Dec

2018

The Great British Trade Off: Investor Humbug updates on a difficult autumn for everyone

DIY Investor

6 December 2018

The Great British Trade Off: Y2Q3 Humbug updates on a difficult autumn for everyone

This autumn has been difficult for me along with just about every other investor in the UK I would say.

No two ways about it, the world order is changing; for most of my lifetime the US has been the dominant power both economically and militarily, but as this century has got going it’s obvious that the power is leeching away from America to China.

According to the International Monetary Fund (IMF) the US is still the world’s biggest economy at $20.4 trillion, followed by China at $14 trillion – the UK is a tiddler by comparison, coming in at $2.94 trillion behind Germany and Japan.

As a side issue, that we’re still the fifth largest economy in the world is a testament to what fine business people we are, if only our politicians were half as competent, we’d still be a world power and wouldn’t have a country that’s falling to bits around us. Anyway, back to the plot.

The Chinese are catching the Americans quite quickly, Price Waterhouse Cooper (the business consultancy) believe that the gross domestic product (GDP) of both China and India will have overtaken that of the US by the year 2050.

‘some stomach-churning volatility this year. The recent correction was really quite nasty’

Can his policies halt the relative decline of America in relation to China and India? My guess is not in the long run as size matters and there are more Chinese and Indians than there are Americans. But in the short term I think his trade war with China will inflict more damage on them than it does on him.President Trump however has other ideas, given that he campaigned for the presidency on the slogan ‘make America great again’.

Whether you think the guy’s wonderful or you’d like to see his head on a spike really doesn’t matter, it’s what the markets think and since the trade war started the Chinese market has suffered more than the American one.

‘At one point in the early Autumn I was only 10% invested’

I buy, sell and hold positions based purely on what my charts tell me to do. I have discretion in my system to override them in certain circumstances (more on that later) but I try hard to trade what I see, not what I think.

But the trade war, Brexit and all the other world stresses and tensions allied to the fact that this is a very old bull market have made for some stomach-churning volatility this year. The recent correction was really quite nasty.

I had a really good run early this summer but as my charts began to signal that the moves were coming to an end, I sold down and went into cash. At one point in the early Autumn I was only 10% invested.

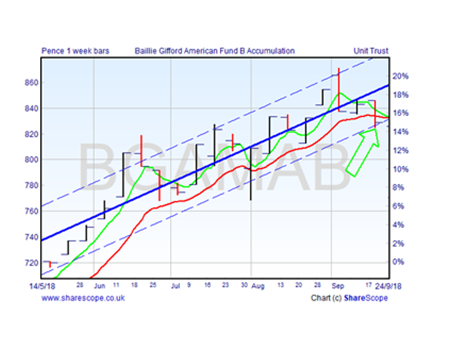

This example shows exactly how I operate; it is a chart of the Baillie Gifford American Fund which I exited on the 24th of September for a profit of £1337.

The price had peaked at just over 860, fallen back down through my moving averages to 830 (the green arrow marks the spot) and thus made my ‘take profit’ signal.

So far so good, at that point my Great British Trade Off portfolio was up 7.6% since April and I was showing a fair number of the clever people who was the ‘daddy’.

But then I made an error and got wrong footed.

Beware of seductive ladies holding whips, the market is a seductive lady always promising wealth and a whipsaw is a chart pattern that my system doesn’t cope well with.

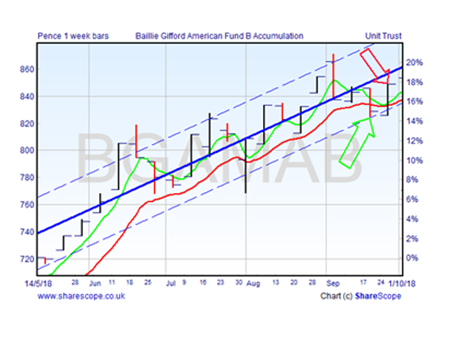

This is what happened next.

The week following my profit taking, the chart made a buy signal (red arrow marks the spot) which I took.

The thinking was sound, buying signal below the trend line in a decent uptrend, but with hindsight a big mistake.

That was compounded because at the same time the Fundsmith Equity Fund, the Neptune Global Technology Fund and the Sarasin Food and Agriculture Opportunities Fund also all made the same buying signal that I also took.

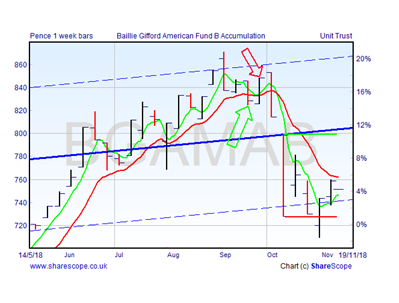

This is what has happened since to the Baillie Gifford American Fund and the other three.

The week after I’d bought £5k of each fund, the October correction started, and all four funds changed from being seductive pretty ladies I’d like to hold for a few months into old slappers I don’t want to be seen dead with.

My system gives me the discretion to override the chart signals if a sudden correction down is a general market move rather than being specific to my holdings and in this instance rightly or wrongly I didn’t sell when the stops were broken, I continued to hold.

Ten days ago, that looked the smart move, as I write today it doesn’t look so clever.

If prices start falling away sharply again, I’ll sell and accept that I called the market wrong. The trick when its going wrong is not to be ‘billy big balls’ and as a result find yourself the wrong side of a big move.

But even after the drama of October, my GBTO portfolio is still up 3.9% since April at the time of writing, which is pretty good bearing in mind all that’s happened.

There will be some great buying opportunities coming up before we’re all much older and as I’m only 30% invested I’m in a good position to take advantage when they come.

So there we have it, my battle with Fagin to see if trading or investing is the better way to generate wealth continues.

Yours, aye

Humbug

To nod in admiration at the highs and secretly savour the lows visit The Great British Trade Off by clicking on the image:

Leave a Reply

You must be logged in to post a comment.