Mar

2020

Their darkest hour? Investment Trust Discount Opportunities

DIY Investor

23 March 2020

Since we last reviewed our portfolio of discount opportunities, an awful lot has happened.

The period from October to December saw a new Brexit deal, followed by the UK government winning a parliamentary majority to implement it.

Both were bullish for UK and European markets, and led to a sharp rally in markets and a rapid narrowing of investment trust discounts.

Globally, the mood was pretty optimistic for 2020; with a growing number of managers and commentators forecasting a rally in cyclical assets and a good year for markets.

Some of our picks saw their discounts narrow in, such that we were even tempted to try to find other opportunities.

But since then two major shocks have changed the picture entirely.

The first was the assassination of Iranian general Qassem Suleimani, which led to fears of a wider conflagration between the USA and Iran.

The second has been the ongoing coronavirus pandemic, which has had a more severe impact on markets, and looks likely to be a long-lasting situation with further economic pain to come.

‘looks likely to be a long-lasting situation with further economic pain to come’

The overall average sector discount has widened, but not excessively (yet), as share prices have fallen only slightly more than NAV.

Nevertheless there are some interesting opportunities emerging. As of market close on 13 March, the average discount was just under 7%; still significantly narrower than the level of c. 10% reached after the 2016 EU referendum (see chart below).

The situation is changing every day, however. Good news about the progress of the virus around the world could lead to markets rallying and trust investors staying the course, while further bad news could see the discounts widen further in the short term.

Last week’s budget and Bank of England rate cuts both gave some fuel for recovery, even if a slowing of the progress of the virus in Europe and the USA is likely to be necessary before the eventual relief rally begins.

In the sector review below, we first look across the universe to see where discounts have been widening. We then review our shortlist and make two new additions.

From this review onwards, we are introducing an innovation to our method. Given that we review these trusts no more frequently than quarterly, we have decided to give a target level for the discount of each trust we pick.

This indicates where we think the discount is no longer wide enough to stand out as warranting investigation. This indicates that the trust will be removed from our shortlist at the next review.

Sector review

The COVID-19 inspired global sell-offs have seen share prices fall across the investment companies universe.

However – by and large – the falls in NAV have themselves been severe, and so the overall impact on discounts has been relatively muted.

‘the falls in NAV have themselves been severe, and so the overall impact on discounts has been relatively muted’

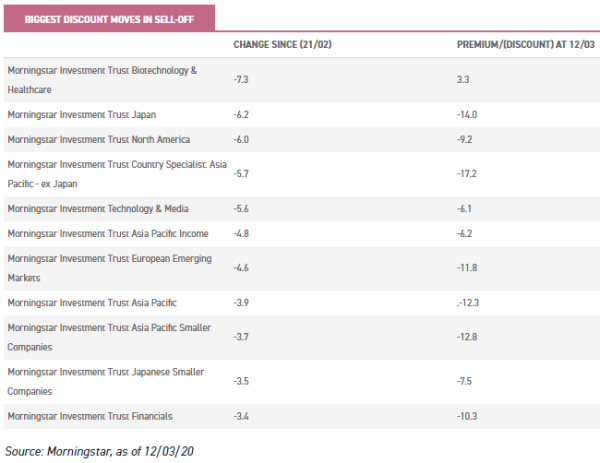

The biggest discount move since the market sell-off began on 21 February (to COB on 12 March) was in the Biotechnology and Healthcare sector, which has seen its premium come down from double digits to 3.3%.

The next biggest move was in the Japan sector, which has seen discounts move over 6% wider. [These figures are excluding all property and infrastructure sectors, which will be on artificially wide discounts thanks to having stale NAVs.]

Japan has been directly impacted by the virus, although its epidemic has been relatively controlled.

Perhaps more important has been Japanese industry’s strong links with China, and its highly global nature, which means it tends to be a high beta market (it was the worst hit stock market in the 2008 crash, for example).

Baillie Gifford Shin Nippon, in the Japanese Smaller Companies sector, saw its discount widen out to 8% on its worst day, and has been over 5% for much of the past two weeks.

