Sep

2019

Thoughts of Saltydog Investor: ‘To travel hopefully is a better thing than to arrive…..

DIY Investor

6 September 2019

It was Churchill who said ‘A politician needs the ability to foretell what is going to happen tomorrow, next week, next month, and next year. Then he needs the ability to explain afterwards why it did not happen.’

It would seem to me, that in the shambles of today’s Parliament and Brexit negotiations our politicians are certainly defined by this saying.

The referendum called for a political decision, to leave the EU or stay; it was not put as an economic vote, and there was no mention of leaving with or without a deal.

It was simply leave or stay, and parliament voted to stand by the result.

Now although this appears to have been a particularly foolish way to launch Great Britain into the future, this is what our politicians did.

We are told that we are a democratic country, yet our parliament does not act in that fashion. It is too bad that all the people who know how to run the country are busy driving taxis and cutting hair!

‘It is too bad that all the people who know how to run the country are busy driving taxis and cutting hair!’

In the context of the above, with Boris battling to take us out of the European Union on the 31st October, then losing the vote in parliament on Tuesday night, thereby making the threat of an early election reality, it is amazing to me that Sterling has not fallen further against the dollar and the euro.

As I write, the £/Euro hovers around 1.11, the £/$ is around 1.22 and gold is about $1540/oz.

For those of us that have invested in dollar denominated technology funds, global and gold funds, and are holding a reasonable amount of cash, then our portfolios will be looking quite rosy.

The fly in the ointment is of course Mr Trump with his desire to create a cold war with China by using tweets and import tariff charges.

It will be interesting to see how long he keeps this up, as these tariffs are having the direct effect of lifting consumer prices in the States.

Possibly that depends on whether he believes that being seen to flex his muscles is likely to win him more votes as the “big I am”, rather than lose votes due to the downside drag on consumers’ pockets.

Two generalised global funds that seem to have the magic touch are Lindsell Train Global Equity and Fundsmith Equity.

‘it is not wise to play with the hare and run with the hounds’

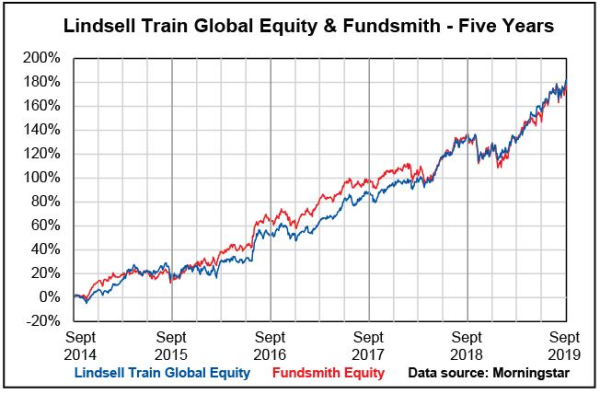

They seem to be able to achieve “fast forward” when the conditions are right and yet do not suffer dramatically when the markets and currency turn down.

The Lindsell Train fund was a Hargeaves Lansdown favourite until the recent shenanigans with the Woodford funds.

This event demonstrated that it is not wise to play with the hare and run with the hounds, so it was withdrawn from their best fifty.

Fundsmith never featured in the Hargeaves best fifty funds, as apparently Terry Smith would not pay the commission to get this exposure.

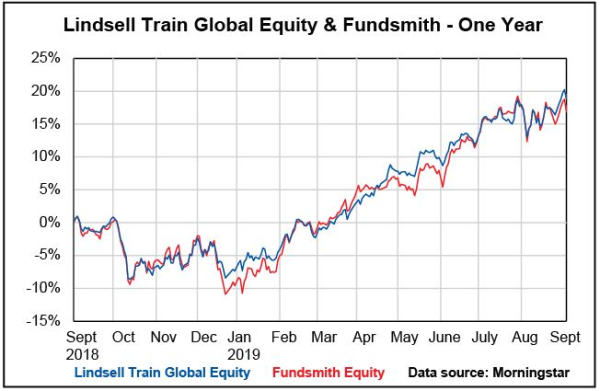

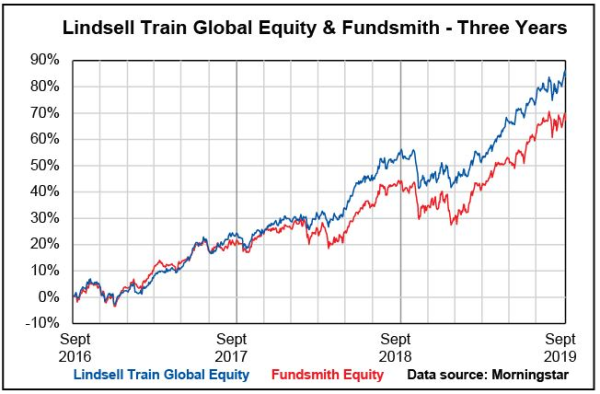

You can see from the graphs below that these two funds are worthy of serious consideration to form part of your portfolio. They do mine.

Here’s how they have performed over one, three and five years.

I finish with a quotation made by Richard Nixon. He said,“The voters have spoken – the bastards.”

This seems to me, to be the attitude that is being adopted by many members of our parliament!

Best wishes and good investing,

Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.