Mar

2022

The high-risk funds bucking the downward trend

DIY Investor

11 March 2022

Funds investing in this part of the world have been one of the few places to make money in recent weeks – thoughts of Saltydog Investor.

It has been a difficult couple of months for investors. At the beginning of the year, there was still concern surrounding the Omicron variant of Covid-19, and fears were mounting over inflation and rising interest rates. Now, the headlines have been taken over by the terrible war in Ukraine.

Nearly all the major stock markets around the world went down in January. February was not any better, and March has got off to a shaky start.

| Stock Market Indices 2022 | ||||

| Index | Country | January | February | 1 to 5 March |

| FTSE 100 | UK | 1.1% | -0.1% | -6.3% |

| FTSE 250 | UK | -6.6% | -3.9% | -8.0% |

| Dow Jones Ind Ave | US | -3.3% | -3.5% | -0.8% |

| S&P 500 | US | -5.3% | -3.1% | -1.0% |

| NASDAQ | US | -9.0% | -3.4% | -3.2% |

| DAX | Germany | -2.6% | -6.5% | -9.4% |

| CAC40 | France | -2.2% | -4.9% | -9.0% |

| Nikkei 225 | Japan | -6.2% | -1.8% | -2.0% |

| Hang Seng | Hong Kong | 1.7% | -4.6% | -3.6% |

| Shanghai Composite | China | -7.6% | 3.0% | -0.4% |

| Sensex | India | -0.4% | -3.0% | -3.4% |

| Ibovespa | Brazil | 7.0% | 0.9% | 1.2% |

| RTSI | Russia | -10.1% | -34.7% | 0.0% |

Data source: Morningstar.

All these indices are now lower than they were at the end of last year, except for the Brazilian Ibovespa, which continues to buck the trend. So far this year it has gone up by more than 9%.

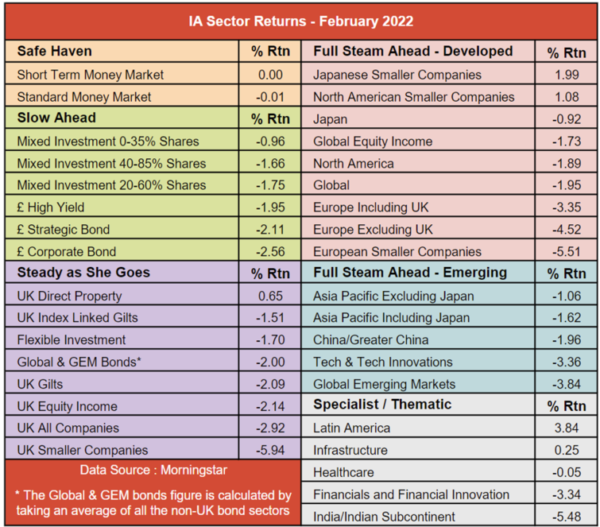

Our analysis of the Investment Association (IA) sectors also shows most sectors making losses in February.

However, there were a few that managed to make gains. UK Direct Property went up by 0.65%, North American Smaller Companies made 1.08% and Japanese Smaller Companies rose by 1.99%.

The best-performing sector was Latin America, gaining 3.84%. In our weekly analysis, we group together the funds from this sector with the funds from the Specialist sector and the other thematic sectors such as Infrastructure and Healthcare.

There are five funds we include in our ‘Latin America SubZone’, and this is how they were doing when we looked last week.

| Fund | SubZone (If Applicable) |

4 Week | 12 Week | 26 Week | ||||

| Decile | Return | Decile | Return | Decile | Return | |||

| Liontrust Latin America | Latin America | 1 | 5.6% | 1 | 15.4% | 6 | -6.7% | |

| ASI Latin American Equity | Latin America | 2 | 4.9% | 1 | 14.6% | 5 | -2.1% | |

| Threadneedle Latin America | Latin America | 2 | 3.9% | 2 | 8.8% | 9 | -16.5% | |

| Invesco Latin American | Latin America | 3 | 3.5% | 2 | 10.2% | 3 | 0.3% | |

| Stewart Investors Latin America | Latin America | 5 | -0.3% | 2 | 6.0% | 4 | -0.8% | |

Data source: Morningstar. Past performance is not a guide to future performance.

With most markets trending down, both of our demonstration portfolios (Ocean Linger and Tugboat) are mainly in cash: 90% and 70% respectively. We have not made any investments for the last few weeks.

One of the funds that we do hold is from the Latin America sector. At the beginning of February, we invested in the Stewart Investors Latin America fund. It is a shame that we did not pick one of the other funds, but at the time it was the front runner with a four-week return of 5.9%. It is easy to be wise in hindsight.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Brokers Commentary » Brokers Latest » Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.