Jan

2021

The Future of Consumption: Emerging Markets and the Digital Revolution

DIY Investor

22 January 2021

Current Market Temperature

With the U.S. sitting atop a decade old bull market and risks seemingly everywhere one looks, investors have been justified in assuming a more defensive posture of late.

We have blood in the streets of Hong Kong, a never-ending Brexit, a full-throated trade war lead by a president currently in impeachment hearings, rising income inequality, the ECB increasing concerns of credit risks, and monetary easing nearly maxed out across the globe.

Just to name the minor issues. Needless to say, sentiment has suffered and investors are beginning to hunt elsewhere for yield. The current silver lining we believe lives in Emerging Markets.

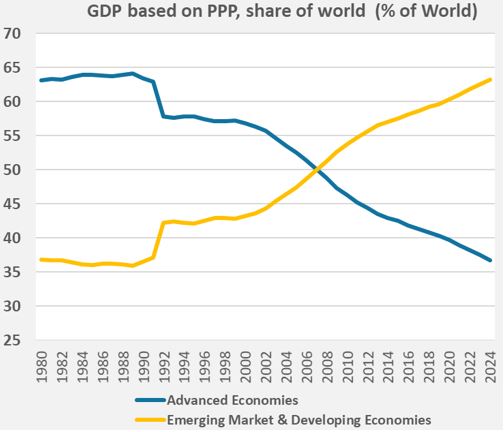

As developed economies continue in a low growth environment, emerging economies have been on the receiving end of arguably the greatest shift in economic wealth and power in history, all in a timespan of a single generation.

Macro Tailwinds in Emerging Markets

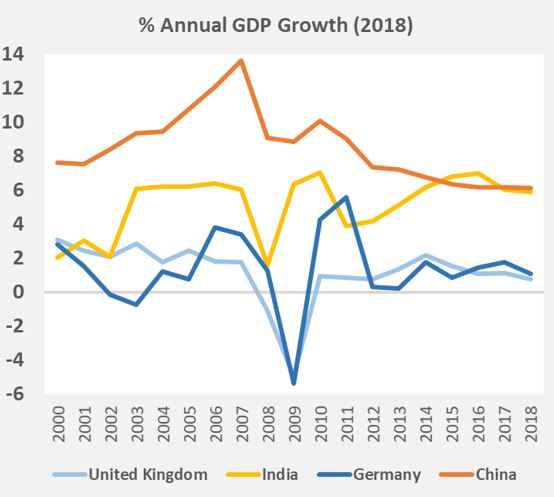

In a world where everything is relative, the top-down argument for emerging markets remains robust. The World Bank estimates 2020 real GDP growth for emerging and developing economies to be 4.6% vs 1.5% for advanced economies.

Demographic advantages persist as emerging countries contain the majority of its people with 85% of the world’s population, including its future, with nearly 90% under the age of 30.

Comparing balance sheets, advanced economies are swimming in debt with a government debt to GDP of 105% vs emerging and developing countries at just over 50% leaving central banks with more policy options going forward.

These conditions do indeed create a positive foundation for future growth, however are not new, and fail to tell the whole story of the size and rate that emerging markets have grown.

For perspective, around the time Tim Berners-Lee, the British SCERN scientist, created the world wide web (1989), the average American was 24x wealthier than the average Chinese, today that number stands at only 3x, and falling.

This rapid ascension of income and purchasing power, combined with populations in excess of 1.3 billion people, has given rise to an unprecedented wave of newly minted middle-class consumers.

This rapidly digitizing consumer wave has now leveraged the very thing that Mr. Berners-Lee created on 30 years ago catalyzing what Ray Dalio, founder of Bridgewater Associates described recently in Beijing as a “new world order”.

Figure 1 [1]. % Annual GDP Growth (2018)

Figure 2 [2]. GDP Based on PPP, Share of World (% of World)

The Next Billion Shoppers

The first internet access for most of the world will not come in the form of a 10 kilo, half meter deep desktop PC with a horribly slow dial up modem. It won’t be the foldable, thinner version that you could put in your lap.

It will come in the form of a supercomputer that fits in your pocket. This leapfrogging effect that most of the emerging world is experiencing, is allowing for and in many ways promoting faster rates of adoption and innovation that has given rise to some of the largest ecommerce and tech companies in the world on par with or in some ways surpassed their Silicon Valley rivals.

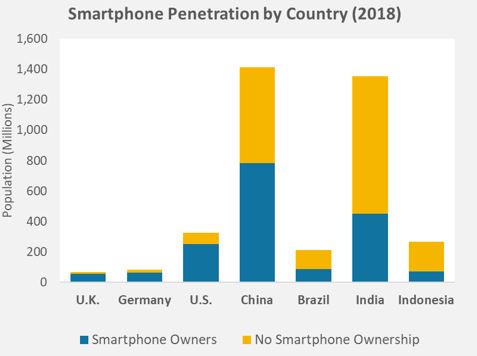

Even still, the vast majority of the online market remains untapped as the average smartphone penetration rate in EM remains under 50% on average, but rising fast.

About every hour 4,000 people in India will get their first smartphone and begin to message their friends, watch videos, order food delivery, rideshare and even use their phone to pay for it all (Figure 3).

With connectivity spreading to all corners of the globe, tens of thousands of people are joining the online community every day and shifting their lifestyles online via their smartphone.

Figure 3 [3]. Smartphone Penetration by Country (2018)

Figure 4 [4]. Global Share of Middle Class Consumption % (2015 – 2030)

The Tip of the Spear: It’s All About the Consumer

This rapid economic growth doesn’t come without growing pains. Undeveloped institutions, legacy infrastructure and inefficiency is still prevalent to put it mildly.

This reality has resulted in an uneven growth rate across different sectors of the economy. Visit nearly any emerging market economy and you will assuredly find reasons why it has stayed classified as emerging.

Political instability, policy risk, corruption, inefficiency, poor education systems, rule of law, runaway inflation, or a broken financial system, all of which are very real risks that investors should rightfully be wary of.

The one consistent green shoot highlighted, promoted and subsidized by nearly all politicians and forward-looking businesses is the rapidly digitising consumer sector.

Whether it be on a metro ride in Delhi, at a political protest in Buenos Aires, or a bike ride in Hangzhou, the sight of young digital natives on their smartphones driving the digital revolution is inescapable. This is a secular phenomenon that we believe is irreversible as nobody is handing in their iPhone to go back to a rotary phone.

The Investment Case

Investing in Emerging Markets as an asset class has slowly evolved over time, luring many to its promise of growth, yet historically left investors disappointed.

As most broad-based exposure results in heavy weightings toward Government Owned or State-Owned Enterprises, often ripe with inefficiency, corruption, and poor corporate governance, ultimately weighing on long term performance and contributing to what many have described as a lost decade in emerging market investing.

We believe these SOE riddled broad based vehicles should be avoided at all costs and a shift to overweight the true entrepreneurial engines behind the businesses of the future in the internet and ecommerce space.

We believe no well-diversified investment portfolio can afford to ignore the confluence of trends that has propagated one of the greatest economic growth stories of our lifetime and feel the internet & ecommerce segment offers investors exposure to the most promising chapter in that story.

The EMQQ Emerging Markets and Ecommerce ETF seeks to provide exposure to the growth of online consumption in the developing world and tracks an index of leading internet and e-commerce companies that serve emerging markets, including search engines, online retailers, social networks and e-payment systems.

Click to visit:

Commentary » Exchange traded products Commentary » Exchange traded products Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.