Dec

2022

The key to happiness in retirement: Over 55s value experiences over material possessions

DIY Investor

5 December 2022

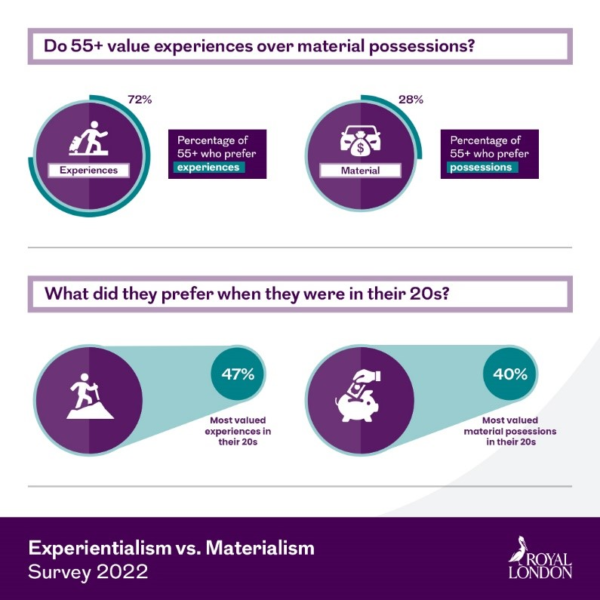

- New research from Royal London reveals that 72% of those aged 55+ are an experience-focused generation favouring holidays, days out and hobbies over material possessions such as houses, cars and expensive art

- More than half (52%) cited spending time with family as the most important aim for retirement

- The majority of over 55s (71%) said they were yet to achieve their life goals with money being the biggest barrier (40%), followed by family commitments (14%).

With the uncertainty following the pandemic, many retirees and pre-retirees are now facing a change of plans for the future, with three in ten (30%) saying they are changing their retirement plans due to the current cost of living crisis.

However, new research from Royal London, the UK’s largest mutual life, pensions and investment company, found that along with that uncertainty, the 55+ generation are focused on making the most of their retirement, with seven in ten (72%) people valuing experiences such as travel, new hobbies and days out over material possessions.

What are people looking for in retirement?

Research shows that the over 55+ age group have a clear focus on experientialism in retirement with 72% choosing this over purchasing material possessions.

As a nation, we become less materialistic the older we get, with 40% of respondents stating they most valued material possessions in their 20s, versus 15% feeling the same at 55+. As indicated in the infographic below, males were revealed to be more materialistic than women, 17% versus 13% respectively.

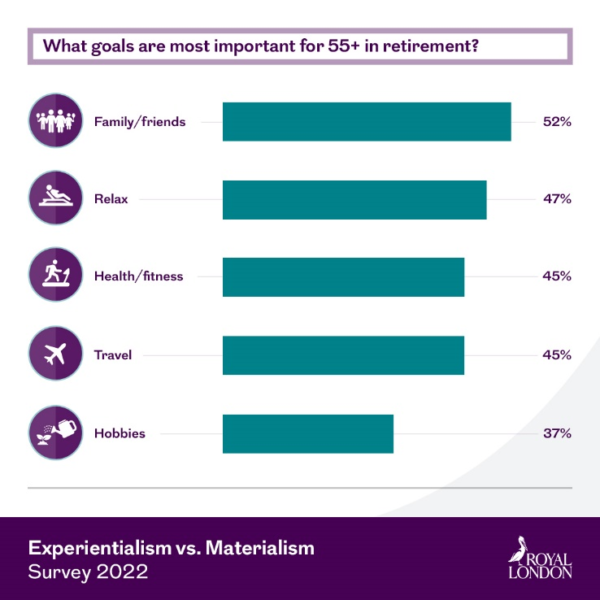

When asked about life goals, the next generation of retirees is focused on creating lasting memories with family and living a healthy lifestyle. Spending time with family was the most important aim in retirement (52%), closely followed by relaxing (47%) and maintaining health and fitness (45%). Women place a higher importance on spending time with family than men (59% vs. 43%) while men placed an emphasis on relaxing as their highest priority.