At the time of writing it is on a 6.5% discount. It is also notable that Baillie Gifford Japan is trading on a discount of 3.7%, having spent most of the past five years on a premium.

The widest discount in the Japan sector remains Schroder Japan Growth (SJG) at 16%.

We included this in our list of discount opportunities last year; we continue to think it is trading too wide.

Perhaps the recovery from the coronavirus-inspired economic dip, whenever it comes, could give the more value-tilted strategy a relative boost?

‘JPMorgan Japanese also looks extremely interesting, at a 12% discount’

JPMorgan Japanese also looks extremely interesting, at a 12% discount. This is a high growth trust with a very strong long-term track record, which in terms of discount has been at levels last seen during the 2016 Brexit-inspired sell-off.

It is in the Asia Country Specialist trusts where the best value has arguably opened up.

VinaCapital Vietnam Opportunities has seen its discount widen from c. 16% to c. 27%, and Vietnam Enterprise Investments from c. 12.5% to c.23%.

Fidelity China Special Situations and JPMorgan China Growth & Income also saw their discounts widen considerably, but then come in slightly as the epidemic peaked in that country.

Both trusts remain on double digit discounts, 10% and 11% respectively, which is considerably wider than they were before the sell-off.

The North America sector has also seen considerable volatility. At times JPMorgan American has looked attractive on a discount basis, but given how quickly markets have been moving, it has been hard to tell.

‘we think the trust is an interesting way to take core US exposure at a startlingly low cost’

Following a revamp of the trust’s strategy, we think the trust is an interesting way to take core US exposure at a startlingly low cost (OCF of 0.38%), with a concentrated portfolio balanced between value and growth, as we discussed in our December update.

Furthermore we note that BlackRock North American Income is now also trading on a discount, having been at a premium on average over the past year. The trust has consistently outperformed its Russell 1000 Value benchmark, as we discussed in our latest update.

Aside from these two sectors, it is largely the smaller companies and cyclical sectors which have been hit particularly hard – perhaps because they are considered more cyclical or ‘risk-on’.

Financials have been hit by the lowering of the rates outlook, which will harm their profitability as well as their sensitivity to economic growth.

Technology trusts have backed out from trading close to or above par, even if they seem less exposed to the slowdown from quarantines.

Shortlist review and addition of catalysts

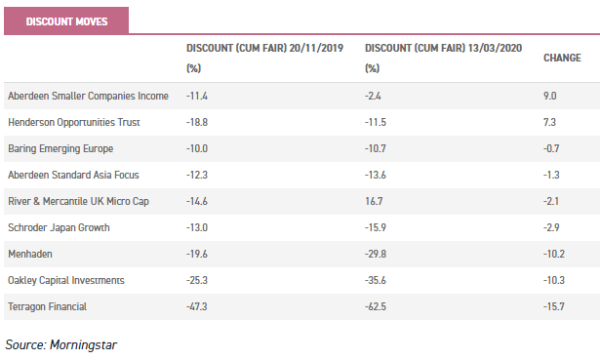

Since our last update in November, discounts on UK trusts have narrowed despite the recent sell-off. Henderson Opportunities (HOT) and Aberdeen Smaller Companies Income (ASCI) have seen significant narrowing of their discounts, by 7.3 percentage points and 9 percentage points respectively.

Our other UK trust, River & Mercantile Micro Cap (RMMC), has seen its discount widen, however, by 2.1 percentage points. The illiquid micro-cap space has struggled.

‘it reflects investors’ nervousness about illiquid small caps following the Woodford debacle’

We think this reflects the fact that it is likely to be the last place to see inflows, as money returns to the UK after the Brexit deal agreement.

We also think it reflects investors’ nervousness about illiquid small caps following the Woodford debacle.

Other trusts saw significant narrowing of their discounts before the impact of the COVID-19 pandemic began to be felt in markets.

The three widest discounts were on Tetragon Financial, Oakley Capital and Menhaden.

