Jan

2023

The long game – historical market returns and 2023 expectations

DIY Investor

5 January 2023

Today’s pain, tomorrow’s gain

Today’s pain, tomorrow’s gain

It’s the humbling time of the year to acknowledge the limits of our ability to predict markets and amend our financial plans for 2023.

2022 reminded us that trees don’t grow to the sky; but for Bonds or Equities, today’s losses mean higher returns tomorrow.

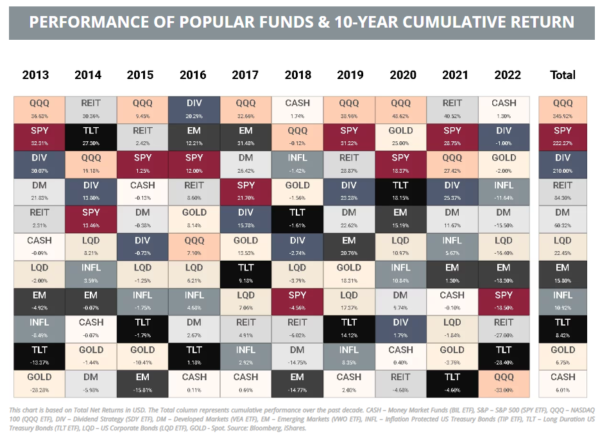

The past decade also became representative of reasonable long-term investing expectations; since 2013, World Equities have gained over 185% and returned 6.4% annually.

What about undervalued sectors?

International Stocks and Small Caps look attractive, but while this is great for learning, remember the game’s rules and try to remain forecast-free.

(Note: The below numbers are as of Dec. 23rd. A final update will be made on the Dec. 30th COB)

What are the best performers of the last decade?

2022 Stock market highlights

- With Inflation of 8-11% across Europe and the US, the 2022 returns need to be taken with a pinch of salt.

- The 60/40 Portfolio had one of the worst years at c. -23% (in Real USD). Its 2008 real return was -18%.

- Gold price was stable, despite high inflation.Higher real interest rates didn’t help. Yes, Investing is hard.

- Yet again, a stronger USD mitigated Europeans’ losses. EUR is down 7% YTD, while GBP lost 12%.

- World Equity ETFs lostc. 18% in USD. But for Europeans the loss is 12%, while for UK investors it’s only 9%.

- From Aug’20 to Oct’22, Long-term Treasuries experienced a record drawdown of -40%, triggered by the most aggressive FED hikes in history.

- Dividend Investors had a great year. Now, more than ever, it may be even more challenging to convince them that this strategy is not superior but merely a reflection of risk factors.

- Value Stocks, certain Trend-Following ETFs and Alternatives outperformed.

What are the worst performers of 2022?

Select volatile markets

- S&P 500’s drop of 19% hides steep declines beneath the surface led by Tesla -70% or Amazon -50%. TikTok or OpenAI challenged businesses like Meta -65%, or Google -38%.

- As the tide went out, speculative market participants were seen swimming naked. The darling of the bull run – ARKK ETF – dropped 69%. Coinbase lost 85% and GameStop 50%.

- Bitcoin trades lower than a couple of years ago after losing 65% this year. Bitcoin’s Market Cap is now 5% of Gold’s.

- Crypto Industry’s Market Cap dropped by $2 trillion from its peak, including FTX and Terra, for which $30 billion were wipeout in a record 24 hours.

- But Blockchain is here to stay. One hundred fourteen nations currently consider some form of Central Bank Digital Currency.

Why You Need To Look Beyond Historical Risk

It’s helpful to look at the risk-adjusted returns.

But it’s even more important to tailor portfolio risks to your circumstances:

- Hedge Your Unique Risks – Standard deviation has a lot of limits, but at least provides ballpark annual declines. Most importantly, choose assets depending on your situation and exposure to your unique life risks (e.g. cyclical job, being near retirement).

- Protect Your Downside – Treasuries exhibited historical volatility, but Standard Deviation doesn’t tell the whole story. Bonds hedged nicely during both GFC and COVID-19 downturns.

- Don’t look (too much) in the rearview mirror – US Stocks remained the best historical risk-adjusted asset class. Most back-testing tools frequently overweight them in portfolios. But remember, history doesn’t crawl. It leaps.

- Think long-term – For example, don’t exclude European and Japanese Stocks, which have the highest dividend premium of 2% vs. the US in 20 years. It may contribute to outperformance, especially if the USD weakens. Look how International Stocks caught up in the past.

Are equities cheap?

In 1991, John Bogle presented a model to estimate long-run stock returns in the United States in the Journal of Portfolio Management.

Bogle noted that you could, reasonably, predict stock market returns with three inputs:

- The initial dividend yield on the stock market

- The predicted change in Price/Earnings (P/E) ratio

- An estimate of earnings growth

Let’s look at why today’s lower levels mean that, while Equities still not cheap, the upside is better, compared to last year.

The only weaker outlook, relates to earnings.

1. Dividend Yield

1. Dividend Yield

In Q4’21, the Initial S&P 500 Dividend Yield stood at some historical lows – around 1.2%.

In Q4’22, this yield is higher, at 1.7%. But S&P 500 dividends are still well below historical levels (median 2.35%). So based on dividend yield alone, the expected return in the long run are just marginally higher.

Change In P/E Ratio

Change In P/E Ratio

The P/E ratio is the most significant driver of stock returns. In Q4’21, the S&P 500 traded at a forward ratio of 23x.

In Q3’22, this ratio stands at 15x, just below the historical average (16.8x). It’s more reasonable to assume positive change in the long run. But, in the short to medium term, P/E ratios have room to fall even further during recessions.

3. Earnings Growth

3. Earnings Growth

By historical standards, 2021 Earnings Growth of 70% was spectacular. Think of Earnings Growth as two aspects (i) revenue growth and (ii) higher margins. Last year, margin growth explained 75% of the earnings growth.

In 2022, short to medium-term revenue growth is threatened on both counts. Pressure on Revenue Growth due to a global recession and margins due to e.g. higher labour costs.

Read the whole article here, and set up an online coaching session >

Thank you for reading. I wish you a Happy New Year and a great start to 2023,

Raph

Commentary » Equities Commentary » Equities Latest » Fixed income Commentary » Isas commentary » Latest

Leave a Reply

You must be logged in to post a comment.