Aug

2022

The two Baillie Gifford funds we’ve just bought

DIY Investor

23 August 2022

Saltydog Investor has been putting his huge cash pile to work over the past month, and for the first time in a long time, holds a broad range of funds

It has been a difficult year for investors, but there has been a change in momentum over the past couple of months. Although global economies are still battling against the tide, it could be the case that all of the bad news is already factored into market prices, and that the only way is up.

Inflation is at a 40-year high, central banks continue to raise interest rates, growth forecasts have been cut, the world looks like it is heading into a recession, winter could bring on another Covid outbreak, and there is a war in Ukraine. But that is all old news.

The optimists will tell you that central banks have taken decisive action, which will bring down inflation, at some point the war in Ukraine will end, supply chains are starting to improve, Covid cases are falling and our management of the virus is constantly improving. Things will get better…they always do.

The pessimists will highlight that stocks, especially in the US, are still overpriced even after the recent correction. Inflation will not suddenly drop from double digits back to the government’s 2% target, do not kid yourself. Interest rates will need to remain high, and the global recession will be deeper and longer than most people think.

Those in the bearish camp also point to no realistic plan being put forwards to address the enormous debts built up through quantitative easing, which started after the global financial crisis and continued throughout the Covid pandemic. We cannot just carry on printing more money every time there is a problem.

On top of that, there is the climate change crisis that needs addressing and will need a lot of money throwing at it. This is just a lull before the storm, and there could be a tsunami heading our way.

Unfortunately, we do not know who is right. This could be a dead-cat bounce, or a bear market rally, but it could also be the beginning of a more sustained recovery.

At Saltydog Investor, we believe in following the numbers and you can see this in our demonstration portfolios. If our analysis identifies that certain sectors are going up, we will look for the best-performing funds and invest in them. We will start with a relatively small position and then add to it if it continues to do well. If it falters, then we will sell up and wait for the next opportunity.

We have been increasing our exposure to the markets for the last four weeks. The cash allocation in our Tugboat portfolio has dropped from 94% to 51%. In the Ocean Liner it has gone from 85% to 36%. Last week, we added to some of our recent acquisitions and also invested in a couple of new funds.

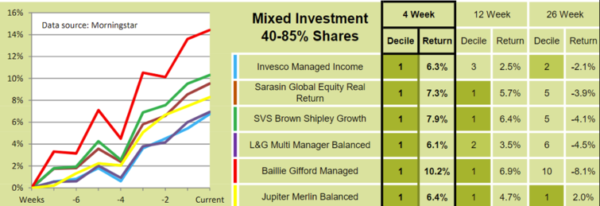

After a prolonged period in the doldrums, all the sectors in our ‘Slow Ahead’ group have made gains in recent weeks. The sectors in this group have had relatively low levels of volatility in the past but can give reasonable returns. When we looked last week, the leading sectors, based on their four-week returns, were Sterling High Yield and Mixed Investment 40-85% Shares. We already hold a few funds from these sectors, and last week we added the Baillie Gifford Managed fund. Although some of the other funds in this sector are less volatile, at the time it had the best four-week return of any fund in its group.

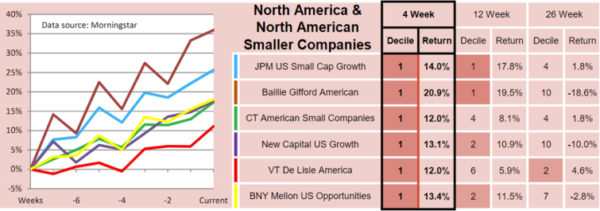

At the more adventurous end of the spectrum, we selected the Baillie Gifford American fund, from the North America sector, which is in our ‘Full Steam Ahead – Developed’ group. Although it was still showing a loss of nearly 19% over the last 26 weeks, it had gone up by more than 20% in the previous four weeks.

We are currently holding funds from the following sectors: Sterling High Yield, Mixed Investment 40-85% Shares, UK All Companies, North American, North American Smaller Companies, Technology and Technology Innovations, Specialist, and Natural Resources. It has been a long time since we last held such a broad range of funds.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Leave a Reply

You must be logged in to post a comment.