Jan

2023

The two UK equity income funds we’ve bought

DIY Investor

16 January 2023

UK funds have had a good start to 2023, which has prompted Saltydog to take action.

The UK’s FTSE 100 fared better than most in 2022. It ended the year up 0.9%, when most indices went down, and since then has gained more than 5%.

The FTSE 100 is unusual in that although it is made up of the leading companies on the London Stock Exchange, it is not particularly representative of our domestic economy. It is made up of large international companies that trade all over the world. It also has relatively little in the way of technology stocks, with a greater emphasis on energy, commodities, finance, and consumer staples.

The FTSE 250, which is more closely aligned to what is happening in the UK, didn’t have such a great year, falling by nearly 20%.

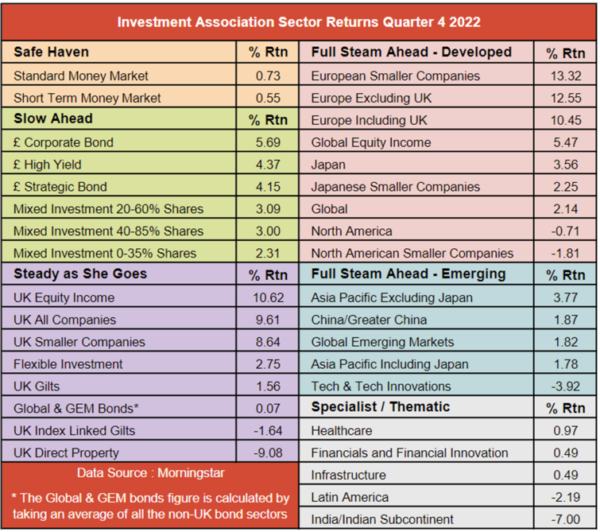

Funds investing in UK equities fall into three of the Investment Association (IA) sectors: UK Equity Income (funds principally targeting income), UK All Companies (funds with a primary objective of achieving capital growth), and UK Smaller Companies (funds investing in the companies which form the bottom 10% by market capitalisation).

All three sectors went down last year. UK Equity Income did the best, but still fell by 2.2%. Then it was UK All Companies, which lost 9.2%, and finally UK Smaller Companies, which dropped by an eye-watering 25.6%.

However, there were signs of improvement towards the end of the year. Having made losses in the first three quarters of the year, the three UK equity sectors went up in October and November. Although they dropped a little in December, they all ended up posting positive returns in the fourth quarter.

UK funds did not do quite as well as the European sectors, which I wrote about last week, but they did enough to deserve a place in our demonstration portfolios.

We are still holding the Baillie Gifford UK Equity Alpha, JPM UK Smaller Companies, and Janus Henderson UK Smaller Companies funds, which we bought in November. They are all showing gains, as is the MI Chelverton UK Equity Income fund that we added at the beginning of December.

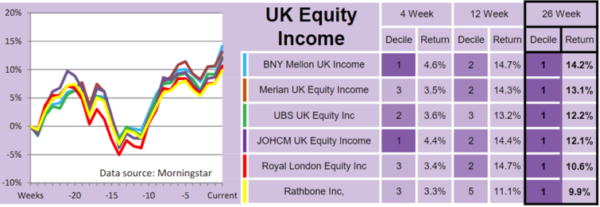

The UK equity sectors have had a good start to 2023 and when we reviewed our numbers last week the UK Equity Income funds were showing an average four-week return of 3.2%. UK All Companies was up 2.8% and UK Smaller Companies was up 2.3%.

We decided to increase our exposure to the UK Equity Income sector.

In our Ocean Liner portfolio we added to the MI Chelverton UK Equity Income fund, but in the Tugboat we added the BNY Mellon UK Income fund, which featured in both our four-week and 26-week shortlists.

Last week, the FTSE 100 hit a four-year high and it is well on its way to setting an all-time record. If that trend continues, I would expect these funds to do well.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Leave a Reply

You must be logged in to post a comment.