These all came in noticeably up to the beginning of February, before markets were hit for six and their discounts widened out once again.

That said, all have significant unlisted exposure which means NAVs will lag share prices, so the current moves in the discount may prove to have been overestimated.

Elsewhere the Asia trusts Aberdeen Standard Asia Focus (AAS) and Schroder Japan Growth have seen their discounts widen.

Baring Emerging Europe (BEE), however, is at much the same levels. A few weeks ago we thought we would be able to remove it from our shortlist, the discount having tightened so much. Just before the markets crashed, the discount was below 5%.

‘the price war between Saudi Arabia and Russia has also created a headwind for the Russian economy’

Unfortunately, Russia’s energy exposure means BEE is sensitive to the fall in global demand that we are seeing as a result of the pandemic; while the price war between Saudi Arabia and Russia has also created a headwind for the Russian economy.

BEE was briefly trading tighter than the emerging markets average. Similarly Aberdeen Smaller Companies Income was briefly trading very close – in discount terms – to Standard Life UK Smaller Companies (SLS).

In both cases we would consider these as signals that the discount opportunity had passed.

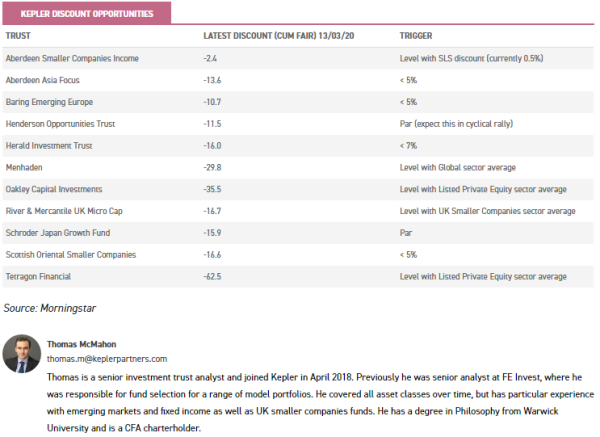

Having missed them this time, we have decided to set an explicit target for each of our ‘discount opportunity’ picks from now on.

This should make it clearer where we think opportunities have changed and should allow us to remove trusts even if the discounts move back out slightly in the short term.

However, in both these cases the moves were so short-lived that we think it makes no sense to remove them; we continue to think they offer significant value at their current levels.

The table at the end of this piece includes details on each of our picks, as well as the trigger or catalyst which we think would indicate that the discount opportunity has played out and that the trust should be removed from our list.

New picks

Herald (HRI) – 16% discount

Herald is a small-cap focussed technology, media and communications trust.

It sits in the global sector, but has a strong bias to the UK, with c. 50% of the portfolio invested here. In the long term it has delivered exceptional NAV total returns, having doubled the value of its portfolio over five years while the Numis Smaller Companies plus AIM ex IT index is up just 29%.

The discount has come into single figures on a number of occasions over the past five years. The tightest it has been was 7% in December 2019.

In the recent sell-off the share price has moved out to c. 16% below NAV, but we think it may come back into mid-single figures when risk appetite returns.

Scottish Oriental Smaller Companies (SST) – 16% discount

Scottish Oriental Smaller Companies is one of the Asian trusts to have been hit hard by the recent sell-off. This is despite it having little exposure to the North Asian countries where the virus has been most prevalent (China, Hong Kong, Taiwan and South Korea).

It looks for high-quality smaller companies and aims to buy at attractive valuations, holding for the long term.

The discount has come out to c. 16%, having been as low as 2% in July 2015. We view it as likely to trade in low single digits again when its style comes back into favour.

The updated discount opportunities shortlist

See more at:

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. In particular, this website is exclusively for non-US Persons. Persons who access this information are required to inform themselves and to comply with any such restrictions.

The information contained in this website is not intended to constitute, and should not be construed as, investment advice. No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not a recommendation, offer or solicitation to buy or sell or take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s Conflict of Interest policy is available on request.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority (FRN 480590), registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.