwind to their performance. Whilst they invest in a mixture of private and public companies, there is a bias towards small and mid-sized companies, and this has been a headwind to performance recently. However, the managers are optimistic on potential returns from this point onwards because of weak current valuations and their historical propensity to bounce back. The shares of the trust currently trade at a discount of nearly c. 29% to NAV, which the managers believe is due to their allocation to private equity. However, they have demonstrated that their private companies have performed well on a fundamental basis which has supported the valuations, but they have taken a prudent approach in light of weaker public markets. As such, the current discount could be seen as an opportunity to access a portfolio already trading on attractive valuations at an even more attractive entry point.

Aberforth Smaller Companies (ASL) is another trust that we think could benefit from a bounce back in smaller companies. Their value approach has helped generate some of the best returns in the smaller company sector over the past year, but the managers still believe there is plenty to come from the UK. Not only have they have pointed to small-cap valuations being at a discount to large caps, but also UK valuations at a discount to international peers, and their portfolio being at a discount to the index as reasons to be positive. Despite the strong performance, the shares of the trust remain on a c. 13.4% discount to their NAV, which is not only wide versus its own history, but also versus the sector average. This has not gone unnoticed by the board which has continued to authorise share buybacks, with the most recent being on 08/08/2023. We believe the trust offers sector-leading exposure to the value investing style from an experienced team with a strong track record in the space. If UK smaller companies are able to bounce back as they historically have, the current discount on the shares of ASL could provide a double-whammy effect to returns.

Whilst valuations are compelling, and history has shown that smaller companies often outperform after periods of weakness, there is an argument to say that share prices don’t go up simply because they are cheap. There needs to be a reason for investors to move from being net sellers to net buyers again, and much has been said about what the potential catalyst could be. However, such catalysts are often only identified after the fact and often, investors could spend so much time analysing what could inspire a market recovery that the recovery happens while they are studying it. Markets are often forward looking, and therefore if investors are waiting for the signal that UK smaller companies could start to outperform, they may miss the beginning of a potential rally.

Conclusion

We think there is strong empirical evidence to show that UK smaller companies could be a good investment opportunity at the moment. Our data has shown that UK smaller companies often perform strongly after periods in which they have struggled, both in absolute terms and relative to large caps. As a result of a number of short-term factors, UK smaller companies have been through a difficult period in the past couple of years and have suffered in both absolute and relative terms.

This has affected the investment trusts that invest in the space, and discounts have widened accordingly. As such, we believe there are a number of smaller company investment trusts trading on compelling discounts which could provide an opportunity for long-term investors. This may not be a smooth ride, considering the uncertainty at present, but for those willing to look through the short-term noise, history has shown that this area of the market often bounces back strongly and the current weakness may well be one of those points that investors look back on in a few years’ time and think this was the moment…

Leave a Reply

You must be logged in to post a comment.