Apr

2022

The fog of war: a multi-asset view

DIY Investor

5 April 2022

Paul O’Connor, Head of the UK-based Multi-Asset Team, considers the prospects for financial markets over the next few months, as investors contend with market uncertainty around central bank hawkishness, the war in Ukraine and lingering Chinese concerns.

Paul O’Connor, Head of the UK-based Multi-Asset Team, considers the prospects for financial markets over the next few months, as investors contend with market uncertainty around central bank hawkishness, the war in Ukraine and lingering Chinese concerns.

Key takeaways:

- The first quarter of 2022 has been challenging for financial markets, with global interest rate shocks, geopolitical instability and China-specific concerns spurring portfolio losses.

- Broadly speaking, multi-asset portfolios suffered losses in equity, credit, and government bonds, across most developed and emerging markets

- From here visibility on the market outlook remains unusually murky, clouded by ongoing central bank hawkishness and political uncertainty with regards to the Russia-Ukraine conflict.

The complacency dominating financial markets around the turn of the year didn’t last long. Global equities peaked on the second trading day of the year, at that point having just doubled, without a 10% correction since the 2020 low.1 The change of mood has been dramatic. By the middle of March, global stocks had seen double-digit losses and the S&P 500 index recorded its fifth worst start to the year since 1927. While the broad-based equity rally in March recovered some of the Q1 sell-off, multi-asset portfolios still suffered losses in equity, credit, and government bonds, across most developed and emerging markets.

Interest rate shock

The first leg of the sell-off was triggered by a global interest rate shock, with markets scrambling to keep up with growing central bank hawkishness. During this period up to mid-February, growth stocks and US equities were the big losers, while value stocks remained fairly resilient. The second phase was, of course, driven by the Russian invasion of Ukraine and the spill over effects. Unsurprisingly, European risk assets suffered most, although emerging market bonds and equities also registered double-digit drawdowns.

Markets were caught between the potential negative impact on global growth from the conflict and the additional inflation shock, with the latter ultimately proving the dominant driver of asset pricing. Reflecting this, government bonds in all the major markets trended lower throughout the quarter, failing to provide the hedging characteristics they usually offer when risk assets sell off.

With the notable exception of China, interest rate expectations in most of the major economies have shifted significantly higher this year. The rethink about the future path of US interest rates has been particularly dramatic.

Looking back to September, the US Federal Reserve (Fed) still regarded inflation as “transitory” and investors were not pricing in hikes for 2022. Fast forward to today, market expectations suggest eight or nine US interest rates hikes this year. Alongside this, the Fed is also expected to end its quantitative easing programme in the months ahead, having purchased US$4.8 trillion of assets since the pandemic began.2 Other central banks are expected to follow suit.

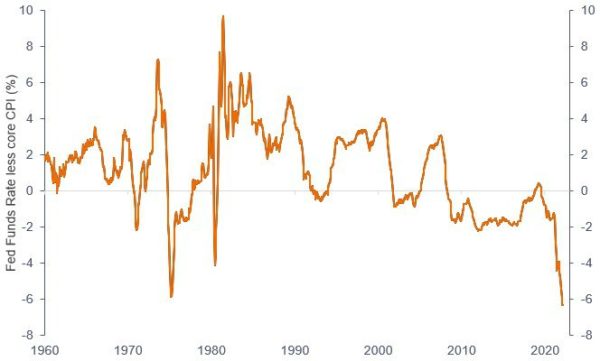

Chart 1: US real interest rates at all-time lows

Source: Bloomberg, Janus Henderson, as at 31 March 2022. Real interest rate is the interest rate adjusted for expected inflation.

It is hard to be confident in the view that markets have now priced in a high enough peak for the unfolding global interest rate cycle. The uncertainty is particularly acute in the US, given that the economy is close to full employment, real policy rates are at low levels last seen in the mid-1970s and quantitative easing continues to provide further monetary stimulus.

Current market expectations are for US policy rates to peak at around 3% in 2023,3 drifting lower after that. While this soft-landing scenario is plausible, the risks seem skewed towards higher peak rate outcomes. The last time that US real policy rates were as negative as they are today, the Fed took eight years to get inflation under control. We struggle to reject the view that US interest rates will need to become meaningfully more restrictive than current market pricing to break the current momentum in US wage and price inflation.

Conflict in Ukraine

Naturally, the outbreak of war in Ukraine hit European risk assets hard, with significant spill overs to other markets through its impact on commodities. At the market low in early March, European stocks had dropped 20% from January’s peak.4 At that point, several key market metrics were indicating levels of investor pessimism about eurozone assets that had only previously been seen during the US sub-prime crisis, the eurozone debt crisis and the early days of the pandemic.

These were all times of recession and prolonged financial stress. Despite the tragic human cost of the war and the short-term impact on commodity prices, most analysis suggests that its impact on the European economy will be much smaller than these systemic crises.

