May

2019

‘The industry’ gains as savers lose out: Thoughts of Saltydog Investor

DIY Investor

14 May 2019

A government that robs Peter to pay Paul, can always rely on the support of Paul.

McDonnell for the Labour party and Hammond for the Conservative party seem to be working on the above principle. It is just that the people they are each cultivating, work at the opposite ends of the wealth spectrum.

I am a “dyed in the wool” capitalist and firmly believe that money has to be earned before it can be spent. How much, and where it is spent, is however the stumbling block. Surely it is not too much to ask that it should be used to enrich the future lives and security of as many of the population as possible.

‘stop politicians, civil servants and CEOs of major banks and industries marking and rewarding their own homework’

Grandiose schemes have become the norm, rather than the exception, and that soaks up the revenue available for the essentials, such as education, health and security.

There must be a way to introduce common-sense and stop politicians, civil servants and CEOs of major banks and industries marking and rewarding their own homework.

Rant over for the moment!

We have just started another ISA year, and no doubt for those people with sufficient free cash to invest, this is a wonderful tax reducing investment for the future.

However, it is a sobering thought that much of this money will be languishing unloved in cash ISAs, Junior ISAs, and “dog funds”. The combined amount is now above an astonishing £500 billion.

Yes, the investor has put himself into a good position to avoid paying tax in the future, but there has to be a gain in order to raise a tax claim.

Therefore the £500 billion mentioned above is effectively in a money box, or under the mattress. It is a saving not an investment.

The people making the gain are the people “looking after” this money, not the people who it belongs to, but trading platforms, fund managers and the financial advisors.

Of course there are many investors and financial advisors who do watch carefully the movements of the stock-markets, and manipulate this investment to maximise their clients’ return. I just wonder are they the exception, or are they the rule? Hopefully it is the latter.

I have a grandson, so Junior ISAs have held my attention over a number of years. Like me, I am sure that some of you may have started off a savings account to give your children or grandchildren a financial start for the future.

I do however wonder how often people review the portfolio once the investment has been made. I have to hold my own hands up to say that in my case it is once a year when the ISA season comes around.

Now this is totally contrary to my belief of being active and trading funds as frequently as the sector performance demands.

‘the initial selection of sector and fund must be researched more thoroughly with an eye on the potential longer term performance’

This Junior ISA portfolio however is a relatively small amount of money, and has been left negligently as a passive investment. The excuse is, a youngster has time on his side and can ride out the troughs in market waves.

On consideration, this is not good enough, and if a passive approach is going to be used, then the initial selection of sector and fund must be researched more thoroughly with an eye on the potential longer term performance.

Thinking about the passive approach meant that we had to decide what would be an acceptable performance from a fund. We finally ran with a 5% gain to be achieved every six months, this adds up to an annual return of just over 10%.

So the question was how many funds, if any, could consistently produce this result. An algorithm was written by David and Richard to examine the last three years’ fund numbers, looking at a continuous repeating six monthly cycle.

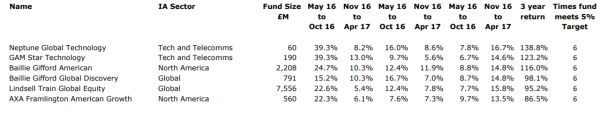

The amazing result is shown in the table below – there are six funds that meet the criteria for every six month period, with another thirty-eight that only missed it once.

It also demonstrates very clearly the sectors that allowed this to happen. They were Technology, North America and Global, which is not that surprising as they all overlap each other to some extent in their area of investment.

Here are the top six funds, to download the rest of the table click here.

The big question is just how useful is this information for a passive investor?

Well, the information is produced from hindsight, so it does not tell you what is going to happen in the future, but it has revealed which fund managers out-perform their peers when individual sectors are on the rise.

So you could now make a list of the preferred managers for future use. If this table were to be produced on a quarterly basis it would reflect changing market conditions and the knock-on effect for the sectors.

It is my belief that this is an aid and not a solution to your fund selection. You will still have to make a judgement looking forward as to what is likely to occur.

For instance, I for one will back the Technology sector going into the future. Money is pouring into research companies all over the world, which in turn leads to more and more stock-market businesses.

This is the new age in which we live. Sectors such as Global, North America and the UK are less certain, but this table and the other Saltydog numbers should help in making a twelve month passive investment decision.

Whether manufacturing will ever return in volume to the West as Emerging countries gain more and more prominence is perhaps a lost hope. I recently acquired a new television, it had a label which said “Built in Antenna”. I don’t even know where that is!

Best wishes and good investing,

Douglas.

Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.