May

2022

The Tech Bubble is Bursting

DIY Investor

20 May 2022

The rise of big tech stocks has been more about valuation than profits – writes Steve Russell, Investment Director, Ruffer

A bubble in profitless tech and so called ‘meme’ stocks may be bursting in front of our eyes. But, so far, investors still think there is safety to be found in the last decade’s big winners, whatever their valuation. This risks confusing size and past success with safety.

In the past few months, profitless tech companies seem to have lost their lustre in the face of higher inflation and likely interest rate rises. Many lockdown darlings have collapsed as investors start to take a more realistic view of their future – and the fact that capital may no longer be free. Both Peloton and Zoom have fallen more than 70% since their peaks (source: FactSet).. Statistically, if a stock trebles, but then falls more than 67%, it will be lower than where it started.

Even Netflix has been caught in the sell-off, almost halving in value back to its pre-Covid level before a recent bounce. (Don’t even look at the chart of last year’s star IPO Oatly!)

In response to the unwinding bubble in such stocks, investors are not surprisingly looking for safety, and many think there is safety in the mega-tech stocks, such as Apple and Microsoft. But we’re not so sure. Despite some reassuring recent results, we fear the Nasdaq giants could be the next shoe to drop.

The reason is simple – valuation.

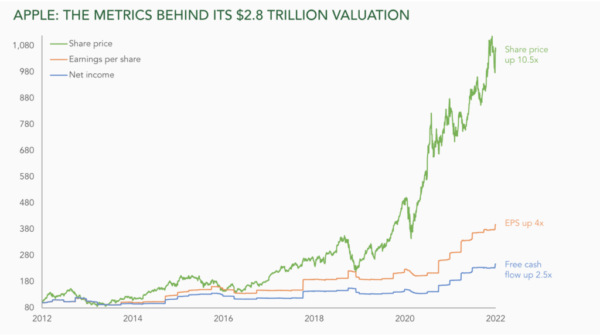

Take Apple, the most valuable company in the world and without doubt one of the most successful businesses of this century. Today it is valued at $2.8tr dollars.

But look at the chart to see what has driven this undoubtedly fantastic business to such a huge value.

Is Apple successful? Yes – free cashflow generated by the company has risen 2.5x over the last decade.

Is it profitable and growing? Definitely – earnings per share (EPS) have risen fourfold over the same period (though share buybacks have boosted this growth well above actual profits or cashflows).

But the vast bulk of the rise in Apple’s value over the past decade has come from revaluation. Can this be relied upon in an environment of higher inflation and rising interest rates? We fear not.

So, is this just another doom-laden attack on the biggest, best and most valuable companies in the world?

Well, yes and no. The mega-tech companies, such as Apple and Microsoft, are real businesses with real revenues, and are immensely successful and profitable. They are most definitely the companies of today and may well be the companies of tomorrow.

But are they safe at today’s elevated valuations of over 30x earnings? Higher inflation and rising interest rates have historically led to lower valuations, especially for highly rated growth stocks. This is happening already in the profitless tech stocks – with dramatic results. Are the big tech stocks really safe havens in this new environment or is this a risk being ignored in plain sight?

Published by our friends at:

Leave a Reply

You must be logged in to post a comment.