Jun

2021

Time to put tech funds back into our portfolios

DIY Investor

29 June 2021

It has been an interesting 18 months for trend investors. At the beginning of 2020, equity markets were performing well, especially in the US. At the time, the Dow Jones Industrial Average, S&P 500 and Nasdaq all set new all-time highs.

In the UK, the FTSE 250 also peaked and although the FTSE 100 was not doing quite as well, it was heading back towards the record it set in May 2018.

Then markets around the world suffered during the Covid-19 market sell-off, with some losing more than 30% of their value in a few weeks.

Fortunately, markets then started to recover, but some definitely moved quicker than others. The ‘tech’ stocks in the US did particularly well, significantly outperforming our domestic market. We picked up on this and last April our Tugboat Portfolio invested in the Polar Capital Global Technology fund and the Ocean Liner portfolio bought the L&G Global Technology Index.

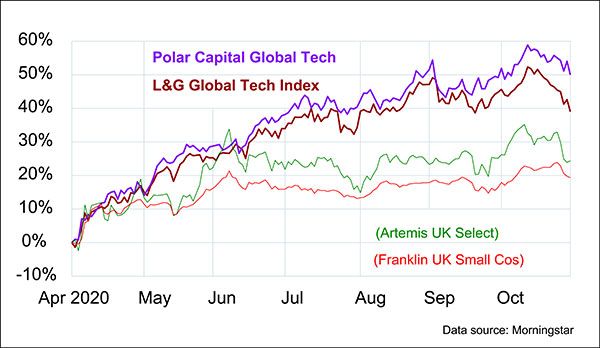

Here is a graph showing how they performed up until the end of October (we actually sold them in late September).

For comparison, I have shown a fund from the IA UK All Companies sector and another from the IA UK Smaller Companies sector – we were not holding them at the time, but we were about to go into them.

As you can see, all four funds were going down at the end of October, but at that point none of them were actually in our portfolios.

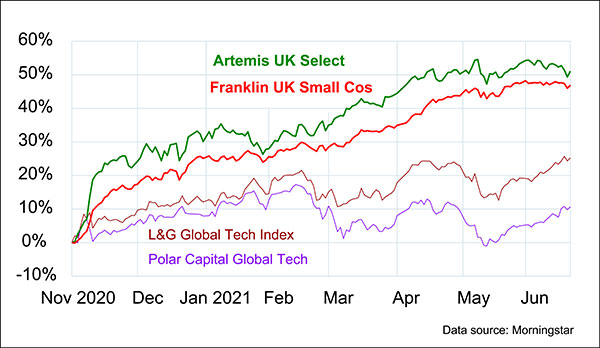

When markets picked up in November, the UK fund sectors were leading the way and that’s when we changed tack and went into the Artemis UK Select and Franklin UK Smaller Companies funds.

In recent months, these sectors have performed well and we have increased our holdings. However, in the last few weeks it looks as though the tide may be changing again as performance has levelled off.

We have already reduced the Franklin fund and last week we sold the Artemis UK Select fund. We still have some exposure to the UK Equity sectors, but are cutting back a little and giving the technology funds another chance.

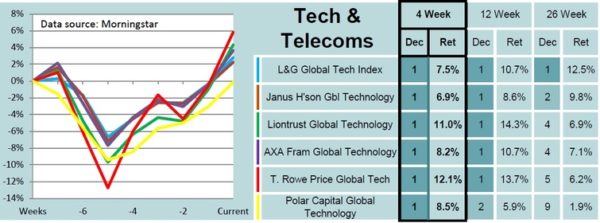

We have gone back into the L&G Global Tech Index in Tugboat. In addition, this time we have also picked the AXA Framlington Global Technology fund for our Ocean Liner portfolio. But we would have been just as happy with any of the funds in this week’s shortlists.

When the large technology stocks do well, it is not just the technology funds that benefit. They have such a large effect on the US economy that anything with exposure to the S&P 500 or Nasdaq will get a boost.

Last year, this was particularly noticeable in the Baillie Gifford funds, regardless of which sector they were in. If the current trend continues, we would expect the Baillie Gifford Managed fund (from the Mixed Investment 40-85% Shares sector) and the Baillie Gifford Long-Term Global Growth fund (from the Global sector) to perform well. We have recently added these to our portfolios.

It is early days, so we are not getting too carried away. However, the numbers would suggest that it is time to be slightly less focused on the UK and spread our nets a little wider.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Leave a Reply

You must be logged in to post a comment.