May

2021

The nuances of value investing

DIY Investor

16 May 2021

Disclosure – Non-Independent Marketing Communication. This is a non-independent marketing communication commissioned by Momentum Multi-Asset Value Trust. The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

With value stocks continuing their rise, distinguishing between different ‘value’ fund offerings can be challenging. Here, we look at a unique multi-asset value strategy…

With value stocks continuing their rise, distinguishing between different ‘value’ fund offerings can be challenging. Here, we look at a unique multi-asset value strategy…

It is unusual for global investment markets to move almost completely as one, with such moments usually coming at times of crisis. But in the last few months, a singular trend has driven markets, fuelled by good news and the rising tide of global stimulus.

The rotation from growth into value was almost unprecedented, after a decade in which growth stocks had dominated the markets, marked most notably by the near exponential growth of the FAANGs. Indeed, at the point of the rotation the valuation gap between growth stocks and value stocks was at a record high, leaving some to suggest that value investing might be over for good.

Of course, rumours of the death of value investing were greatly exaggerated. In the six months to 12 April 2021, the MSCI ACWI World Value index returned 17.71%, against a 7.37% return for the MSCI ACWI World Growth index.

Tapping into the value revival

Unfortunately, many investors were caught out by this rotation. As growth continued to flourish through the 2010s, many funds opted or were forced to change their investment approaches to a more growth-focused style. As a result, portfolios were often wholly or largely growth-oriented as the value rally began in November.

While investing on a backward-looking basis alone is rarely a good plan, several financial institutions, including JPMorgan and Barclays, have said that they believe the rally has further to run. One key driver is the gradual re-opening of major economies such as the UK and US, prompted by successful vaccination programmes. With governments indicating that they are likely to continue providing economic stimulus through extended welfare programmes for some time to come, it seems likely that a pent up spending spree is on the horizon.

Naturally, investors are now looking to add more value exposure to their portfolios. However, with so many funds on offer, it is worth considering what this actually means.

For some, a value allocation focuses almost exclusively on so-called “distressed” stocks, the kinds of companies that have experienced such challenging operational environments in recent years that some investors believe they cannot recover. An example here would be cinema chains, or even GameStop, prior to its Reddit-fuelled resurgence.

For others though, value is more nuanced. For the managers of Momentum Multi-Asset Value Trust (MAVT) this includes applying a value lens to a broad range of asset classes, and on a global basis too.

Refined value

MAVT has long been managed with a distinctive “refined value” approach. In practice, this means applying the same value lens the managers use for their directly-held UK stocks to a broad variety of asset classes located globally, accessed largely through third-party funds.

This combination is unique, offering investors a ‘core’ value allocation, alongside a differentiated approach to value in the other half of the portfolio. This combination also helps prevent the fund from being too defined by its value style, and the portfolio as a whole does not show a technical bias towards value, even as the managers use this as their investment lens.

The team is finding opportunities on both sides of their portfolio. On the UK equity side, the team agrees with the institutions that the value rally has a while to run yet and have maintained their already-overweight exposure in recent months on the basis of this conviction.

This is being driven by both bottom-up and top-down observations, with the team identifying the UK market as a whole as undervalued and reporting finding numerous attractive stock-specific ideas. UK leadership relative to global peers on vaccine deployment should enable the economy to recover quicker, and a pathway to economic reopening gives the team increased confidence in consumer-facing holdings which had been punished in 2020.

On the other hand, the team are finding a number of contrarian opportunities for the other half of the portfolio. As investors have become more accustomed to the value in renewable assets, these have included more esoteric and specialised ideas in this theme. An example is Cordiant Digital Infrastructure, which invests in digital economy infrastructure like fibre optics cables, following its IPO in February.

A proven formula

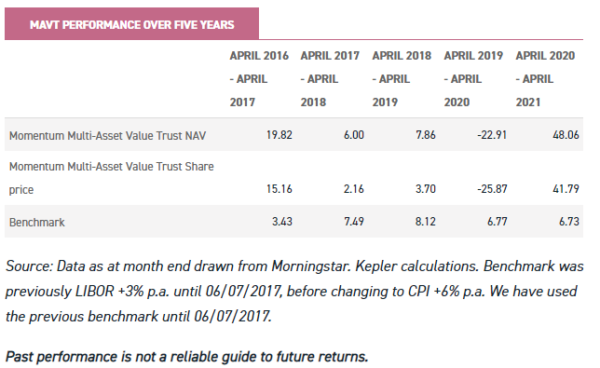

The distinct combination of UK-listed value equities and alternative assets at attractive valuations offers investors a truly distinctive ‘value’ allocation. And – although past performance is not a reliable guide to the future – the trust has a strong track record; over five years it has outperformed its benchmark while increasing its dividend on an annual basis.

Click here to read the latest research on Momentum Multi-Asset Value Trust >

Click to visit:

Disclaimer

This report has been issued by Kepler Partners LLP. The analyst who has prepared this report is aware that Kepler Partners LLP has a relationship with the company covered in this report and/or a conflict of interest which may impair the objectivity of the research.

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that if you are a private investor independent financial advice should be taken before making any investment or financial decision.

Kepler Partners is not authorised to make recommendations to retail clients. This report has been issued by Kepler Partners LLP, is based on factual information only, is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. In particular, this website is exclusively for non-US Persons. Persons who access this information are required to inform themselves and to comply with any such restrictions.

The information contained in this website is not intended to constitute, and should not be construed as, investment advice. No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not a recommendation, offer or solicitation to buy or sell or take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s Conflict of Interest policy is available on request.

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.