The biggest retirement worries and tips to overcome them

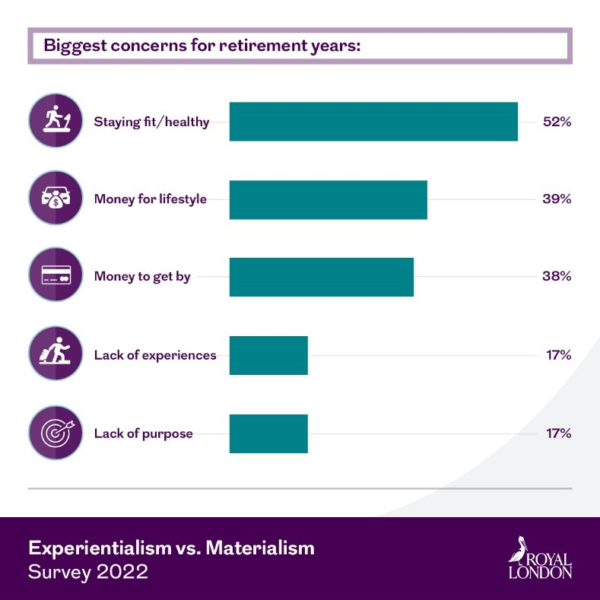

Staying healthy is the biggest concern as people head into retirement. The research revealed that more than half (52%) of respondents were concerned with their health, followed by being able to afford to live the lifestyle they want (39%) and having enough money to get by (38%). Another significant concern is loneliness, with one in ten (12%) worried about staying in touch with friends and family.

Achieving those goals

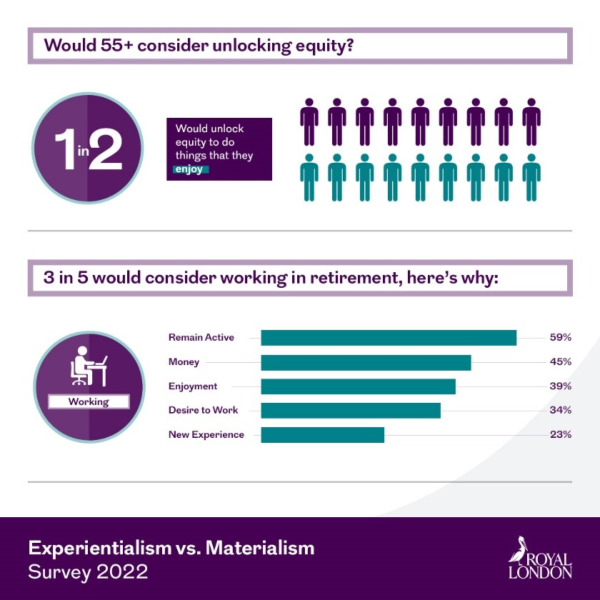

While joining new clubs, volunteering and staying active are all positive steps to addressing wellness concerns in retirement, there are options to overcoming financial barriers to achieve life goals. One option would be to release equity in your home with the research showing that one in five (22%) would consider doing this to fund new experiences and, in turn, achieve their life goals.

Equity release is a flexible, tax-free way to unlock equity, with no requirement to make regular monthly payments (although you can make voluntary payments if you wish). This may enable people to enhance their experiences in their retirement years, whether that be travel to new places, fund new hobbies or treat family members. Royal London offers both a detailed guide and an easy-to-use equity release calculator where over 55s can find out more about eligibility and how much they can release from their homes.

Taking on part-time work to fund exciting new experiences is also an option with around six in ten (58%) saying they would consider working in retirement and two in five (40%) saying they would work if it enabled them to do more things they enjoyed.

Commenting on the findings, Gary Beyer, Protection Product Lead from Royal London said:

“It is clear to see that those aged 55 and over value experiences more than anything else, including material possessions. Being able to lead an active, healthy lifestyle, try new things and travel to new places, combined with spending more time with family is the key to retirement happiness.

“After a tough few years following the pandemic and now with the added pressures of the cost-of-living crisis, being able to achieve these life goals might seem more difficult, but there are options out there for people who want to make their dreams a reality.”

For more information on the study: https://www.royallondon.com/articles-guides/equity-release/over-55s-materialism-or-experientialism

For more information on how Royal London can help with equity release: https://www.royallondon.com/retirement-planning/using-property/equity-release/

Leave a Reply

You must be logged in to post a comment.