May

2021

The Rapid Growth Potential for Emerging Markets Investments

DIY Investor

13 May 2021

We explore the themes and companies exciting The JPMorgan Emerging Markets Investment Trust’s lead portfolio manager Austin Forey.

We explore the themes and companies exciting The JPMorgan Emerging Markets Investment Trust’s lead portfolio manager Austin Forey.

Investing in Companies, not Countries

Is the future in China? Can Brazil bounce back? Industrials or IT? Emerging markets investors will be looking for the winners of the much-vaunted “K-shaped” recovery but, rather than chasing market or sector-specific waterfalls, the team behind the JPMorgan Emerging Markets Investment Trust is firmly sticking to its “companies not countries” strategy of evidence-based stock selection.

“A clear focus on targeting strong fundamentals and long-term growth potential will, in our opinion, continue to drive gains,” says lead portfolio manager, Austin Forey, who has led the trust since 1994. This has proven an enduringly successful strategy: the trust has outperformed its benchmark for the last 10 calendar years, and, was Investment Week’s Emerging Markets Investment Company of the Year in 2020.

The trust’s strategy has paid off during the pandemic period in which we’ve seen the dramatic acceleration of themes where the trust is already invested. These will become ever-more-important to emerging market investors going forwards.

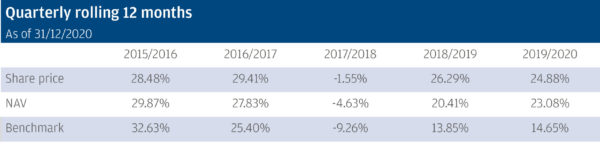

JPMorgan Emerging Markets Investment Trust: Quarterly rolling 12-month performance (%) as at end of December 2020

Source: J.P. Morgan Asset Management/Morningstar. Net asset value performance data has been calculated on a NAV to NAV basis, including ongoing charges and any applicable fees, with any income reinvested, in GBP.NAV is the cum income NAV with debt at fair value, diluted for treasury and/or subscription shares if applicable, with any income reinvested. Share price performance figures are calculated on a mid market basis in GBP with income reinvested on the ex-dividend date. The performance of the company’s portfolio, or NAV performance, is not the same as share price performance and shareholders may not realise returns which are the same as NAV performance.

Opportunities for Healthcare Investments

Thanks to a worldwide pandemic, it’s of no surprise to investors that healthcare offers a myriad of opportunities for future stock picks, from private healthcare to device manufacturers, testing service suppliers to front-edge pharma invention.

Recent portfolio addition KingMed Diagnostics is the leading Chinese medical diagnostic information services provider, with a long growth roadmap and potential to be a global player. Another new holding is Roche Biologics, which supplies contract research and facilities for biotech development, giving generic exposure to the burgeoning biotech sector.

Growth in the Energy Sector

Another prominent theme is the growth, in many parts of the emerging world, of electric vehicles – and the strong performance of companies in the sector, whether producers of vehicles themselves, or linked products such as batteries.

Electric vehicle adoption will accelerate further as supportive government policies become mandatory, and especially when price parity is reached with renewable energy. Likewise, there is much promise in the renewables space, especially solar power, which will of course come at the expense of traditional energy providers.

Forey says this ‘will produce some enormous losers from companies whose business models become obsolete – and enormous winners too.’

The Advance of Digital Business Models

Digitalisation is a key architect of a K-shaped future, and creator of winners and losers across the whole corporate sector. The advance of digital or internet-type business models in emerging markets – led by portfolio holdings such as Tencent – is by no means recent, but the pandemic-induced step-change in consumer preferences and corporate behaviour has transformed this movement from evolution to revolution. ‘It’s really hard to overstate how significant this is,’ says Forey, who compares the game-changing ability of digital companies to disrupt entire industries – ‘even in businesses we thought were unchanging and long-lasting like consumer staples’ – to Amazon’s toppling of the traditional high street business model.

E-commerce Growth in Emerging Markets

Ecommerce is one theme associated with digital business models – and a huge beneficiary of the migration of consumer preference to online services during the pandemic. One name to watch is trust holding, SEA, a leading platform in markets such as Indonesia and Thailand, which integrates ecommerce, online gaming, and digital financial services.

Another is Chinese internet tech company, Netease Games, which Forey describes as ‘fantastically cash-generative’. Neatease is a leading player in esports – an industry whose enormous scale in Asia, and potential for growth elsewhere, some investors have been slow to understand.

Emerging Changes in the Financial Services Industry

Finance is another area in the early throes of digital disruption. Forey explains: ‘We’re seeing the emergence of financial services businesses operating as software companies – whether that’s in clearing, or digital payments.

This is of great interest to us as investors because we think there could be a big profit shift within certain parts of the financial services industry as business models change. B3 – the Brazilian Stock Exchange – is one such example.

To those wondering how a stock exchange has a similar model to an ecommerce company, Forey explains that stock markets are ‘really electronic marketplaces – not so different to Amazon except that they enjoy a degree of regulatory privilege and have naturally monopolistic characteristics.’

Shifting from Assets to Ideas

All these companies – whether in healthcare, financial services or gaming – illustrate the fundamental shift in emerging markets from assets to ideas. They are capital-light, they don’t depend on large amounts of fixed assets, and they are built on intangible value creation – whether that’s software, ecommerce or pure-play consumer branding like trust holding Bud Asia.

They are the antithesis of the basic industries historically associated with emerging markets such as commodity extraction and fixed line telecoms. Emerging market growth opportunities are becoming more like those in the developed world: it is not the market that is attractive to investors but companies with the right type of business model, with the potential to gain market share.

These companies tend to have higher returns on capital and are very cash generative. Forey is excited about the prospect: ‘The team are seeing as many opportunities as they have at any point in the last 10 years. It’s a really interesting time to be a stock-picker working in the emerging world.’

More information on JP Morgan Emerging Market Investment Trust here >

To buy this trust login to your EQi account

Select JP Morgan Emerging Markets (JMG) – GB00BMXWN182

Important information

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not reliable indicators of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met.

J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. Investment is subject to documentation. The Annual Reports and Financial Statements, AIFMD art. 23 Investor Disclosure Document and PRIIPs Key Information Document can be obtained free of charge from JPMorgan Funds Limited or www.jpmam.co.uk/investmenttrust.

This communication is issued by JPMorgan Asset Management (UK) Limited, which is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England No: 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP. 0903c02a82b0b116

Commentary » investment trust commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » Uncategorized

Leave a Reply

You must be logged in to post a comment.