Consensus forecasts of 2022 eurozone real GDP growth have been downgraded but most estimates are still in the range of 2.5% to 3%.5 The rally in European stocks towards the end of the quarter reflected the fact that the initial plunge had priced in a lot of bad news and some optimism had emerged regarding negotiations between Ukraine and Russia.

Still, while it is encouraging that both sides remain in talks, no clear progress has been made towards a ceasefire, never mind a more enduring resolution of the conflict. With neither Russia nor Ukraine looking set for a decisive military victory, the most likely way for this war to end, in our view, seems to be through a negotiated settlement. Sadly, it is far from obvious as to whether this outcome is currently within reach, and a prolonged war, in some form, seems more likely than an imminent sustainable resolution.

While the war continues to have a substantial impact on world commodity markets, the impact on global equities appears to have been more fleeting. Following the initial sell-off, global stocks made a ‘v’-shaped recovery within a few weeks of the bad news, a pattern seen around many previous geopolitical events.

Still, it is hard to see a sustained revival in global appetite for European assets while the conflict continues, given its adverse impact on confidence, growth, and inflation. Investors can at least take comfort that some concerns are already priced into European markets. The valuation of eurozone stocks relative to global equities are now at levels last seen during the eurozone financial crisis of 2011.

Chart 2: Relative valuation of eurozone stocks

Eurozone 12m forward PE relative to MSCI World

Chinese concerns linger

While central banks and the war in Ukraine have been the most obvious effectors of financial markets in 2022 so far, China-related concerns have also had an impact. Chinese equities were a major underperformer in 2021 and continued to struggle this quarter, performing even worse than eurozone stocks.

At the low point in March, the MSCI China Index was down 30% over the year to date, having more than halved from its early-2021 high.6 While last year’s concerns about regulatory interventions and the property slump continue to weigh, the impact of surging commodity prices and the flare-up in COVID-19 cases amid its zero COVID policy are new sources of anxiety.

Despite these worries, we see some light at the end of the tunnel. Chinese policymakers have recently signalled intentions to de-emphasise their punitive regulatory interventions and efforts to cool the property market, and instead “actively introduce policies that benefit markets.”

This could potentially ease some of the concerns that have troubled investors since the start of last year and offer hope that the underperformance of Chinese stocks and emerging market equities more broadly might be coming to an end. However, with the near-term economic outlook likely to remain difficult, as China absorbs the economic impact of the commodity surge and the COVID-19 resurgence, some progress on the health front and additional policy stimulus measures might be needed to restore investor confidence in Chinese stocks.

Low visibility

The first few months of 2022 have been very challenging for multi-asset investors, who have had to contend with market turbulence from central bank hawkishness, the war in Ukraine and some China-specific concerns. While most asset classes have delivered negative returns this year, the March rally has delivered relatively benign performance numbers considering how difficult markets felt at the low point earlier in the quarter.

From here, visibility on the market outlook remains unusually murky. While we can see reasons to believe that the bear market in Chinese and emerging market stocks is coming to an end, we are less convinced that wider markets have fully priced in the adjustments that central banks need to make to break the current momentum in inflation expectations. This central bank hawkishness in relation to inflation is colliding with growth concerns due to the war in Ukraine to form a challenging backdrop for many financial markets at the start of Q2.

S&P 500®Index reflects US large-cap equity performance and represents broad US equity market performance.

MSCI China Index℠ reflects the equity market performance of China.

1 Bloomberg, as at 23 March 2022. Low on 24 March 2021 and high on 4 January 2022.

2 Bloomberg, Fed balance sheet as at 28 Feb 2022.

3 Bloomberg, as at 1 April 2022.

4 Bloomberg, as at 1 April 2022. European equities drawdown to 8 March 2022 as measured by the Euro Stoxx 50 in EUR.

5 Consensus forecasts from Goldman Sachs (2.5%), Bank of America Merrill Lynch (2.8%), Morgan Stanley (3.0%), JPMorgan Chase (2.9%) and Credit Suisse (2.8%).

6 Bloomberg, as at 1 April 2022. China drawdown to 15 March 2022 as measured by MSCI China index.

Glossary

Drawdown: The difference between the highest and lowest price of a portfolio or security during a specific period.

Forward price-to-earnings (PE): A popular ratio used to value a company’s shares. It is calculated by dividing the current share price by its earnings per share. Forward PE uses forecasted earnings in the calculation.

Hawish: A central bank may be described as ‘hawkish’ when it is in support of raising interest rates to counter inflation.

Inflation: The rate at which the prices of goods and services are rising in an economy.

Quantitative easing: A monetary policy used by central banks to stimulate the economy by boosting the amount of overall money in the banking system.

Risk assets: Financial securities that can have significant price movements (hence carry a greater degree of risk). Examples include equities, commodities, property and bonds.

V-shaped recovery: A quick and sustained recovery in measures of economic performance after a sharp economic decline.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Brokers Commentary » Brokers Latest » Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.