Mar

2023

Mind the gap: the most and least consistent fund sectors

DIY Investor

15 March 2023

Saltydog Investor looks back at how fund sectors fared in 2022, highlighting the difference between the best and worst funds.

In most of the analysis that we provide for our members we focus on the best performing funds from the best performing sectors. However, from time to time it is interesting to have a look at how some of the worst performing funds have fared.

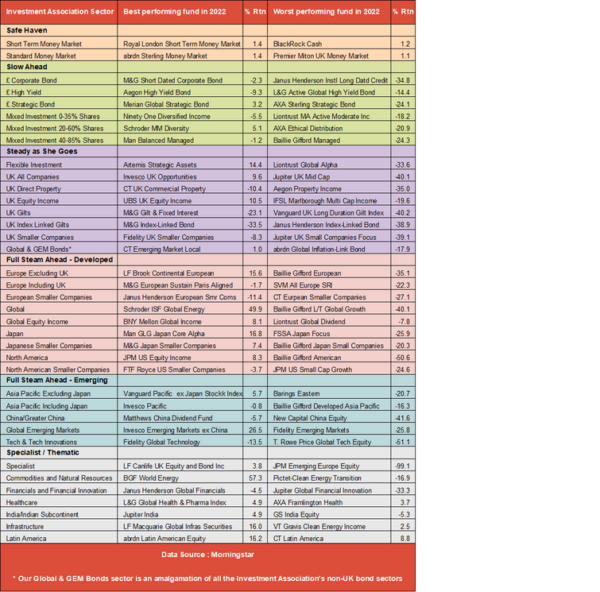

Here is a table showing the best and worst funds that we followed during 2022 for each of the Investment Association sectors. We have shown them in our Saltydog Groups where we combine the sectors based on their historic volatility. The sectors in the Safe Haven Group are the least volatile, then its Slow Ahead, followed by Steady as She Goes, and finally the two Full Steam Ahead groups and the Specialist / Thematic sectors.

In the Safe Haven group there is not much difference between the best and worst funds in each sector, however that changes as soon as you get into the Slow Ahead group. In the £ High Yield Bond sector the difference between the best and worst fund was relatively small -9.3% to -14.4%. However, in the £ Corporate Bond Sector there was a much greater variance. The best fund, M&G Short Dated Corporate Bond, went down by 2.3% while the worst fund Janus Henderson Institutional Long Dated Credit lost 34.8%.

The biggest difference in the Steady as She Goes group was in the UK All Companies sector, where the Invesco UK Opportunities fund went up by 9.6%, but the Jupiter UK Mid Cap fund fell by 40.1%.

In the Full Steam Ahead groups there was an even more extreme case. In the Global sector the Schroder ISF Global Energy fund grew by 49.9% while the Baillie Gifford Long Term Global Growth fund lost 40.1%.

It is not a surprise that the largest overall variance was in the Specialist sector, because it contains funds that have very different strategies and can invest in different types of assets. The best-performing fund in this sector was LF Canlife UK Equity and Bond Income, up 3.8%, and the worst was JPM Emerging Europe Equity, which went down by 99.1% (although it is hard to get an accurate valuation because of the war in Ukraine).

Although we maintain that when building a portfolio it is important to select the right sectors before worrying too much about which funds to go into, that does not mean that fund selection is not important. Our table highlights just how much variance there can be within a sector.

Having decided which sectors to invest in, it is relatively easy to see which funds have been performing well. We provide our members with shortlists every week. However, once invested it is also important to monitor your holdings. Just because a fund did particularly well one year does not necessarily mean that it will do well the next.

As a case in point, the Baillie Gifford American fund, from the North America sector, was the best- performing fund in 2020, up more than 120%, but went down in 2021 and last year was the worst- performing fund in its sector.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com

Leave a Reply

You must be logged in to post a comment.