Jul

2023

The top 10 fund performers in the second quarter of 2023

DIY Investor

10 July 2023

Saltydog Investor runs through the best sector performers over the three-month period to the end of June, and highlights individual fund winners

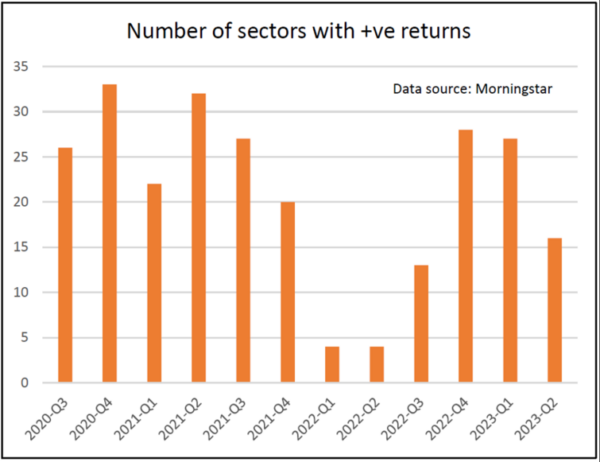

After a disappointing first three quarters in 2022, there was a significant improvement in overall sector performance in the final quarter of last year with 28 of the 35 sectors that we monitor making gains. This year started almost as well with 27 sectors going up in the first quarter.

However, in the latest quarter the total number of sectors showing positive returns has dropped to 16.

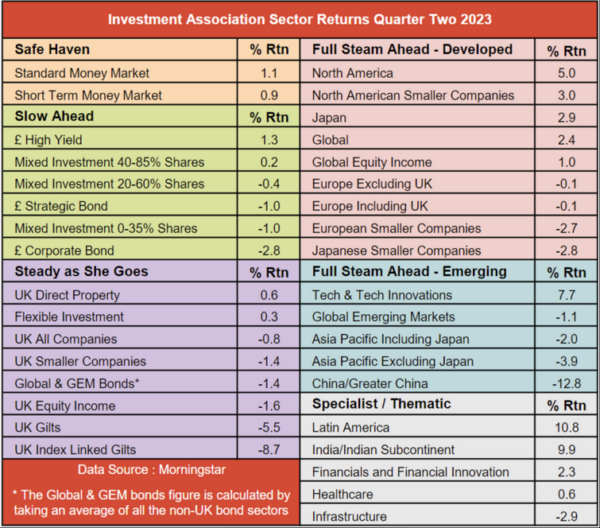

In the latest quarter (1 April to 30 June), the best-performing sector has been Latin America, up 10.8%, followed by India/Indian Subcontinent, which has made 9.9%. The Technology and Technology sector took third place, up by 7.7%.

The best-performing sector in the first quarter of this year was Technology and Technology Innovations, with a three-month return of 15.8%, followed by Europe excluding UK, which had made 8.1%, and then Europe including UK, which was up 7.5%. The worst-performing sector was India/Indian Subcontinent, which had gone down by 5.8%.

There are 10 sectors that went up in both the first and second quarters of this year. Seven sectors have gone up in each of the last three quarters, but only three have gone up in all of the last four quarters (the two money market sectors and Japan).

The European sectors, which did well in the first quarter, made losses in the second quarter. The worst-performing sector was China/Greater China with a three-month loss of 12.8%.

The top 10 funds that we monitor, based on their cumulative three-month returns, include three from the Technology & Technology Innovations sector, five from the North American sector, and two from the India/Indian Subcontinent sector.

The best-performing fund, Liontrust Global Technology, has gone up by 16.7% in the last three months.

Saltydog’s top 10 funds in Q2 2023

| Fund name | Investment Association sector | Monthly return April | Monthly return May | Monthly return June | Three-month return |

| Liontrust Global Technology | Technology & Technology Innovation | -1.6 | 16.6 | 1.8 | 16.7 |

| L&G Global Technology Index | Technology & Technology Innovation | -0.2 | 13.0 | 1.7 | 14.8 |

| Baillie Gifford American | North America | -3.7 | 13.7 | 4.7 | 14.6 |

| UBS US Growth | North America | 1.0 | 9.4 | 3.4 | 14.2 |

| T. Rowe Price Global Tech Equity | Technology & Technology Innovation | -3.4 | 16.9 | 0.9 | 14.0 |

| Jupiter India | India/Indian Subcontinent | 4.9 | 2.8 | 4.9 | 13.1 |

| New Capital US Growth | North America | -0.8 | 5.3 | 7.8 | 12.5 |

| T. Rowe Price US Large Cap Growth Equity | North America | 1.7 | 7.5 | 2.7 | 12.3 |

| Stewart Inv Indian Sbctnt Sustnby | India/Indian Subcontinent | 1.8 | 6.1 | 3.4 | 11.6 |

| FTF Franklin US Opportunities | North America | 1.3 | 6.7 | 3.0 | 11.3 |

Data source: Morningstar. Past performance is not a guide to future performance.

We currently hold three of these funds in our demonstration portfolios: Liontrust Global Technology, L&G Global Technology Index, and UBS US Growth.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com

Leave a Reply

You must be logged in to post a comment.