Jan

2024

The sector that dominated the Santa rally

DIY Investor

9 January 2024

Nearly all sectors rose in the final month of 2023 – but Saltydog Investor found one sector that stood out from the crowd.

It is not unusual to see a final flourish in the lead up to Christmas and the new year…a Santa rally.

That was certainly the case last year with most of the stock market indices we follow making gains in December. The only exceptions were in the Far East, where the Hang Seng was flat and the Nikkei 225 and Shanghai Composite both went down. This is reflected in our latest sector analysis.

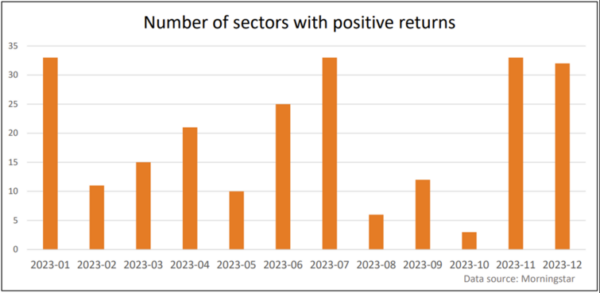

After a disappointing August, September and October, nearly all the Investment Association (IA) sectors that we monitor rose in November and December.

Only two of the 34 sectors failed to make gains in December. UK Direct Property went down by a mere 0.03%, but China/Greater China lost 2.9%.

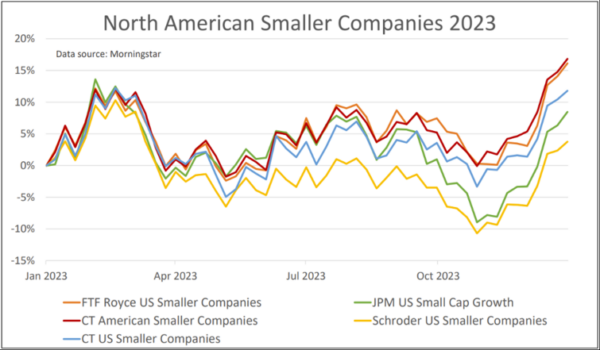

The best-performing sector was North American Smaller Companies, up 10.4%, followed by Latin America which made 8%. The UK Smaller Companies and European Smaller Companies sectors were next with a one-month return of 7.1%.

They are North America, for funds which “invest at least 80% of their assets in North American equities”, and North American Smaller Companies, for funds that “invest at least 80% of their assets in North American equities of companies which form the bottom 20% by market capitalisation”.

Because the US market is so large you also tend to find that many of the funds from the Global sector are predominantly invested in US companies, as are the Technology & Technology Innovation funds.

The best-performing funds in December were actually two funds from the Specialist sector. Because the fund objectives and strategies can vary so widely for the funds in this sector, the IA do not publish the overall sector performance, but at Saltydog we do track the performance of the individual funds.

Saltydog’s top 10 funds in December 2023

| Fund Nname | Investment Association sector | Monthly return |

| Pictet-Biotech | Specialist | 17.7 |

| AXA Framlington Biotech | Specialist | 15.4 |

| Baillie Gifford Global Discovery | Global | 14.4 |

| FTF Royce US Smaller Companies | North American Smaller Companies | 12.8 |

| JPM US Small Cap Growth | North American Smaller Companies | 12.1 |

| Liontrust UK Ethical | UK All Companies | 12.0 |

| CT American Smaller Companies | North American Smaller Companies | 11.2 |

| Schroder US Smaller Companies | North American Smaller Companies | 11.0 |

| CT US Smaller Companies | North American Smaller Companies | 10.5 |

| Janus Henderson UK Smaller Coms | UK Smaller Companies | 10.0 |

Past performance is not a guide to future performance. Data source: Morningstar

Five of the top 10 funds were from the North American Smaller Companies sector.

These funds had a good start to 2023 but then went off the boil and only really came back on form in the last couple of months of the year.

In our demonstration portfolios, we currently hold the UBS US Growth fund from the North America sector, which has performed reasonably well for us, but do not hold any funds from the North American Smaller Companies sector. We are considering adding a North American Smaller Companies fund, but unfortunately they have not had a very good start to this year. The five funds shown above each fell by over 4% last week.

I am always slightly suspicious of the numbers at this time of year. Stock markets are closed for the bank holidays and, when they are open, volumes tend to be very low. It will be interesting to see what happens when business gets back to normal.

For more information about Saltydog Investor, or to take the two-month free trial, go to www.saltydoginvestor.com

Leave a Reply

You must be logged in to post a comment.