Jul

2022

The new sector we have invested in

DIY Investor

7 July 2022

A bright spot in global stock markets has persuaded Saltydog to deploy some of its giant cash pile

Over the weekend, I read somewhere that stocks had had their worst first half of the year for 50 years. I am not exactly sure which stock market they were talking about, and I have not double checked the numbers, but I am not disputing it.

It has certainly been a challenging time for investors.

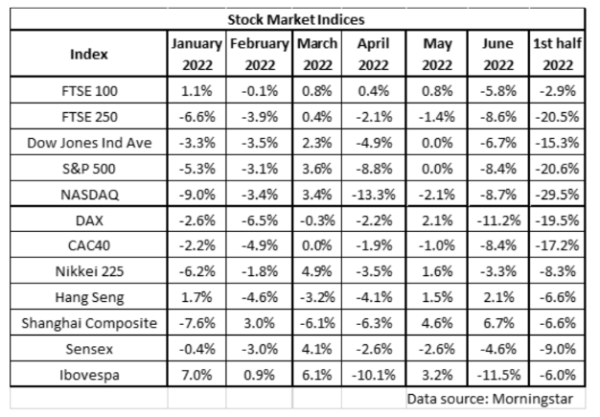

At Saltydog Investor we track a selection of indices covering the largest stock markets in the world, and at the end of June they were all showing losses over the first six months of the year.

The Nasdaq, which includes the largest companies in the world, is down by almost 30%.

The best performing index over the last couple of months has been the Shanghai Composite. It went up by 4.6% in May and 6.7% in June.

As you would expect, the Investment Association sector performance for last month also looks pretty dire.

If you wanted to invest in something which many people might think would be a relatively safe bet, like UK Index Linked Gilts, then you would have lost over 10% in one month

When you dig a bit deeper, then you find that over 90% of the funds that we analyse have gone down this year. Almost 20% have lost 20% of their value.

At Saltydog we believe in investing in things when they are going up and steering clear when they are going down. Therefore, it should not be a surprise that our most cautious demonstration portfolio, the Tugboat, is currently over 95% in cash. Even our more adventurous portfolio, the Ocean Liner, only has 20% exposure to the equity markets.

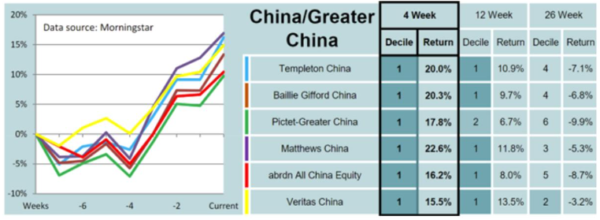

Last month, the best performing sector, by a country mile, was China and Greater China. We have also seen this coming through in our weekly analysis.

A couple of weeks ago our Ocean Liner portfolio invested in the Templeton China W(acc) fund and last week the Tugboat bought the Baillie Gifford China B Acc funds. At the time they were the top two funds based on their decile rankings over the last four weeks.

I do not claim to know exactly why the Chinese funds are doing so well at the moment, apart from the fact that they have struggled recently due to Covid restrictions, which are now being lifted, and they may not be suffering as much as other countries from the economic fallout of the war in Ukraine.

We have only made modest investments and will be watching them closely over the coming weeks.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com

Leave a Reply

You must be logged in to post a comment.